Software Jobs are Spreading out from Silicon Valley and to Retail

According to a recent study conducted by Glassdoor, there have been two big shifts in the tech boom happening in the U.S. First, since almost every company is transforming itself into a tech company, the share of software jobs has risen sharply in three non-tech industries: Retail, Banking & Financial Services, and Manufacturing. Second, even though the Seattle area has long been a major employer of software talent, that trend has escalated during the past five years, while the share has fallen sharply in the heart of tech-centric Silicon Valley, San Jose. In this article, we will look at why tech jobs are spreading out of tech hubs and where the biggest gains in the share of software experts are hiring.

boom happening in the U.S. First, since almost every company is transforming itself into a tech company, the share of software jobs has risen sharply in three non-tech industries: Retail, Banking & Financial Services, and Manufacturing. Second, even though the Seattle area has long been a major employer of software talent, that trend has escalated during the past five years, while the share has fallen sharply in the heart of tech-centric Silicon Valley, San Jose. In this article, we will look at why tech jobs are spreading out of tech hubs and where the biggest gains in the share of software experts are hiring.

A Sharp Rise in Software Jobs in Retail Explained

Considering online retail sales are projected to surpass traditional sales, many organizations are steering their ships in the very same direction where they beef up their e-commerce capabilities by exploiting new technologies. Therefore, the retail industry has made a significant upwards movement over the past five years with 7.5 percent increase in the industry’s software job postings. The retail sector is followed by the Banking & Financial Services industry, especially when it comes to software roles related to online security and payments, electronic trading, and mobile banking apps, according to the study. The rising demand for software hiring in non-tech sectors makes a lot of sense, considering the domino effect that happens when so many disruptors are reinventing an industry, the way of doing business in other associated sectors would also change.

While machine learning and data science are the most in-demand skills in software development at the moment, according to LinkedIn, there is also an alarming talent gap in these emerging tech fields. In fact, a research from the McKinsey Global Institute finds that in the United States, the gap could reach 1.5 million graduates by decade’s end. China, where many global companies have staked growth plans, faces a shortage of 23 million college-educated workers by 2020. Canada is also headed for a major technology talent shortage in the next five years. Canada needs 182,000 people to fill positions for information systems analysts and consultants, computer and network operators, Web technicians, software engineers and others by 2019, according to an IT labor market report. Additionally, a research conducted by ClickZ last year found that 20 percent of marketers in Asia-Pacific said they were “not very confident” in digital skills, compared to a global average of 15 percent.

To me, one of the main reasons behind this shift is the rise of mobile commerce. According to a BI Intelligence report, between 2016 and 2020, U.S. mobile commerce (m-commerce) sales are projected to grow nearly 260%, from $79 billion to $284 billion. Gartner also estimates that in 2017 U.S consumers’ mobile engagement behavior will push mobile commerce revenue up to 50 percent of U.S. digital commerce revenue. No wonder why non-tech industries are trying to transform their businesses into a tech company in order to consolidate their position in the face of growing competition fueled by today's advanced technology.

As an example, at Starbucks, for instance, mobile payments currently account for more than  25% of transactions at its U.S. operated stores. Starbucks Mobile Order & Pay makes up more than 7% of total U.S. transactions. As the leading coffee brand believes in the importance of redeveloping its tools along the lines of the new consumer reality, Starbucks keeps innovating new ways of engaging with customers through fun and personalized experiences. The company has recently introduced a conversational ordering system called "My Starbucks Barista" which is a digital assistant powered by Apple's Siri. It will allow customers to place orders via voice command or a message. On top of that, the platform will deliver real-time personalization and product suggestions. To do so, Starbucks will track your buying habits and use that information to recommend your favorite food and drinks so you will be served based on your tastes and preferences.

