What Lies Between The Front and The Back Office

The front office systems such as CRM have always been the priority as it is, typically  considered the place where the revenue comes from. The similar conception goes with the back office technology as well. Conversely though, the magic actually happens in between the two: The middle office. In today’s B2B market, where high expectations of the B2C market are bleeding into, having cloud-based middle office solutions in their technology stack is becoming more imperative for enterprises which set their businesses up to remain with or ahead of the curve.

considered the place where the revenue comes from. The similar conception goes with the back office technology as well. Conversely though, the magic actually happens in between the two: The middle office. In today’s B2B market, where high expectations of the B2C market are bleeding into, having cloud-based middle office solutions in their technology stack is becoming more imperative for enterprises which set their businesses up to remain with or ahead of the curve.

Organizations had overlooked this area for a long time. However, in recent years, the middle office systems have been brought to their attention by software giants dispersing billions of dollars on the acquisitions of configure-price-quote (CPQ) software, Digital Transactions Management (DTM) solutions, and quote-to-cash systems.

Silicon Valley Snags Middle Office Market Technologies

Last week, SAP acquired CallidusCloud for $2.4 billion or $36 per share in an effort to  significantly strengthen SAP's position in the customer relationship management (CRM) space as CallidusCloud offers a full suite of SPM and CPQ solutions, including sales enablement, sales analytics, and customer engagement.

significantly strengthen SAP's position in the customer relationship management (CRM) space as CallidusCloud offers a full suite of SPM and CPQ solutions, including sales enablement, sales analytics, and customer engagement.

The platform is designed to help sales teams manage the sales cycle better, from lead through to a proposal, to contract and then commission or payment. Founded in 1996 and having gone public in 2003, Callidus has itself acquired 14 companies since 2010. CallidusCloud is positioned highest and furthest to the right on the “Ability to Execute” and “Completeness of Vision” axes of the Gartner Magic Quadrant for Sales Performance Management (SPM). This deal has a big potential to carry SAP ahead of Salesforce in CPQ.

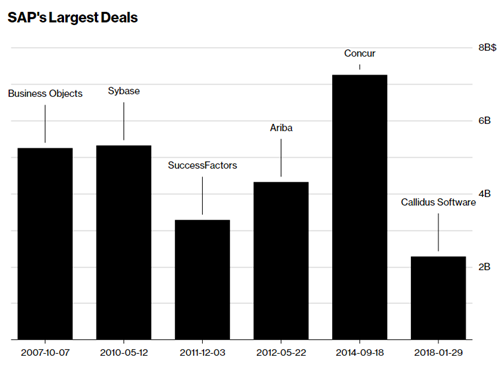

The deal marked the biggest SAP acquisition in more than three years. To put the size of the deal in context, Bloomberg created the graph below:

“The addition of CallidusCloud aligns perfectly to SAP’s innovation strategy to transform the front office. SAP gives CallidusCloud the global scale to accelerate its already impressive growth,” SAP CEO Bill McDermott said in a statement. He also added: "SAP is connecting the back office to the front office in this consumer-driven growth revolution."

Hubspot, for instance, has had an enhanced native integration with PandaDoc to enable  HubSpot CRM users to close deals with better quotes, proposals and contract management processes without leaving the HubSpot user interface.

HubSpot CRM users to close deals with better quotes, proposals and contract management processes without leaving the HubSpot user interface.

Hubspot is not the only CRM vendor that PandaDoc has a partnership deal with. As Microsoft Dynamics is a formidable challenger to the market leader Salesforce, Microsoft Venture also participated in PandaDoc’s most recent funding to extend their partnership. The partnership between these two enabled users to build a quote quickly from a library of approved custom content and pricing information that updates automatically for them as the numbers change. Due to the direct link to Dynamics, users can add recipient information right from the database and track quotes they’ve sent automatically in the customer record.

Salesforce acquired quote-to-cash vendor Steelbrick for $360 million, including $60 million in  cash to be able to offer quote-to-cash and CPQ capability in-house instead of through partners such as Apttus, an enterprise configure-price-quote product provider. This move was a kick in the head for the unicorn quote-to-cash vendor as the platform was built on the Salesforce platform.

cash to be able to offer quote-to-cash and CPQ capability in-house instead of through partners such as Apttus, an enterprise configure-price-quote product provider. This move was a kick in the head for the unicorn quote-to-cash vendor as the platform was built on the Salesforce platform.

Speaking of Apttus, last month, the vendor announced that IBM joined multiple investors in Apttus' Series E funding. "Through this investment in Apttus, we aim to encourage creativity and entrepreneurial spirit that will drive IBM AI and cloud technologies into new applications and enterprises,” said George Ugras, managing director, IBM Ventures. Should we expect an acquisition story to arise from this investment? I think time will tell so we will see when it does.

How to Improve Middle Office Operations

Aside from having a better organizational structure, obviously having the right technology in place is essential to improving the middle office performance. As imperative as it is, creating an end-to-end business process is a very complicated task. One of the common reasons many organizations don’t have a comprehensive business model is the lack of middle office technology. Those are the tools you would want to have so your organization could stitch things together in between the front office and the back office, and eventually automate them.

