Consortium Led by China's Apex to Buy Lexmark for $3.6 B

American printer maker Lexmark has agreed to be acquired by a consortium of companies, led by Chinese firm Apex Technology and private equity firm PAG Asia Capital, in a $3.6 billion all-cash deal valuing Lexmark at $40.50 per share. Legend Capital Management Co., Ltd. (Legend Capital), formerly known as Lenovo Capital, is also a member of the Consortium.

Lexmark shares jumped 14% in post-market trading after the company reportedly accepted the offer to be acquired. Lexmark said the deal represented a 30 percent premium to its closing price on October 21st when the company started to work with investment bank Goldman Sachs to “explore strategic alternatives.”

Lexmark shares jumped 14% in post-market trading after the company reportedly accepted the offer to be acquired. Lexmark said the deal represented a 30 percent premium to its closing price on October 21st when the company started to work with investment bank Goldman Sachs to “explore strategic alternatives.”

CMS-Connected reported earlier this month that Apex Technology, which is a manufacturer of ink cartridge chips, was eyeing a potential acquisition of Lexmark International.

The decision has been made by Lexmark’s Board of Directors, with the assistance of external advisors, as a result of an exhaustive evaluation of strategic alternatives to enable shareholders to make the most of the company's value and unearth potential of the company.

“This is an exciting transaction that Lexmark’s board of directors believes is in the best interests of our shareholders,” Lexmark Chairman and Chief Executive Officer Paul Rooke said in the statement. “The transaction will benefit our customers and provide new opportunities for our employees.”

The company expects the deal will help its efforts to expand in the Asia Pacific market. In that regard, Rooke stated:

“With the Consortium’s resources, we will be able to continue to invest in and grow the business to more fully penetrate the Asia-Pacific market for hardware, software, and managed print services.”

The deal offers a new opportunity in an utterly different market where paper and fax machines are still prevalent while paperless transactions and digital signatures are becoming more common in the U.S. and Europe.

“The acquisition allows Lexmark to offer a full range of products and solutions to its customer and it also opens the entire China market for Lexmark where it to date has a very small market share," said Weijian Shan, Chief Executive Officer at PAG.

The Market

Since consumers started to shift from the traditional PC model to mobile devices as well as ditching standard printers, like other printer makers, the US firm has been struggling to maintain a strong business position.

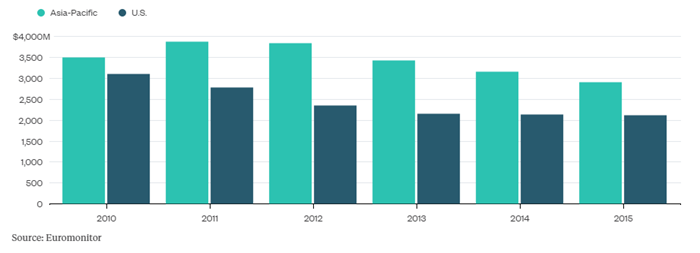

While sales are falling, Asia-Pacific has a bigger share of the global market for printers than the U.S.

Apparently, the acquisition will open doors for Lexmark into the more promising Chinese market. Lexmark Chairman Paul Rooke stated the transaction would benefit customers and provide “new opportunities'' for employees. On a side note, Apex is controlled by Zhuhai Seine Technology, which also owns Pantum International, China's first maker of printers.

Not only Lexmark but also the entire printer and hardware industries have been having a hard time. HP Inc. saw its earnings from printing drop by a quarter for the three months ended January. Revenue at Xerox’s hardware division has been falling for years. For this reason, these companies have tried to separate their hardware and software businesses as two different entities.

CMS-Connected reported last Monday that HP Inc. sold its software assets to OpenText for $170-million (U.S.) in cash, as the company had intended for a while to divest some assets and streamline its products in order to focus on its core business to keep its market share.

On this note, a different point of view in relation to the acquisition of Lexmark came from TheStreet's Jim Cramer on CNBC's "Stop Trading" segment: “This is a nice premium for Lexmark, which closed at $34.65 on Tuesday.” However, he argued HP would have been wise to acquire Lexmark:

In addition to the recent restructuring activities, as CMS-Connected reported earlier this month that EMC Corp. wants to shed its content management business, Documentum, which was bought for $1.7 billion in 2003. Alan Pelz-Sharpe, Vice President & Managing Director VOCalis with Digital Clarity Group and previous guest on The CMS-Connected Show, spoke with us about the story behind the divestiture:

“Documentum has never been a good fit within EMC anyways. EMC is a strong hardware company while Documentum is a software firm and they are sold differently,” Alan told CMS-Connected. “…to keep Documentum, just doesn't make sense.”

Lexmark

Lexmark, like its encounters in the industry, has spent years wrestling with a maturing hardware market. In recent years, Lexmark has made a big push into business software and digital document management services to reduce its dependence on the strongly competitive printing business and support more services and software. Its enterprise software business developed strongly last year, but mainly due to its $1 billion acquisition of software provider Kofax, which left Lexmark with a serious amount of debt.

The company reported $968.8 million in fourth-quarter sales, with about 83 percent coming from its Imaging Solutions and Services unit, which houses its printing division while its software division reported $160.8 million in quarterly revenue. The US firm has posted losses in four of the past five quarters. In February, Lexmark’s share price nearly halved from its peak last July and cut 550 jobs or about 4 percent of its workforce. The stock has since increased 40% from lows but is still much lower than two years ago.

Due to the company’s situation and the fact that consumers shift from printing documents and photos to being satisfied with screen-only versions of them, this acquisition is a timely deliverance for Lexmark shareholders.

Chinese Buyers

From the Apex’s perspective, this acquisition is another deal activity that a Chinese organization seizes the opportunity and provides a new lease of life to a Western company in a shrinking industry in the Far East under Chinese ownership.

China’s state-owned fund tasked with supporting the country’s semiconductor industry invested 500 million yuan ($77.4 million) into Apex, which is listed on the technology-focused Shenzhen stock exchange, last year. In addition, Legend Capital, an associate of Lenovo’s biggest shareholder, Legend Holdings brings its experience in successfully closing deals for U.S. tech assets and getting regulatory approval.

As you may recall Lenovo became one of the biggest country'spersonal computer makers after it purchased IBM’s PC division over ten years ago. Later in 2014, the company also acquired IBM’s low-end server unit. On the other hand, Lexmark was IBM’s desktop printing unit before a private equity firm acquired it in the early 1990s. These parallels and the presence of Legend in this recent acquisition may suggest that Chinese interest in IBM's legacy businesses resumes.

Due to the slowing Chinese economy and a weakening yuan, Chinese investors have been more active than ever in overseas markets this year. According to Thomson Reuters figures, Chinese buyers represented $101bn, or 15 per cent, of global deal activity in the first three months of this year. It is clear that Chinese suitors have been seizing opportunities to acquire expertise, established brands and access to new markets as their home economy slows.

Jackson Wang, chairman of Apex Technology said Lexmark was a “tremendous cultural fit”. He said the acquisition would help Apex, which makes components for laser and ink-jet printer cartridges, to pursue “untapped opportunities for future growth”.

Lexmark’s two business groups, as well as the company’s regional and country operations, will continue unaffected. Lexmark will remain headquartered in Lexington, Kentucky, and Chairman and Chief Executive Paul Rooke is expected to continue to lead the company.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.