25% of transactions at its U.S. operated stores. Starbucks Mobile Order & Pay makes up more than 7% of total U.S. transactions. As the leading coffee brand believes in the importance of redeveloping its tools along the lines of the new consumer reality, Starbucks keeps innovating new ways of engaging with customers through fun and personalized experiences. The company has recently introduced a conversational ordering system called "My Starbucks Barista" which is a digital assistant powered by Apple's Siri. It will allow customers to place orders via voice command or a message. On top of that, the platform will deliver real-time personalization and product suggestions. To do so, Starbucks will track your buying habits and use that information to recommend your favorite food and drinks so you will be served based on your tastes and preferences.

Artificial intelligence technology is also not just something invented for billionaire Silicon Valley companies. Non-tech companies are utilizing accelerated AI solutions as well. In fact, the technology is primarily affecting industrial and mechanical industries by boosting productivity in mass production, but today all types of businesses are taking advantage of artificial intelligence in order to increase efficiency and customer engagement. For example, an insurer and finance company, United Services Automobile Association (USAA) works with an AI product built by Intel’s Saffron. The platform matches patterns of consumer behavior, so the organization can predict how to reach out to customers specifically about what products they might be interested in. As a result, the organization can approach a prospect/customer through personalized and organized customer service. When you think about it, this is a win-win situation as the company reduces cost while consumers are encountering better experiences.

As digital transformation continues to engulf everything in its path, opportunities and challenges will equally get off the ground. With that in mind, it is time for non-tech sectors to adopt a mobile-first approach, or maybe even go beyond that by innovating new ways of delivering exceptional customer experiences. Investing in mobile, video content, conversational systems, social advertising, and digital storefronts seem to be a huge help for forward-thinking businesses that want to remain with or ahead of the curve over the next 5 to 10 years. Organizations who tap into these technology trends will be rewarded. On that note, mid-sized companies will have the highest impact on IT spending as they can rapidly adopt new technologies and solutions without getting too affected by economic volatility.

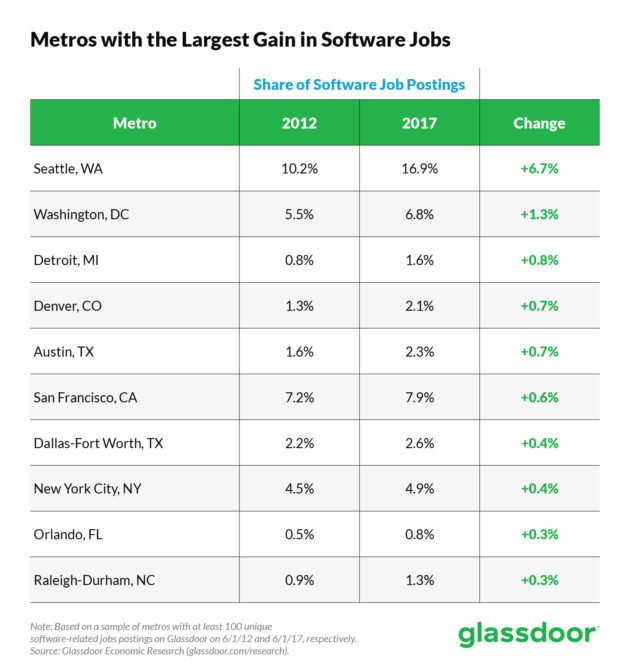

Seattle is the Fastest-Growing U.S. City for Software Job Growth

Moving onto the second interesting finding from the report cited in the opening paragraph, conducting that Seattle is the fastest-growing U.S. city for software developer jobs which grew 6.7 percent in the past five years, where San Jose experienced a 7.7 percent fall out in software jobs posted over that same time period.

According to CBRE’s annual Scoring Tech Talent report, Seattle is now one of the top two tech markets in the nation, coming behind San Francisco. “With the number of projects and moves on the horizon and a clear desire from both tech workers and corporations that are either willing to move or expand here, Seattle continues to be a desirable market for technology companies nationwide, driven by both the jobs that are being created in the market and the strong talent base coming out of the region,” said Matt Walters, first vice president with CBRE’s Technology and Media Practice Group in Seattle. Here are the main factors behind this shift, according to CBRE:

-

Seattle is the most educated market in the nation

-

Tech workers are well-paid, with an average wage of $113,906 in Seattle

-

The cost of living in Seattle is significantly cheaper than the Bay Area as the average rent in Seattle remains more than $1,100 per month less than San Francisco.

