Amazon is Moving into the Social Media Party, Why Now?

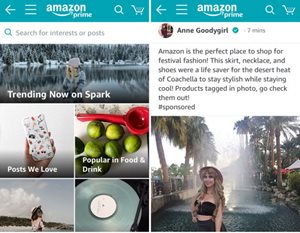

Years ago, Alibaba’s Taobao captured the Chinese culture of social shopping by providing a  mobile platform that keeps shoppers engaged because the brand saw the gap between social engagement and shopping and realized that they actually go hand in hand and eventually, increase conversion. Meanwhile, social media and commerce firms in the US and Europe have been living in denial of the impact a seamless e-commerce integration would have on their bottom line. Finally, the situation is about to change as Amazon is wading into the social media foray, having launched its Amazon Spark feature, which allows users to share photos of products they like, much like on an Instagram or Pinterest feed, but additional to those social platforms, with Spark, users also can click on an image and buy the items in it. The primary goal here is blurring the line between moments of inspiration and actual buying.

mobile platform that keeps shoppers engaged because the brand saw the gap between social engagement and shopping and realized that they actually go hand in hand and eventually, increase conversion. Meanwhile, social media and commerce firms in the US and Europe have been living in denial of the impact a seamless e-commerce integration would have on their bottom line. Finally, the situation is about to change as Amazon is wading into the social media foray, having launched its Amazon Spark feature, which allows users to share photos of products they like, much like on an Instagram or Pinterest feed, but additional to those social platforms, with Spark, users also can click on an image and buy the items in it. The primary goal here is blurring the line between moments of inspiration and actual buying.

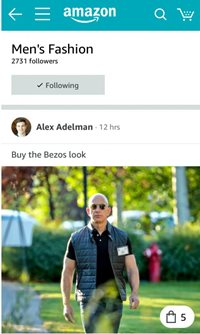

Even though, at a first glance, Spark could be seen as a challenge to Facebook’s Instagram, the platform is a formidable challenger to Pinterest as well, due to its feed-style interface providing users with ideas for things like decorating your home or wedding favors. However, only Amazon Prime members can post products to Spark while any Amazon customer can browse and buy from the “shoppable” feed.

Being the creator of the statements like “Frequently bought together” or “People who bought  this also bought” and given its strength in AI, Amazon, expectedly, powers its Spark platform with machine learning. To that end, the platform requires that you select up to five areas of interest not to bombard users with images of items that they have no interest in. The categories include “Books,” “Style & Fashion,” “Technology,” “Home Décor,” “Music,” “Fitness,” “Toys & Games,” and more, besides a number of niche categories like “TV Bingewatching,” “Cats,” “Internet of Things,” “BBQ,” and others that are much more specific and narrowly focused.

this also bought” and given its strength in AI, Amazon, expectedly, powers its Spark platform with machine learning. To that end, the platform requires that you select up to five areas of interest not to bombard users with images of items that they have no interest in. The categories include “Books,” “Style & Fashion,” “Technology,” “Home Décor,” “Music,” “Fitness,” “Toys & Games,” and more, besides a number of niche categories like “TV Bingewatching,” “Cats,” “Internet of Things,” “BBQ,” and others that are much more specific and narrowly focused.

As the feature is not designed for desktop use, users have to use the Amazon mobile app. If an image features a product that Amazon sells, users will be notified with a shopping bag icon in the bottom right corner illustrating a number that tells how many items from that image are available to be purchased on Amazon’s site. For that reason, in my opinion, the e-commerce behemoth is even late to get into the social media game.

The Social Evolution of Amazon

This year has been a milestone in Amazon’s journey to social shopping as even though Amazon had so many opportunities to strengthen its platform through social network features, the company always passed until this year. Obviously, the launch of Spark is by far the biggest step in that regard, not the first, though, as the e-commerce giant has been taking baby steps in recent months. After keeping the strong specific social networks that it owns like IMDB and Goodreads separated from its online store for years, things have started changing since last February when it announced to shut down IMDB’s message boards as it lost millions of IMDB commenters to IMDB’s Facebook page. The company hinted on that it would improve social experiences on its site.

Shortly after, Amazon’s livestreaming video service, Twitch, launched Pulse, an integrated social media feed that acts like a version of Twitter or Facebook where users can posts videos, images, text, and more that anyone following them will see. Additionally, Amazon rolled out its Influence Program which is invite-only to people with large followings on Instagram, YouTube, and other sites who can earn commission on any purchases they drive to Amazon by sharing a vanity URL in their posts.

