What's Behind Macy's Closing 100 Stores?

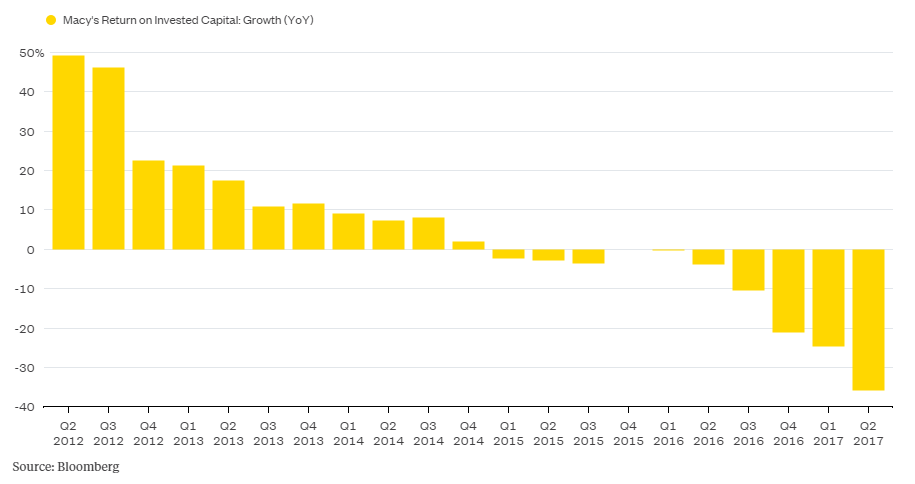

The latest blow to the retail industry came from Macy’s when the department store announced its plans to shutdown 100 more stores, which represent about 15% of the company’s total number of stores in an effort to turn its business around after six quarters of declining sales. This closure is more than the total amount of stores Macy's closed over the past six years combined.

Macy’s sales plunged 3.9% to $5.87 billion from May 1 to July 30, with even licensed departments slumping 2%. Net income slipped to $11 million from $217 million a year earlier and the company took a $249 million charge in the current period for the store closures. Chief Financial Officer Karen Hoguet, however, said she was encouraged by improved apparel sales, a strong start to the back-to-school shopping season, and a moderation in the falloff in spending by tourists.

It should be noted, Macy's had been impressively performing after the Great Recession. Moreover, under the management of Terry Lundgren, Macy's Chairman and outgoing CEO, the company had sought some expansion opportunities like buying high-end beauty brand Bluemercury and adding a same-day delivery service. In additon, they had employed e-commerce technology innovations like launching its own off-price chain, testing an artificial intelligence tool that would free up sales assistants to provide higher levels of customer service and announcing the pilot of "Macy's On Call," a mobile web tool that uses IBM Watson to answer natural language questions about a store's product line up. However, despite all these efforts they couldn’t stop the decline in sales.

"We operate in a fast-changing world, and our company is moving forward decisively to build further on Macy's heritage as a preferred shopping destination for fashion, quality, value, and convenience. This involves doing things differently and making tough decisions as we position ourselves to serve customers who have high expectations of their favorite stores, online sites and apps," Lundgren said in a release.

Macy's was an early adopter of online retailing which most likely made the company the second-largest seller of apparel online after Amazon, according to trade publication, Internet Retailer. On the other hand, Macy's 15% online sales growth in 2015 pales in comparison to Amazon's 48% sales boom last year, according to Internet Retailer data. Meanwhile, Amazon increased the number of apparel products on its website by 87% which boosted apparel sales to $16.3 billion. In fact, if the current situation continues, Amazon would be expected to "comfortably” supersede Macy's and become the largest apparel retailer in the US by 2017, according to Market Research Firm Cowen & Co.

Neil Saunders, CEO of Research Firm Conlumino, said the Macy's store closures are "sensible," but largely the result of a self-inflicted defeat. "Macy's has simply not bothered with a large rump of stores for many years. They have lacked investment, been devoid of management attention, and now look distressed and dispirited," he wrote in a report.

Changes in Consumer Spending Behavior

According to analysts, Macy’s is having trouble combatting the dominating online behemoth Amazon and adjusting to changes in consumer spending behavior.

Overall, shoppers are buying less apparel and spending their discretionary money elsewhere. In fact, according to Morgan Stanley estimates, U.S. apparel sales have grown only 1% annually over the past 15 years, despite price deflation. On that note, apparel prices, per unit, have diminished 13% to $20.22 since 2001, Morgan Stanley said. For the back-to-school season, children’s clothing shipments fell 13% from a year earlier, according to Research Firm Panjiva.

To back up these findings above, Reuters also notes that “shoppers increasingly prefer to spend on big-ticket items such as electronics and cars than on clothes,” which is in line with the fact that U.S. automakers had their best sales year ever in 2015, and have maintained a strong sales pace this year.