Although there are numerous technologies available and coming up that help organizations build better middle offices, their benefits haven’t been discussed and grasped much yet. To make a technology investment, especially in this long-neglected market, enterprises need to have more detailed business use cases of those technologies as well as a clear-eyed understanding of their own business process and workflow so they can decide which technology would be the best fit to their ecosystem. With this in mind, assessing the workflow and finding the gaps in the current operating model would be a good starting point to develop a list of what to expect from technology.

From there, before going too far down the way and assessing the vendors that serve in the space, it is always a good idea to outline the capabilities that would make the current business process and operation model more efficient. It almost feels like writing down a wish list or creating a blueprint for a product as if you will develop one. With the advent of technology, the possibilities are endless, and with the rise of embracing microservices, we now have more flexibility in terms of capabilities. Unlike the past, reinventing a new workflow out of new components is not that intimidating anymore.

In heavily regulated industries, the middle office capabilities cater to the needs of compliance and risk management, and as regulatory requirements have increased, demands on middle office systems have risen. An organization’s compliance will always only be as good as its data integrity and accuracy floating between its systems. Especially, in the finance and healthcare industries, enabling intelligent automation of the middle office functionalities has been a big roadblock as for many organizations in those fields, the systems between their front office and back office need to be upgraded to more cognitive technologies rather than having just middleware.

Before making that upgrade, it is essential to know where the most value is to be had in automation. Tracking down manual intervention makes a good starting point, from there, a discussion of how to automate those tasks may begin.

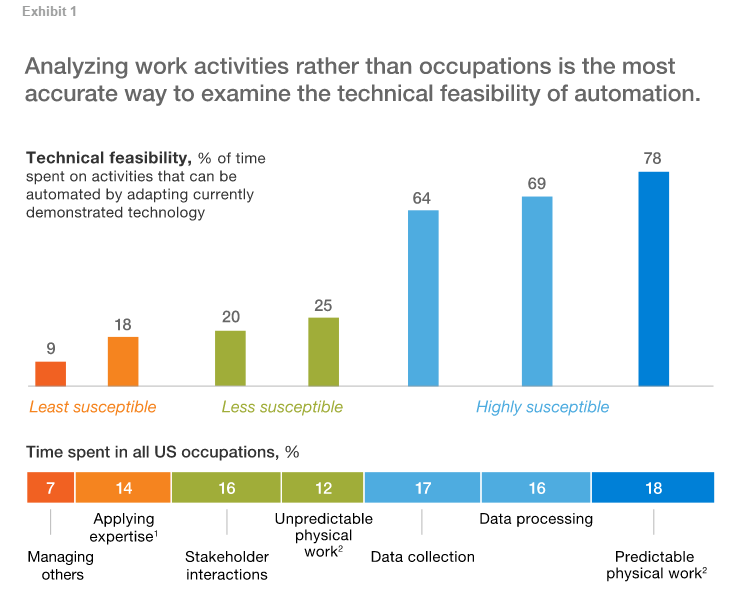

According to the consultancy McKinsey, to determine what activity will be automated, there are five factors involved: technical feasibility; costs of automating; the relative scarcity, skill, and cost of workers who might otherwise do the activity; benefits of automation beyond labor-cost substitution; and regulatory and social acceptance considerations. The chart below designed by McKinsey illustrates the technical feasibility, using currently demonstrated technologies, of automating three groups of occupational activities: those that are highly susceptible, less susceptible, and least susceptible to automation:

Once it is determined what the costs are to do the task manually and how much it would cost to automate that effort, then determine how much money will be saved, perhaps in time or other resources, by automating that task. Although calculating return on investment (ROI) of automation sounds very straightforward, it can get tricky when you do not consider how much it will cost to maintain your automation and any automation tool isn't a set-it-and-forget-it process. Therefore, the technology should be future-proof as well. Decision makers should make sure they understand the data and automation technologies on the horizon today.

My POV

Although the market is emerging, some small and medium-sized businesses (SMBs) may still feel automating and improving the middle office tasks is a complicated task that only the largest companies can pull off but, this is simply not true. In fact, there are many cases that SMBs may find even greater value when they start small, say, first tracking the touch points throughout the buyer journey via marketing automation. To me, one of the biggest motivations to do so is the increasing adoption of cloud-based deployments in both SMBs and enterprise. For larger organizations, the middle office functionality, historically, has garnered less attention from top management than the front office and it still remains a critical challenge for increasing the efficiency. However, thanks to big acquisitions like SAP’s deal with CallidusCloud, the topic is getting more spotlights in the news, and eventually, the middle office market will get the attention that it has long deserved.

At the end of the day, it is important to know that the majority of the benefits of having robust middle office capabilities may not come from reducing labor costs, but from raising productivity through fewer errors, higher and faster output, and increased quality and safety.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.