451 Research: "Azure is Closing the Adoption Gap with AWS"

Yet another research firm found that Microsoft Azure is emerging as a formidable challenger,  closing the market adoption gap with AWS. According to 451 Research’s latest Voice of the Enterprise (VotE): Cloud Transformation study report, 22 percent of companies have adopted a cloud-first approach. Infrastructure as a service (IaaS)/public cloud is the fastest-growing cloud model. While AWS remains the consensus leader of the IaaS public cloud computing market as respondents’ most important IaaS provider (39 percent), nearly 35 percent of respondents named Microsoft their most important IaaS provider, up from 20.2 percent in the previous survey. The study also argues that Google with its Cloud Platform has made considerable strides as well.

closing the market adoption gap with AWS. According to 451 Research’s latest Voice of the Enterprise (VotE): Cloud Transformation study report, 22 percent of companies have adopted a cloud-first approach. Infrastructure as a service (IaaS)/public cloud is the fastest-growing cloud model. While AWS remains the consensus leader of the IaaS public cloud computing market as respondents’ most important IaaS provider (39 percent), nearly 35 percent of respondents named Microsoft their most important IaaS provider, up from 20.2 percent in the previous survey. The study also argues that Google with its Cloud Platform has made considerable strides as well.

Another interesting finding from the same study, which represents more than 700 web-based surveys completed by IT and cloud decision-makers worldwide, supplemented by 20 in-depth phone interviews, is that 48 percent of AWS users are also using Azure, with 51 percent on Azure using AWS. However, the report cites that organizations are not actively using both providers to support the same workload, such as compute in AWS and storage in Azure. To put that into perspective, a multicultural enterprise may use AWS for running its workloads for its North American division while developing an app on Azure in Europe. With a multicloud approach, enterprises aim at spreading their risk and dependencies while getting more nimble. It is also worth noting that some consulting companies and software vendors also build on and use both Azure and AWS, as these platforms represent most of the cloud market demand.

Speaking of regions, among the European respondents surveyed, Microsoft emerged as the predominant primary IaaS provider, with 43.7 percent of European respondents citing it vs. 32 percent naming AWS.

Enterprises Need “Moderate” or “Significant” Transformation

According to the same study, almost 80 percent of the organizations indicated that their IT environments require moderate or significant transformation to meet business requirements over the next five years, involving migrating workloads to the cloud and keeping cloud spend on an upward trend.

"As organizations implement IT transformation in earnest, they are increasingly relying on  strategic partners for operational assistance. Those IaaS service providers who position infrastructure and technological innovation alongside meeting business requirements will be best positioned to capitalize on this market opportunity," said Melanie Posey, research vice president and lead analyst for 451's Voice of the Enterprise: Cloud Transformation service, in a statement.

strategic partners for operational assistance. Those IaaS service providers who position infrastructure and technological innovation alongside meeting business requirements will be best positioned to capitalize on this market opportunity," said Melanie Posey, research vice president and lead analyst for 451's Voice of the Enterprise: Cloud Transformation service, in a statement.

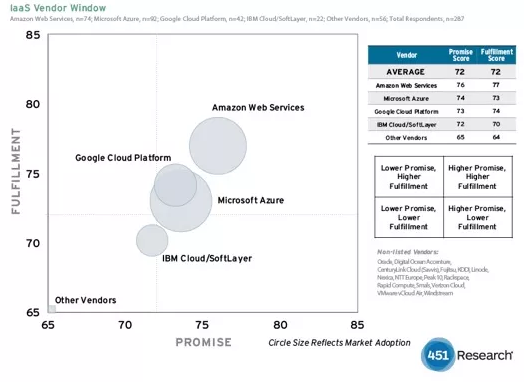

Survey respondents rated their IaaS providers on a range of attributes prior to purchase (promise) and after implementation (fulfillment). The diagram below illustrates that AWS dominant market position with 76 for the promise and 77 for fulfillment, ahead of Microsoft (74 and 73), Google (73 and 74) and IBM (72 and 70). AWS has surpassed competitors in terms of multiple promise and fulfillment rating criteria, most notably breadth of services/features, brand/reputation, technical expertise, and innovation.

Additionally, Google Cloud Platform secured particularly strong marks for service reliability and value for money/cost. Google and Microsoft are seeing higher overall adoption rates since the previous survey in 2015.

Cloud Shift

The cloud transformation is definitely one of the top highlights of this decade as it is incredible to witness how on-premises infrastructure is being steadily and rapidly replaced by cloud infrastructure. To put this change into perspective, let’s let the numbers tell the story:

-

In 2016, revenues for cloud service providers surged 38 percent from $16 billion to $22 billion.

-

Amazon Web Services (AWS) grew 55 percent in 2016.

-

Microsoft Azure grew 116 percent

-

IBM experienced 35 percent growth.

-

AWS generated $1.1 billion in Q3 2016 alone. Without this revenue stream, Amazon’s $816 million profit for the quarter would have been a $300 million loss.

Study after study predicts that cloud computing is taking place at an extremely fast pace, so much so that even the most recognized market research firms keep revising their predictions on growth. Forrester, for instance, has recently indicated: “We predict that the public cloud market will generate revenues of $236 billion by 2020 — 23 percent higher than our 2014 forecast. The increased size of the 2020 public cloud market reflects faster-than-expected growth, especially for cloud platform revenues, whose 2020 total of $64 billion will be 45 percent higher than we projected two years ago.”

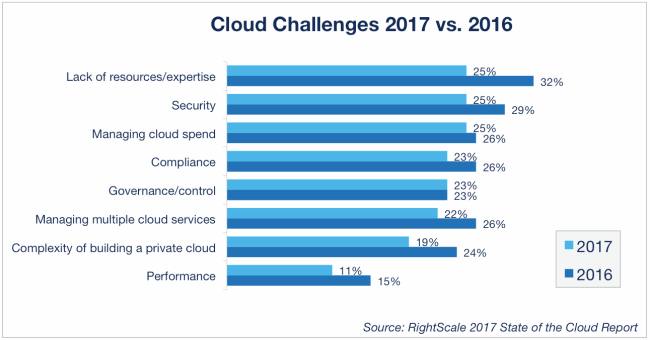

Despite the high level of cloud adoption, there are still challenges to cloud transformation. The good news is, emerging maturity of both cloud users and cloud providers results in an across-the-board reduction in cloud challenges. In January 2017, RightScale conducted its sixth annual State of the Cloud Survey of the latest cloud computing trends, with a focus on infrastructure-as-a-service, and the study found that cloud challenges declined across the board with the exception of governance/control, which remained flat. The top challenges are expertise, security, and spend. It is interesting to see that this publication last year reported the lack of resources/expertise as the number one challenge, but this year there is a significant drop as only 25 percent cited it as a major concern while this number was at 32 percent in 2016.

My POV

More and more enterprises are embracing the cloud shift for cost optimization and increased competitiveness. Like every other trend, cloud shift establishes both opportunity and risk for users and providers. From the providers’ perspective, they should be wary but also proactive when it comes to creating new cloud-based opportunities and innovating as any type of aggressive approach at this point can jeopardize their position in the cut-throat competition. From the users’ perspective, planning a comprehensive strategy before undertaking the transformation is the key to minimizing the impact of cloud shift on their businesses and the level of waste in cloud spend which is often overlooked and underestimated.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.