Likes, comments, and shares on social networks hugely contribute to the analysis of the customer journey as they represent deep patterns related to consumer behaviors. Given its strength in AI, Amazon obtaining this type of data holds the power to disrupt the e-commerce market once again. Have being said, the company actually has been making a significant investment into conversational communication through its Alexa. Even though its improved Echo family bolsters consumer engagement, Amazon still needed a social media integration to compete with Facebook's Messenger that enables merchandisers to interact with customers.

The State of the Social Shopping Trend

Today, shopping experiences go well beyond a logical assessment of available alternatives, rather, they have become guided and emotional activities. Therefore, on top of integrated marketing execution, delivering proactive customer service and interactive experiences has become imperative for businesses to remain in the game and drive sales. Women, for instance, who comprise 63 percent of all online buyers, are now looking for an interactive relationship with brands in addition to convenience. In other words, creating a sense of community drives online sales.

Another big driver is social proof. The profound impact of social proof on making purchases and decisions comes from the fear of missing out which is, scientifically, a form of social anxiety and also known as FOMO in pop culture. Marketers have been harnessing the power of authentic social proof through user-generated content that is created by consumers who are willingly sharing their reviews and opinions about brands’ products and services. In fact, 70 percent of consumers place peer recommendations and reviews above professionally-written content, according to a survey conducted by Reevoo.

The recognition of the impacts of creating a sense of community and social proof on making purchases has been driving technology companies to adopt stronger, more tightly integrated social engagement capabilities through either acquisitions or from building the capabilities in-house. A day after of the release of Amazon’s Spark, Google, for example, announced a new newsfeed product that looks and feels much like Facebook’s newsfeed product. Users will be exposed to news stories, features, videos and music not only based on their interactions with Google, but also factor in what’s trending in their area and around the world. As a nature of machine learning algorithms, the more they use Google, the better their feed will be, according to the company.

Whether it is e-commerce or cloud software, today, vendors are in the process of injecting social networks into their platforms. If you think that this emerging trend of social media integration is only limited to the B2C commerce market, I would like to remind you Microsoft’s acquisition of LinkedIn for $26.2 billion, with an aim to integrate the most popular professional social network with its cloud-based product line, including Office 365 and Dynamics 365. Given LinkedIn has passed 500 million registered users in 200 countries on its platform, Dynamics 365 is expected to dramatically increase the effectiveness of salespeople by tapping into their professional networks and relationships.

The Possible Future of Amazon Spark

Even though it hasn’t yet been made clear whether Amazon plans to monetize Spark through  advertising, many think that eventually, such platforms that are run by the power of influencers will take a monetization turn to provide its users with incentives that can go beyond the typical rewards of internet popularity. More importantly, making money from product suggestions posted seems to be working for its rivals both Instagram and Pinterest so in the future, Amazon may come up with an updated affiliation program that allows a retailer to give a cut of the proceeds of any purchases made from a recommendation made by an influencer.

advertising, many think that eventually, such platforms that are run by the power of influencers will take a monetization turn to provide its users with incentives that can go beyond the typical rewards of internet popularity. More importantly, making money from product suggestions posted seems to be working for its rivals both Instagram and Pinterest so in the future, Amazon may come up with an updated affiliation program that allows a retailer to give a cut of the proceeds of any purchases made from a recommendation made by an influencer.

From July 30, those who have already written Amazon product reviews will be able to share them via their Spark profile as long as they are in the US and using the iOS Amazon app.

My POV

Given Google’s massive knowledge of its customers’ preferences, search history, and app usage, the newsfeed product has a huge potential to become a formidable challenger to Facebook, while Amazon’s Spark has a decent chance of stealing valuable attention from Instagram and Pinterest’s core customer set. What this situation tells us is that the biggest innovative technology giants are reaching the limit of their natural growth so much so that they are looking for ways of expanding their footprints into each other’s core markets to generate new revenue streams.

Moving forward, what we could expect is first, seeing other e-commerce giants such as Walmart following suits. On that note, in the upcoming months, we may even hear that Walmart or eBay is acquiring Snapchat which leads us to my second prediction. Reversely, we can witness a couple of the social media giants like Facebook injecting commerce into its social engagement platforms. Well, Facebook has already tried to do so with the launch of Facebook stores but the company has done a really poor job on awareness as well as functionality. Nevertheless, one thing is certain that major technology providers are disrupting the spaces that they are in by taking advantage of consumers’ obsession with their mobile devices as well as flexible content repositories that allow content to be published beyond a website to apps, channels, and Internet of Things (IoT) devices to create new touchpoints.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.