-

Seattle has a lower cost to operate a tech company than San Francisco as office rents are almost half the cost of it.

-

The city has an increasing young population as approximately 14,100 Millennials have moved to the area since 2009, a population increase of 11.7 percent for that generation.

Seattle is not the only city that has seen more and more clusters of high-tech boom, though. From Denver to Washington, DC, and Austin, Texas to Detroit, MI, entrepreneurs have spread outside of the coasts and high-profile tech hubs, such as San Francisco, Boston, and New York City, to other parts of the country. Denver, for instance, is becoming one of the big beneficiaries of this movement due to its relatively low cost of living and its high concentration of good universities as in Austin and Seattle. At this point, the city isn’t the headquarters for any big tech companies just yet but some tech titans like IBM and Oracle, which paid more than a billion dollars to acquire Datalogix, a Denver-based data-collection firm back in 2014, have offices there. In 2015, Denver startups attracted more than eight hundred million dollars in venture-capital funding, led by technology, energy, food, and marijuana companies. Have being said, the region is enticing vibrant start-ups. Scott McNealy, a founder of Sun Microsystems, picked Denver as the headquarters for a data-analysis startup called Wayin. In an interview, he explained why he left California, “The prices of everything have skyrocketed. The regulations. The pension deficit. The traffic. It’s just not a fun place to go start.”

Here Comes Again the Amazon Effect

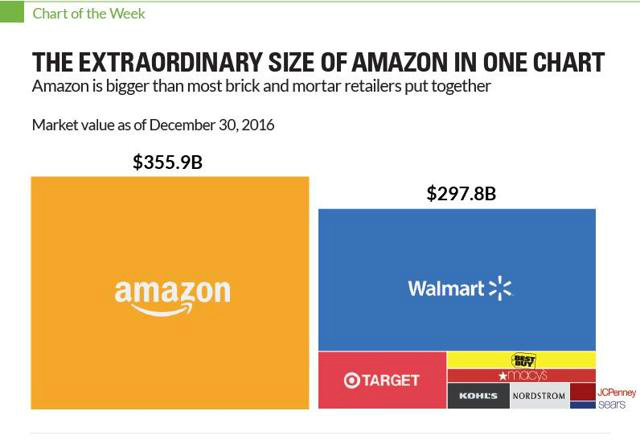

When we circle back to the Glassdoor report, its two important highlights about the unprecedented growth of the demand for tech workers in both retail industry and Seattle naturally bring e-commerce behemoth Amazon to mind. Amazon had less than 9,000 workers five years after it was founded in 1994. Today, Amazon has 340,000 workers, making it the fastest company to reach the 300,000 jobs mark ever.

More than the half of online shoppers go to Amazon when they go online. A recent research from One Click Retail (OCR) claimed that Amazon is enjoying an average year-over-year growth (YoY) rate of 38% compared to the total retail market’s combined growth average of 6% for U.S. housewares, health & personal care and beauty industries. "What we're currently witnessing is eCommerce finally beginning to disrupt everyday household products, with Amazon leading the pack," said Spencer Millerberg, OCR's CEO. "Consumers benefit from buying these items in bulk and having them delivered right to their doorsteps. Our numbers continue to demonstrate just how significant these everyday items are in helping to drive Amazon's exponential YoY growth."

My POV

In the advent of technology, digital transformation is gearing up in many various industries as businesses try to figure out how to get things done in the most productive way in order to engage with their audience more than ever, and ultimately, to generate leads and conversion. Therefore organizations that focus their digital engagements on addressing the customer experience and customer satisfaction first will win the hearts and wallets of modern buyers. With this in mind, the sharp growth for tech positions available in non-tech sectors like retail tells us a major digital transformation has picked up the speed in many industries.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.