Mobile Commerce is on the Rise, so is Fraud

By Venus Tamturk

August 24, 2016

big data, customer experience, Customer Journey, data, Data Security, ecommerce, Mobile Content Management, smart data, social media, vendors

In 1997, Coca-Cola installed two vending machines which accepted payment via SMS text messages in Finland, and it was the first time mobile commerce services were delivered. Since then, mobile commerce has come a long way, as in March, Amazon submitted a patent application for payments by selfies. In fact, between 2016 and 2020, U.S. mobile commerce (mCommerce) sales are projected to grow nearly 260%, from $79 billion to $284 billion, according to a BI Intelligence report. However, every rose has its thorn. The average percentage of successful fraud transactions in the mobile channel also jumped from 26% to 35%, based on the data provided by LexisNexis.

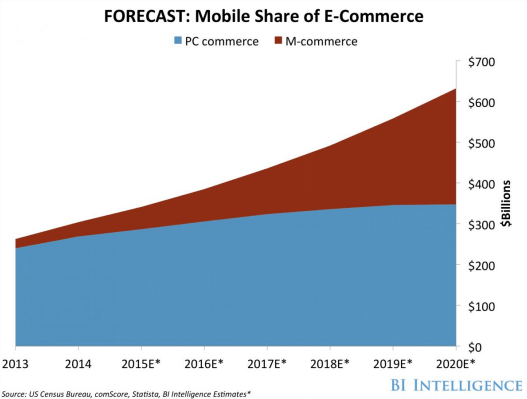

In 2014, mobile made up 11.6% of the US e-commerce, equaling $303 billion in sales. BI Intelligence forecasts that by 2020, mobile will account for 45% of the nation’s $632 billion in total e-commerce sales. Currently, only 16% of all merchants embrace mCommerce. While another 32% are considering engaging in mobile commerce within the next 12 months, 80% indicate they will accept mCommerce payments within the next year or two. On the other hand, mCommerce companies experience 880 fraud attempts each month, and 581 of those attempt, representing 66%, are successful, according to the LexisNexis report.

“When looking at industry statistics, is obvious that consumers’ comfort level with mobile transactions has been steadily growing,” noted Monica Eaton-Cardone, Co-Founder and Chief Operating Officer of Chargebacks911, a dispute mitigation and risk management firm. “As a result, many merchants are shifting their attention to the mobile channel in an effort to claim a share of the mCommerce pie. However, it’s critical for them to have measures in place to handle the rising fraud and chargebacks that have become a growing threat to mCommerce profitability.” She urges merchants to pursue multi-layered solutions, since evidence shows they are effective in reducing both false positives and successful fraud attempts.

Although the idea of paying by selfie sounds very futuristic, it might be one of the best solutions in regards to securing mobile payments. In fact, the recent study by Lux Research suggests that mobile payments should embrace innovations like multi-modal biometrics to provide ease of use and security consumers seek.

How to Combat Mobile Commerce Fraud

-

Analyzing current and historical statistics, which is called predictive analytics, is the key to predict fraud. With this technique, the system can spot patterns of fraudulent activity and differentiate these patterns from legitimate purchasing activity. Once done, it flags orders that are likely to be fraud.

-

Based on the predicted analytics, merchants can assign points for different elements of each mobile transaction such as IP address, email service provider, shipping and billing addresses, the AVS result code, ticket amount, type of merchandise, shipment method, and the length of the customers relationship. In the end, all these points provide the order’s overall fraud score in order for merchants to sort orders for approval, rejection, or review.

-

It is important to determine mobile device’s exact location to catch when fraudsters disguise their identity and trick merchants.

-

Pre-paid devices are more likely to chosen by fraudsters. Best-in-class fraud prevention solutions for mobile commerce are able to notify merchants when a device is pre-paid so they can better analyze the risk and respond accordingly.

-

Transactions coming from card-present mobile POS systems like Square & Intuit GoPayment, are less risky than transactions from card-not-present mCommerce. Therefore solutions used by merchants should be able to determine if it is a card-present or a card-not-present transaction so they can apply the appropriate level of inspection.

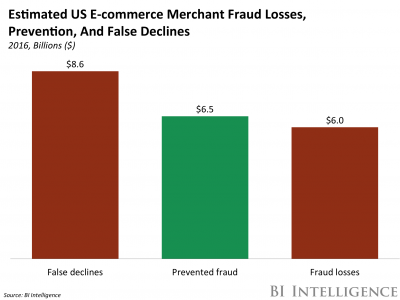

On the other hand, merchants have to make sure their fraud prevention strategy is contributing to a seamless, friction-free customer journey. If their fraud prevention is likely to manifest more of an obstacle than a help to the goal, then it’s time to restructure the strategy. In fact, false declines, which are valid transactions that are incorrectly rejected, are becoming more of an expensive issue than actual fraud. BI Intelligence estimates for 2016 that US e-commerce merchants will lose $8.6 billion in falsely declined transactions which are over $2 billion more than the $6.5 billion in fraud.

Gartner also shed a light on this issue and reported this year: “Web commerce has shifted the role of fraud detection from the arcane back office loss prevention department to being front and center in the customer experience.”

Social Shoppers

The social media impact on mCommerce is becoming impossible to ignore for online retailers. In 2014, the top 500 retailers generated $3.3 billion from online shopping through social media. Monetate’s data showed that shoppers who shopped on e-commerce websites after clicking from social media channels such as Twitter, Facebook and Instagram spent $108.72 per order during the second quarter of 2015. According to Business Insider, social-driven retail sales and referral traffic are increasing at a faster rate than any other online channels. With the launch of buy buttons on Twitter, Pinterest, Instagram and Facebook, social media is gaining wider traction.

2015 was a turning point for mobile shopping. Especially during the holiday season, mobile played a bigger role than ever, with a 45% increase in mobile traffic and 82% increase in revenue. However, everything is not awesome. Retailers are also losing $18 billion annually because of shopping cart abandonment. Research reveals over two out of three users who add items to their online shopping cart leave without making a purchase. The numbers are even more depressing on mobile where conversion rates are 70 percent lower than desktop. Taking into account that back-to-school is in full swing and the winter holidays are just around the corner, it’s the perfect time for online retailers to assess whether their checkout is set to deliver today’s ideal customer experience while preventing mobile commerce fraud.

2015 was a turning point for mobile shopping. Especially during the holiday season, mobile played a bigger role than ever, with a 45% increase in mobile traffic and 82% increase in revenue. However, everything is not awesome. Retailers are also losing $18 billion annually because of shopping cart abandonment. Research reveals over two out of three users who add items to their online shopping cart leave without making a purchase. The numbers are even more depressing on mobile where conversion rates are 70 percent lower than desktop. Taking into account that back-to-school is in full swing and the winter holidays are just around the corner, it’s the perfect time for online retailers to assess whether their checkout is set to deliver today’s ideal customer experience while preventing mobile commerce fraud.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.