Oracle's 'Big Mistake' Turned Out Salesforce's Huge Gain

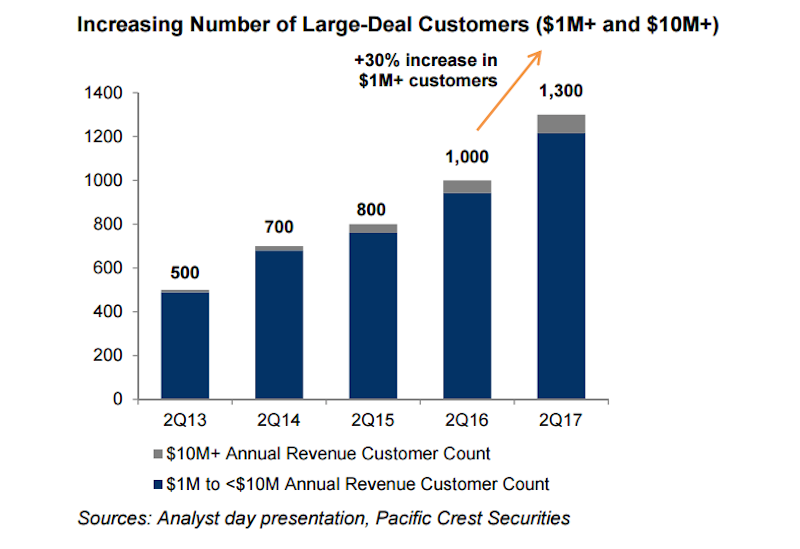

In 2013, Salesforce, a provider of enterprise cloud computing solutions, with a focus on customer relationship management (CRM), set up three main goals and one of them was nailing down more deals with large customers. The CEO Marc Benioff has thought that the hiring of ex-Oracle executive Keith Block would hit the spot. Today in 2017, Block turned out being Oracle’s “big mistake” while Salesforce’s huge gain as now the CRM giant has roughly 1,300 customers that are under contracts worth $1 million or more. According to Pacific Crest, that's a 30 percent jump from last year and a 2.6-times increase from the second quarter of 2013.

In 2012, Block left Oracle, when instant messages he sent a colleague criticizing the quality of Oracle products and the behavior of his boss, Mark Hurd were disclosed. Block said that the firm had “bought a dog” when it acquired Sun Microsystems for $7.3 billion. On top of that, he also described Oracle president Hurd as generating “lots of noise, not much results.” Those statements came to light as part of a Hewlett-Packard lawsuit against the company. Shortly after this incident, Benioff hired Block, telling journalists at the time that the recruitment effort had taken 10 years. “I think the biggest mistake Mark Hurd ever made was letting Keith Block leave Oracle because he’s probably the best sales executive the enterprise software industry has ever seen,” Benioff said. It turned out he had a point as Oracle has experienced uneven results since Block left the company and missed Wall Street expectations in a couple of quarters.

In 2012, Block left Oracle, when instant messages he sent a colleague criticizing the quality of Oracle products and the behavior of his boss, Mark Hurd were disclosed. Block said that the firm had “bought a dog” when it acquired Sun Microsystems for $7.3 billion. On top of that, he also described Oracle president Hurd as generating “lots of noise, not much results.” Those statements came to light as part of a Hewlett-Packard lawsuit against the company. Shortly after this incident, Benioff hired Block, telling journalists at the time that the recruitment effort had taken 10 years. “I think the biggest mistake Mark Hurd ever made was letting Keith Block leave Oracle because he’s probably the best sales executive the enterprise software industry has ever seen,” Benioff said. It turned out he had a point as Oracle has experienced uneven results since Block left the company and missed Wall Street expectations in a couple of quarters.

In Block’s first two years at Salesforce, the company’s revenue has grown from $4.1 billion to $5.4 billion. At that time the company also revealed that the average contract duration has risen from one to three years due to Block’s aggressive sales strategy. So what was the strategy? Considering Salesforce is the first highly successful cloud company who built up a big lead in the enterprise software space, he tried to make the cloud company sell more like the hardware titans first. Another primary tactic was focusing on securing huge deals with the big players such as Coca-Cola and Barclays, who each pays the company at least $10 million a year, instead of going after businesses of any size. He even orchestrated software designers to make them develop more customized products for particular industries so they could expand into specific verticals like finance, healthcare, and government sectors. He also formed designated teams for major accounts, and those teams include developers coding industry-specific software, the salespeople explaining how Salesforce’s offerings solve their business problems, customer service personnel assisting them through every step. On top of these, he changed the whole sales culture within the organization by making the sales process more disciplined and rigid which formerly was relatively laid back.

Naturally, all these achievements made Benioff proud of his decision about hiring a 26-year veteran of Oracle, so much so that he famously had Salesforce buy Block a $41,000 watch in recognition of his sales leadership, according to documents filed with the SEC. In return, under Block’s management, the company has made very profitable deals with more large enterprises than ever before. This resulted in expanding into vertical industries. The total number of companies that spend over $10 million on Salesforce has increased 47 percent year-over-year, and 7.6-times since the second quarter of 2013, based on Pacific Crest’s data. As Benioff stated in the past, Block also "brought in a world-class management team."

Last September, Block told investors during Citi’s 2016 Global Technology Conference in New York City that the US team is tightening its playbook and making necessary adjustments. “This is a blip, more or less, a speed bump around execution,” Block said. “I have enormous confidence in our leadership team in the US. We’re tightening processes and adjusting the playbook.”

There is still a fierce battle between Oracle and Salesforce to become the first enterprise company to reach $10 billion in sales from the SaaS (Software as a Service) segment, and since 2015, Benioff has been telling the world that Salesforce is on track to become a $10 billion company. He may not be imagining it either, after all as the company claimed that the team signed more than 600, seven-figure-plus deals ($1 million or more) in one quarter. On top of that, in late March, Salesforce announced that the U.S. Department of Health & Human Services (HHS) has launched an agency-wide $100 million Blanket Purchase Agreement (BPA) for Salesforce subscriptions. In addition to the HHS BPA, the General Services Administration (GSA) awarded a $503 million BPA for Salesforce implementation, integration and support services for all federal government agencies eligible to order from the GSA Schedule program.

The San Francisco-based company reported $6.7 billion in revenue for 2016 and raised full-year revenue forecast for the fiscal year 2017 to $8.08 billion-$8.12 billion from $8.0 billon-$8.1 billion. Additionally, the company narrowed net loss to $25.5 million in the fourth quarter ending January 31, from $65.8 million.

Just because Salesforce is a leader in internet-based software, for the time being, doesn’t mean the big players, Oracle, SAP, and Microsoft, are willing to lose the fast-growing cloud market to their younger rival. That being said, this cut-throat competition also resulted in so many speculations saying that Oracle or Microsoft will possibly buy Salesforce in a couple of years or Salesforce will overtake SAP or Benioff, a former Oracle alum and a protege of Ellison, will return to Oracle to become a final caretaker when Ellison leaves. Nobody knows what the future holds for Salesforce and its successful execs but it is certain that alongside many other various factors, Block has been a very prominent piece of Salesforce’s unprecedented growth in sales, and what he has done for the company so far is a significant achievement. Therefore, I am excited to discuss the rest of story with you all when it evolves with many more twists and turns in coming years.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.