NetSuite Gives Oracle Additional Muscle in the Cloud War

Business software maker Oracle agreed to acquire cloud-based ERP provider NetSuite for about $9.3 billion in cash, aiming to gain market share in the fast-growing cloud computing business where the company has been lagging the competition.

"Oracle and NetSuite cloud applications are complimentary, and will coexist in the marketplace forever," said Oracle co-CEO Mark Hurd. "We intend to invest heavily in both products -- engineering and distribution." The deal had been speculated for a long time, not just because of its natural fit but also the long history between Oracle and NetSuite. NetSuite was started in 1998 by Evan Goldberg, a former Oracle executive. Oracle Executive Chairman Larry Ellison (pictured left), who stepped down as CEO in 2014, has been NetSuite's largest shareholder as he, with his family, own about 45.4 percent of NetSuite’s common stock, according to a recent company filing. Additionally, Zach Nelson, NetSuite’s CEO, ran Oracle’s marketing operations in the 1990s. For this reason, the acquisition is considered to be the least shocking acquisition news in the history of enterprise software.

"Oracle and NetSuite cloud applications are complimentary, and will coexist in the marketplace forever," said Oracle co-CEO Mark Hurd. "We intend to invest heavily in both products -- engineering and distribution." The deal had been speculated for a long time, not just because of its natural fit but also the long history between Oracle and NetSuite. NetSuite was started in 1998 by Evan Goldberg, a former Oracle executive. Oracle Executive Chairman Larry Ellison (pictured left), who stepped down as CEO in 2014, has been NetSuite's largest shareholder as he, with his family, own about 45.4 percent of NetSuite’s common stock, according to a recent company filing. Additionally, Zach Nelson, NetSuite’s CEO, ran Oracle’s marketing operations in the 1990s. For this reason, the acquisition is considered to be the least shocking acquisition news in the history of enterprise software.

"It’s like the high school sweethearts you always knew would get married but they had to get through four years of college first," said Frank Scavo, President of Strativa.

As an interesting fact, there was a time once, when Software baron Larry Ellison famously mocked cloud computing as a fad. Apparently, it turned out wrong and just like its leading rivals, including Microsoft, SAP, and IBM, Oracle has been aggressively trying to beef up its cloud offerings and significantly move its business toward the cloud-computing model as sales of traditional software licenses strive.

Eighteen-year-old NetSuite is a very well established company in the cloud enterprise resource planning (ERP) space by helping organizations track supply and demand, inventory, accounting, customer relationships (CRM), and HR. Adding Netsuite to the fray will help Oracle not only play catch up with competitors such as Workday and Salesforce.com, that specialize in cloud-based offerings, but also gain some additional competitive edge in taking on their rivals as NetSuite enables Oracle to reach out to smaller sized companies than its traditional clientele.

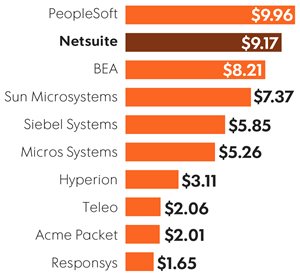

The ERP industry has been an active space for M&A in the past few years, and Oracle has also been eager to acquire smaller companies, spending more than $1 billion in recent months to buy Opower Inc., which makes cloud software for the utility industry, and Textura Corp.,which provides similar services for construction businesses. Prior to these buyouts, the largest recent deal was Oracle’s $5.3 billion purchase in 2014 of Micros Systems Inc., which sells internet-connected cash registers. However, the NetSuite deal is Oracle’s largest acquisition since it bought PeopleSoft for $9.96 billion in 2004, according to data from Standard & Poor’s Global Market Intelligence. Although the deal extended Oracle’s customer base and product offerings, approximately 5,000 PeopleSoft employees were laid off in the following months.

The ERP industry has been an active space for M&A in the past few years, and Oracle has also been eager to acquire smaller companies, spending more than $1 billion in recent months to buy Opower Inc., which makes cloud software for the utility industry, and Textura Corp.,which provides similar services for construction businesses. Prior to these buyouts, the largest recent deal was Oracle’s $5.3 billion purchase in 2014 of Micros Systems Inc., which sells internet-connected cash registers. However, the NetSuite deal is Oracle’s largest acquisition since it bought PeopleSoft for $9.96 billion in 2004, according to data from Standard & Poor’s Global Market Intelligence. Although the deal extended Oracle’s customer base and product offerings, approximately 5,000 PeopleSoft employees were laid off in the following months.

Spending big on the acquisitions of cloud companies and restructuring its engineering has paid off somehow as the company generated $12.2 billion in core cloud software sales in the last fiscal year which is an increase of 49 percent from fiscal 2014. However, pure cloud software represents only 8 percent of its overall revenue which shrank 3 percent last year.

On the other hand, NetSuite also announced its quarterly results and the company’s sales growth has been consistently strong. Revenue in the second quarter saw a 30 percent jump to $230.8 million, but its loss reached to $37.7 million from $32.3 million over the year-ago period. Excluding certain costs, such as expenses related to stock-based compensation, NetSuite’s earnings rose to $6.6 million from $1.7 million.

What NetSuite Brings Oracle

-

NetSuite brings Oracle about $800 million in revenue.

-

NetSuite's cloud approach can plug the holes in Oracle's cloud offerings, including manufacturing, retail, commerce, and professional services, all of which are areas Oracle still serves with an on-premises model.

-

Oracle will expand its market share as NetSuite has a market capitalization of $7.37 billion.

-

NetSuite has more than 30,000 customers, the bulk of which are small and mid-size companies where Oracle has not had a strong presence. With the deal, Oracle can take advantage of NetSuite’s inroads with smaller corporate customers.

-

Cloud provided the most significant growth for Oracle, up 36 percent to $2.85 billion, but it is still struggling to catch up with AWS, Microsoft, and Google due to its late start. The acquisition will definitely help Oracle step up its game.

In return, Netsuite stands to benefit from Oracle's global scale and technical assets as its international sales are modest. “NetSuite will benefit from Oracle’s global scale and reach to accelerate the availability of our cloud solutions in more industries and more countries,” Netsuite's CEO said in a statement released with the news. “We are excited to join Oracle and accelerate our pace of innovation.”

"It's definitely pricey from Oracle's perspective, but it's understandable and it's justifiable especially in this environment, when we've seen software-as-a-service companies go as high as 10, 11, 12 times sales," said Morningstar Analyst Rodney Nelson.

Ray Wang, Founder and Principal Analyst with Constellation Research, suggests customers try to renew contracts with more favorable terms before Oracle takes over: "Companies making acquisitions often raise prices to pay for them," he explained. "We always tell companies to renegotiate their contract if they like their current terms -- you want to lock in what you have.” He also suggests partners expect some changes as he believes that NetSuite's partner program is "friendlier" than Oracle's is, so it would be in NetSuite partners' interest to lobby Oracle to keep those programs separate.

Anurag Rana, an Analyst with Bloomberg Intelligence, made a bold prediction on the industry and Oracle’s rivals:

“Salesforce could be an eventual target, though there are few buyers that are large enough to snap it up. Workday Inc., the cloud-based software company that provides tools for human resources, could also be in play, and Microsoft could be a buyer.”

According to Abhey Lamba, an Analyst at Mizuho Securities USA Inc: “The industry is ripe for deals as big companies, bolstered by strong balance sheets, search for growth -- and smaller companies look for new paths to expansion.”

Oracle said the deal is expected to close in 2016, subject to regulatory and shareholder approval. Although the acquisition didn’t shock many, it will be interesting to see how its outcome will shape the industry and the cloud war.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.