Microsoft Dynamics CRM After the Acquisition of LinkedIn

On the heels of the LinkedIn acquisition announcement, Microsoft has begun to work on how to connect LinkedIn with the Dynamics products in an effort of expanding its CRM market share.

For those who aren’t acquainted with Microsoft’s largest acquisition in the history of the company, as CMS-Connected reported early last week, Microsoft Corp. announced that it has agreed to acquire LinkedIn in an all-cash transaction for a jaw-dropping price of $26.2 billion. In addition to the announcement, Microsoft explained how it plans to utilize LinkedIn’s Sales Navigator alongside Microsoft’s Dynamics, customer management product, to provide “actionable insights” to help users find leads and close deals through leveraging the data in the core LinkedIn social networking database.

For those who aren’t acquainted with Microsoft’s largest acquisition in the history of the company, as CMS-Connected reported early last week, Microsoft Corp. announced that it has agreed to acquire LinkedIn in an all-cash transaction for a jaw-dropping price of $26.2 billion. In addition to the announcement, Microsoft explained how it plans to utilize LinkedIn’s Sales Navigator alongside Microsoft’s Dynamics, customer management product, to provide “actionable insights” to help users find leads and close deals through leveraging the data in the core LinkedIn social networking database.

Both companies' CEOs, Satya Nadella and Jeff Weiner, stressed the importance of LinkedIn’s Sales Navigator service. “Now we will be able to take that business intelligence tool, Sales Navigator, deeply integrate that into Dynamics and CRM and we believe we can change the game that way,” LinkedIn CEO Jeff Weiner told investors on Monday.

Microsoft's CRM Efforts

Over the past year, Microsoft has been investing in reinforcing its Dynamics to leverage its CRM functionality which is key to staying competitive with Salesforce as it has made a number of strategic acquisitions in recent years to grow. The technology giant has played catch-up by acquiring a web portal Adxstudio, field service management FieldOne, and customer service capabilities Parature. A couple of weeks ago, Microsoft also announced the latest Dynamic release with big data, analytics, and Internet of Things capabilities in an effort of keeping up with the CRM competitors. However, the lastest accusation of LinkedIn has changed the direction of the game. Integrating Microsoft with LinkedIn's professional user data can provide strong competitive differentiation to Microsoft Dynamics customer relationship management (CRM) system from other application service providers and its rivals could find it hard to match. No doubt that if Microsoft could figure out how well Microsoft connects LinkedIn with the Dynamics products, that data will strengthen all these efforts to compete head-to-head against Salesforce in the market.

The CRM Market

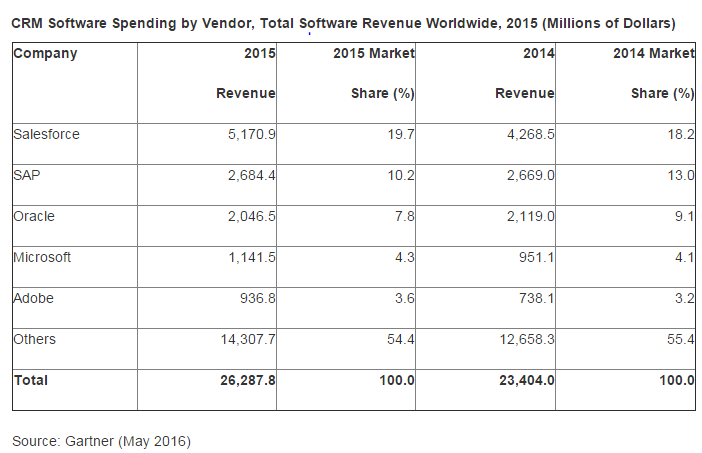

Microsoft holds 4.3% of the $26.3 billion market for sales tools, known as customer relationship management, which is well behind Salesforce, SAP, and Oracle, according to Gartner’s latest numbers from May this year:

As the table above illustrates, Salesforce is a pioneer in delivering applications software in the cloud and is the market leader in CRM with a 19.7% share, followed by SAP at 10.2% and Oracle at 7.8%. However, the Microsoft-LinkedIn deal will allow Microsoft to compete more effectively with Salesforce.com, according to a research note by Deutsche Bank. How so?

Microsoft owns a much smaller share of some major market categories addressed by Dynamics, leaving more room to grow. Although Microsoft has recently increased its focus on the option of delivering the technology on a cloud service which is getting more popular among customers, it still sells ERP software that customers can install and run on their own servers. LinkedIn’s huge data of resumes enables Microsoft’s ERP tools to help human resources professionals manage the overwhelming number of temporary and contingent workers, such as drivers for Uber Technologies Inc. However, Microsoft has been also struggling in the ERP competition where SAP SE leads with 23% of the market, followed by Oracle with 12%. The reason for the struggle is that both companies have moved their services to the cloud, and this makes their customers lock-in which is the case when customers are often unwilling to migrate away from software that runs on site as well as manages back-office operations.