The U.S is ‘Over-stored’

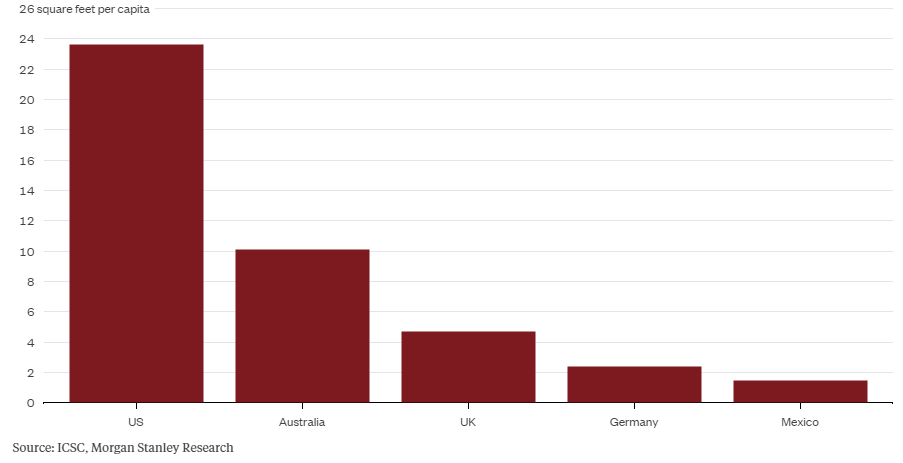

The United States has almost five times more retail space per person than France, Japan, and the U.K, according to Terry Lundgren. Another way to put it is that the U.S. has more retail square footage than Australia, the U.K., Germany, and Mexico combined.

“The department stores, in the beginning, were known for big box stores that had the best selection in each of the categories they sold,” said C. Britt Beemer, Chairman of Consumer Research firm America’s Research Group. “Now, they don’t stand for anything.”

After looking at all this data, it is safe to say that Macy’s took a step in the right direction as there is no point in letting the stores, which are not bringing in money anymore, weigh on the overall business. According to what Macy’s estimates, the magnitude of the sales shortfall from shutdown locations will be about $1 billion, representing 3% of annual sales, while the company will generate revenue with its $21 billion worth of real estate. Although Macy's still has not told investors what it will do with $21 billion, no doubt that some will be spent to enhance the company’s omnichannel performance so e-commerce can pick up some of the traffic the company will lose from the closure.

A real-estate research firm, Green Street Advisors, saw this situation a decade ago, claiming that chains would need to collectively close 800 stores to achieve the kind of profitability per square foot they needed. Green Street Advisors issued a report specifically saying that a substantial number of department-store closures will be "problematic" for "lower productivity malls that have already had their fair share of struggles competing against online retail." For those malls, the problem will be similar to the dilemma once faced by harried shoppers. Up until now, Green Street says mall landlords have done an "admirable" job of keeping spaces filled with stores surrounded by the retail changes. Productivity has also declined due to a saturation of retail square footage. From 2006 to 2015, sales per square foot at department stores dropped from $200 to $165, according to the real estate research firm.

Melina Cordero, Head of Retail Research for Commercial Real-Estate Brokerage CBRE, said department stores downsizing will continue. "I think department stores as a whole are really in a precarious position. Chains that traditionally appealed to middle-class consumers are going to suffer,” she said and added: “New store concepts pose an opportunity for some of these malls to restructure, refurbish and redevelop along the lines of the new consumer reality.”

Macy's Competitors to Follow Suit

Sales at department stores have been falling since the early 2000s. Government figures show they hit their peak in January 2001, when monthly sales came to $19.9 billion. In June of this year, that figure had edged up at 34% to $13.2 billion, government data demonstrates. The statistics also confirm sales falling 50% from $27 billion in January 2001 to $13.4 billion in June.

As a solution, department stores have begun to rely on huge markdowns by sacrificing their margin in an effort of turning their diminishing business around. Even major luxury brands have joined the wave of constant sales and promotions and become less reliant on department stores. Moody’s Investor Service noted: “Investment and penetration of omnichannel will continue to weigh on margins as the promotional environment is expected to remain intense.”

Walmart announced its plans in January to shut down 269 stores this year and just last week, made a $3.3 billion deal to acquire Amazon rival Jet.com to undergo a digital transformation in e-commerce.

Kohl’s announced a drop of 2% to $4.18 billion in sales in the last three months while sales at existing stores slipped 1.8%. Net income slumped to $130 million from $140 million a year earlier. Mr. Mansell, Kohl’s CEO, said: “Amazon.com Inc. and off-price retailers such as TJ Maxx and Marshalls were continuing to gain share.”

Nordstrom’s margin went down 45% to $117 million, and sales declined 0.2% to $3.6 billion in the three months leading up to July 30. Sales at current stores dropped 1.2%, while off-price Nordstrom Rack stores grew 5.3% as Nordstrom took increased markdowns to clear excess goods. Co-President Blake Nordstrom said the move enabled the company to make “substantial progress bringing down inventory in line with sales.” Macy’s and Kohl’s also completed their quarters with lower inventory.

Moreover, many brands have already adopted the strategy of closing their excess stores in hopes of increasing productivity along with margin. Ralph Lauren, for instance, announced it would close 50 stores while Sears said it would shutdown 78 Sears and Kmart stores. Aeropostale is closing 113 locations, and Sports Authority is closing down the entire chain while Tailored Brands said it would close 80 to 90 stores. Kohl’s is going to leave 18 underperforming stores while Chico's White House Black Market are spacing out the net reduction of 105 stores total.

To shutdown an excessive amount of stores definitely makes sense in this digital era where e-commerce has become a major spending driver. However, brands have a lot of work to do if they want to strike the right balance between stores and digital. As we covered earlier on CMS-Connected, brick-and-mortar is still a dominant player despite the power of smartphones, tablets and the increased investment in online sales by traditional retailers. However, the secret sauce comes in the form of offline and online merging such as building smart dressing rooms, utilizing beacon technologies, and so on. At the end of the day, channel-agnostic brands will have greater international potential, higher revenues, stronger brand loyalty, and a longer life-span.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.