Salesforce Buys Demandware to Join E-commerce Space

Salesforce announced the largest deal in its history that it would acquire Demandware, an enterprise cloud e-commerce software provider, for $2.8 billion in cash.

“Demandware is an amazing company—the global cloud leader in the multi-billion dollar digital commerce market,” said Marc Benioff, Chairman and CEO, Salesforce. “With Demandware, Salesforce will be well positioned to deliver the future of commerce as part of our Customer Success Platform and create yet another billion dollar cloud.”

“Demandware is an amazing company—the global cloud leader in the multi-billion dollar digital commerce market,” said Marc Benioff, Chairman and CEO, Salesforce. “With Demandware, Salesforce will be well positioned to deliver the future of commerce as part of our Customer Success Platform and create yet another billion dollar cloud.”

Burlington, Mass.-based Demandware was founded in 2004. The company raised $54 million when it was still a startup. According to its most recent quarterly earnings reported at the end of April, its revenue was $67 million, with a net loss just under $12 million. It offers a cloud-based e-commerce platform and related services to retailers and manufacturers around the world. Clients include Design Within Reach, Lands’ End, L’Oreal, and Marks & Spencer. Demandware went public in 2012, trading on the New York Stock Exchange (NYSE) and raising $88 million in its IPO. According to the Demandware's annual report: "As of December 31, 2015, we had 331 revenue generating e-commerce customers operating sites on Demandware Digital, up from 204 and 267 as of December 31, 2013 and 2014, respectively."

“Demandware and Salesforce share the same passionate focus on customer success,” said Tom Ebling, CEO, Demandware, also in a statement. “Becoming part of Salesforce will accelerate our vision to empower the world’s leading brands with the most innovative digital commerce solutions that enable them to connect 1:1 with customers across any channel.”

Another good point is that Demandware could run on AWS as CMS-Connected reported last week that Salesforce will use Amazon’s public cloud instead of its own infrastructure to run more of its new and international software applications.

Salesforce.com CEO Marc Benioff told CNBC in an interview:

"We've never seen more deals and more things happening. We're not winning every deal. This is just a deal we were actually able to get done." Here is more of what Benioff had to say on the Demandware deal:

Salesforce’s billion dollar cloud deal from CNBC.

The acquisition is very important not only because of the eye-popping price but also the reasons below:

Filling the Blanks

Just like Alan Pelz-Sharpe predicted on the CMS-Connected Show aired on January 28th, the e-commerce world is getting huge. Gartner expects to see spending on digital commerce platforms to grow by more than 14 percent annually, reaching $8.544 billion by 2020, according to Salesforce’s press release.

The large enterprise B2C customers in the retail and CPG industries have been Salesforce’s missing puzzle piece that Demanware’s expertise could fit. It will be a move into the e-commerce space with a Salesforce Commerce Cloud. The acquisition brings Salesforce into heated e-commerce competition with the likes of Shopify, Amazon, and eBay.

On the conference call, Salesforce President Keith Block said that Demandware would be the foundation of yet another business unit or “cloud.” The new e-commerce cloud will join Salesforce’s existing Sales, Marketing, Service, and upcoming Internet of things (IoT) clouds.

With Demandware’s functionality which is not only transactional commerce but also strong customization and engagement can help Salesforce extend the contracts with existing customers.

Even this reason alone makes the deal very valuable, however, Demandware doesn’t really have the same level of expertise when it comes to the B2B market, which is another branch of the fast growing e-commerce tree.

"A lot of what Salesforce is trying to do is capture all of your business, and they've been very, very good at it," said Jim Cramer, TheStreet's founder. "Salesforce wants to be with the consumer. The [acquisition] made sense."

Speaking of Customer Expansion

Salesforce will be able to upsell its current offerings from online marketing analytics through back-office software for sales and other IT capabilities to some of Demandware's existing customers, which include Lands' End, L'Oreal, and Marks & Spencer. The deal is expected to increase Salesforce’s annual revenue by between $100 million to $120 million while trimming adjusted earnings per share by 7 cents. Salesforce increased its revenue guidance, now saying it expects 2017 revenue of between $8.26 billion to $8.32 billion, up from its previous anticipation of $8.16 billion to $8.20 billion.

The revenue of the Cloud-commerce software maker Demandware has projected to grow by an average of 27 percent in each of the next four years which is much better projection compared to the anticipation for ExactTarget made at the time it was acquired. However, the margin doesn’t seem like Salesforce’s big concern, considering that the company has rarely turned a profit in its last 17 years. The reason is not that the company doesn’t generate revenue, yet it pays high prices for acquisitions due to its preference to prioritize growth. Salesforce has been growing at a sustained rate of 25-30 percent for many years.

Salesforce's Expensive Taste

Salesforce purchased 14 companies in the last three years and 39 companies in total since it was launched in 1998. It is quite interesting that they have been paying a premium most of the time. For instance, in 2014, it acquired the big-data company RelateIQ for $390 million which was 70 times its annual recurring revenue of less than $5 million. In 2012, Salesforce spent $745 million on the acquisition of Buddy Media more than 20 times the social-media marketing company’s revenues.

The closest deal to the Demandware deal was Salesforce's $2.5 billion acquisition of ExactTarget, announced in June 2013. That was pricey as well. Although the deal helped Salesforce double its stock and became one of the fastest growing parts of its portfolio, the integration wasn’t as successful as expected, as ExactTarget runs on a completely separate infrastructure, so the concern regarding the new Demandware integration is if it makes the infrastructure even more complex.

The reason behind why Salesforce paid a premium for Demandware could be the rush to catch up to its big rivals; SAP which bought Ariba in 2012 and Oracle which bought Micros in 2014 as an e-commerce software.

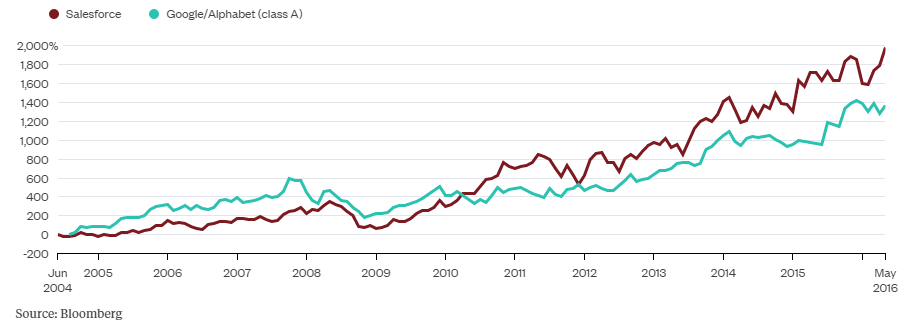

Salesforce’s strategy is to acquire fast-growing companies which can help to improve its growth rate as well as provide a new business line. This strategy seems like paying off as the illustration below demonstrates that Salesforce’s stock trades at about 30 times its IPO price in 2004, while Google’s stock, which went public at the same time with Salesforce, trades at 18 times its IPO price.

Although with this deal, Demandware will plug the e-commerce gap that Salesforce has had for so long, there is still an obvious omission on the salesforce portfolio which can’t be improved by Demandware’s capabilities. This missing part is “content”. The bottom line is that we all will see how much the Demandware transaction, which is expected to close in Q2 of Salesforce’s 2017 fiscal year, will help Salesforce maximize its growth and make some actual profit in upcoming years.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.