LinkedIn is a Software-as-a-Service vendor with approximately 70% of its revenue coming from software related services, so this integration is expected to expand Microsoft's overall cloud and SaaS footprint.

On the other hand, SAP made a somewhat similar move which was the competitive value of LinkedIn’s social network in human resources in May 2014, when it acquired Fieldglass, a cloud software that helps companies procure and manage contingent labor and services, but it hasn’t had the same level of impact with LinkedIn on the market yet.

Microsoft’s acquisition of LinkedIn seems like a big threat to Workday Inc., which has 3% of shares in the ERP market, according to research firm Gartner Inc., but Workday has disagreed as a company spokesman said: “We are not concerned, given Dynamic’s current market position.”

On the other hand, the LinkedIn deal has broader implications than just CRM, as Microsoft has stressed too. The developers and designers are also working on ways to increase the number of LinkedIn users, integrate LinkedIn with Office 365, and develop a new, sophisticated HR management offering. If the teams can come up with great innovations, the acquisition could be a pivotal moment in Microsoft's history.

How To Become a Market Leader

The CRM market looks that it has been heading to predictive selling where brands engage and educate buyers and guide them to optimized, personalized marketing messages, advice, and/or purchase recommendations regarding your products and services, just like Amazon does. Microsoft has already embraced this predictive slant on CRM as an early adopter, and there is the machine learning technology in place so that in the long term, Microsoft can take advantage of the unique data LinkedIn provides to boost its predictive selling motion. Ultimately, if Microsoft plays its card right and turns this deal into a step beyond platforms and technology and into the realm of data services and social networks, Salesforce may not be able to quickly catch up and will lose its market share.

Thought Leaders

In Forrester’s Quick Take: Microsoft Bets on Social to Transform the Business Customer Experience report on the acquisition, Forrester Analyst Mary Shea stated that through the tie-up, Dynamics could become a more attractive customer relationship management (CRM) package in the business-to-business (B2B) market:

In Forrester’s Quick Take: Microsoft Bets on Social to Transform the Business Customer Experience report on the acquisition, Forrester Analyst Mary Shea stated that through the tie-up, Dynamics could become a more attractive customer relationship management (CRM) package in the business-to-business (B2B) market:

“Microsoft Dynamics gains an important competitive advantage over Salesforce since both companies had equal access to the LinkedIn Sales Navigator widget previously,” she said and added: “The planned development of a proprietary and tightly integrated Dynamics/Sales Navigator offering will be compelling for B2B organizations looking to optimize their social selling efforts – as will the improved access to LinkedIn profile data, which is a valuable source of targeting insights for account-based marketing, one of the most significant trends in B2B marketing right now.”

Umberto Milletti, Founder and CEO of InsideView, an independent software vendor in the market intelligence  space with over 20,000 customers and a longtime partnership with the Microsoft Dynamics CRM team, said:

space with over 20,000 customers and a longtime partnership with the Microsoft Dynamics CRM team, said:

"In a few years, we'll look back at this acquisition as a landmark event in the CRM and marketing technology industry. Every CRM or marketing technology provider will be required to provide intelligence as part of their solution. Customers will demand it. How can one market, sell, or recruit without having access to intelligence about one's market, the companies, and people in it?" He also expressed: “While social sales methods have grown in popularity, augmenting CRM with external sources should be done to provide value beyond sales. Marketing, customer service, sales, and anyone else engaging with customers can benefit from access to better insights. We expect to see Microsoft leverage the LinkedIn capabilities across the whole revenue cycle, and beyond.”

Brent Leary, Co-Founder and Partner at CRM Essentials, who has followed the market for many years says it could give Microsoft Dynamics a significant boost. “If they leverage the data in LinkedIn alongside the other data sources they have through their systems and run it through machine learning and artificial intelligence (AI), it could be potentially game-changing” he said and added:

Brent Leary, Co-Founder and Partner at CRM Essentials, who has followed the market for many years says it could give Microsoft Dynamics a significant boost. “If they leverage the data in LinkedIn alongside the other data sources they have through their systems and run it through machine learning and artificial intelligence (AI), it could be potentially game-changing” he said and added:

"One thing to watch is whether Microsoft decides to open the LinkedIn APIs to third party developers, which would also make it available to rivals like Salesforce" Leary believes it will because it will increase the value of the LinkedIn data.

Who knows if Microsoft will prove history wrong and find a secret sauce which Salesforce won't be able to easily recreate, but there is no doubt that this deal injects energy into Microsoft. We will explore the impact of the deal more in subsequent posts as events unfold.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.