Amazon Prime Day; A Brilliant eCommerce Conceptualization

By Erika Jones

August 6, 2019

Amazon, Amazon Prime, Digital Marketing, ecommerce, E-mail Marketing, Episerver, Exclusive Interviews, marketing, Revenue, ROI, Salesforce

I, myself, love a sale. Who doesn’t?

As an Amazon Prime member, I was well aware of their mid-July annual event—Amazon Prime Day. I had a number of desired items that I had been hemming and hawing about buying, languishing in my ‘cart’. I was eager for the big day to arrive to pull the trigger and make some purchases.

A week before the sale while shopping at the popular grocery store, Whole Foods, I was given a $10 Amazon gift card for use during the two-day sale extravaganza. A small gesture, but I think it was the deciding factor for me to snap up the goodies on my wish-list. Their marketing efforts were on point, and I happily finalized my purchases, as did a slew of other online shoppers. Since its inception in 2015, Amazon Prime Day has evolved into a two-day shopping event that is now one of—if not the— biggest event in eCommerce.

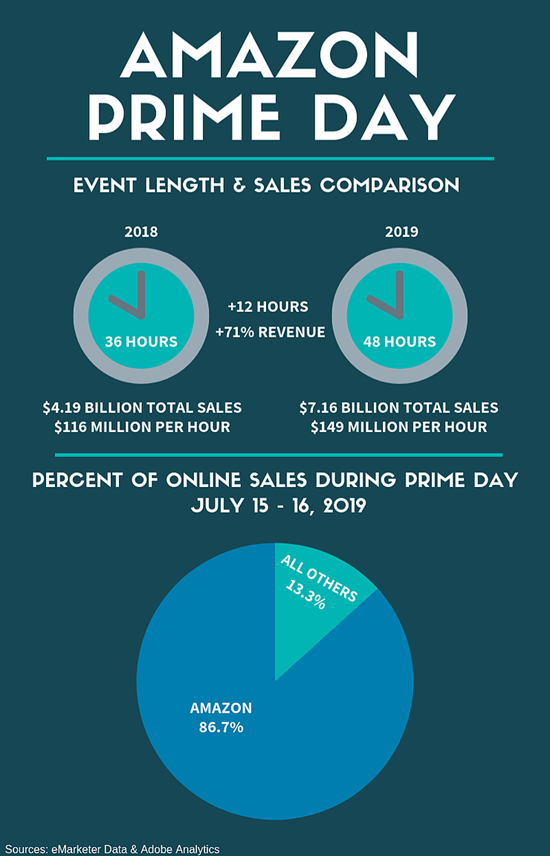

Amazon Prime Day 2019 took place over a two-days between July 15th and July 16th. The stats have come in to reveal that this year’s commerce frolic was the most successful yet, registering sales of 175 million items over the 48 hours. Amazon’s Prime Day earnings reached US$7.16 Billion, which was more than its sales for Black Friday and Cyber Monday in 2018 combined.

Prime Day is far more than a mere sales event. It has morphed into something of a manufactured holiday that has become more and more recognizable with each passing year. To be sure, Prime Day is proving to be just as popular, if not more so, than the post-U.S. Thanksgiving Cyber Week.

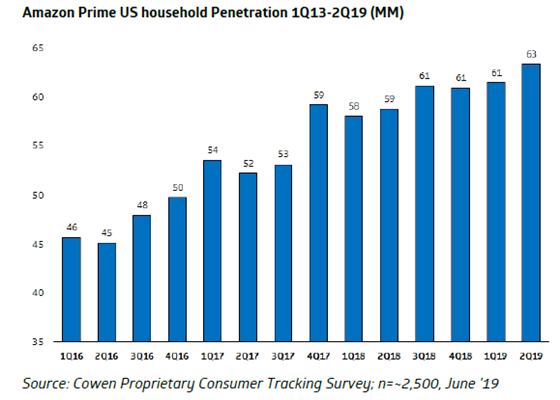

The initial conception of Prime Day’s primary goal was to encourage those who were not already Amazon Prime subscribers to purchase memberships. Prime members get access to their coveted free, next day shipping, streaming access to Netflix’s competitor, Prime Video, music streaming on Amazon Prime Music, and a host of other benefits. The number of Prime subscribers has been snowballing since its inception with around 63 million U.S. households having a Prime membership. Amazon Prime Day is truly an ingenious e-marketing scheme created by the online marketplace mogul.

Prime Day has begun to have a massive influence on online retailers outside of Amazon. As a matter of fact, large retailers (those with >$1 billion in revenue) saw an average increase of 68% in revenue. Small to mid-size retailers also saw a rise in sales of 28%.

Prime Day has genuinely caught on. Some are even calling it ‘Christmas in July’. Brands have ‘seen the light’, and now everyone seems to want a piece of this summer shopping action. Salesforce recorded a 37% year-over-year growth for global retailers other than Amazon. They also looked at the IR Retail 500 and followed the brands to see how they were preparing for Prime Day 2019. Interestingly, they found that 51% of these type of online retailers did some manner of promotion during Prime Day, advertising either on their website or through their email blasts. Of that group, 17% mentioned ‘Prime Day’ or ‘Black Friday in July’ in their promotion which verifies that Amazon’s mid-summer sale is definitely a hot ticket!

The digital commerce and digital marketing platform, Episerver, analyzed 9.6 million sessions on 39 eCommerce websites that are running Episerver’s personalization technologies. By examining these companies over the last three years, they found that:

These jaw-dropping stats reveal the growth to be astronomical. It is quite astonishing given how this newly manufactured holiday’s popularity has boomed to this extent in such a relatively short period. Wanting to delve a bit deeper into these stats, CMSC Media connected with Ed Kennedy, Senior Director of Commerce at Episerver. We were keen to get some more information about how brands outside of Amazon are getting involved in the event.

How have Amazon’s competitors stepped up to prepare for Amazon Prime Day, and what has contributed to their increased revenue?

“Amazon’s competitors have launched their own big-ticket sales events to join in this emerging peak shopping season that Prime Day helped create. By offering their own versions of Prime Day, retailers like Target, eBay and others have tapped into the momentum around Prime Day. Since consumers are already primed for deals and for back-to-school shopping, Amazon competitors are well-positioned to drive sales with deals-conscious summer shoppers.

This trend isn’t going anywhere soon, but only time will tell which retailers will continue to find these massive, heavily publicized summer sales feasible.”

What categories would the eCommerce sites analyzed by Episerver fall into, and do they consider Amazon a direct competitor?

“We take aggregate data from our retail customers on Episerver Digital Experience Cloud™ and use Power BI to pull trends such as B2C commerce sites discounting more in July than in November or December. The categories of the sites analysed include global retailers offering apparel, craft supplies, home décor, school supplies, sporting equipment, and many others—all of which are directly impacted by Amazon.”

Of these websites, how many of them have implemented a customer experience strategy allowing for seamless transactional experiences that compete with the ease of Amazon check-outs?

“The surveyed sites all use Episerver Perform, which analyses every visitor, their individual customer journey, and actions of similar visitors to autonomously present personalized product recommendations across all channels. It optimises the experience for every visitor by utilizing behavioral data and merchandising strategies to emulate an Amazon-like experience.”

In Episerver’s Reimagining Commerce Report, released earlier this year, it was revealed that voice commerce had shown an 80% growth over last year. Is there data available to confirm if the 2019 Amazon Prime day showed an increase in voice purchases? Do you predict voice commerce to continue to grow in popularity?

“While we didn’t track transactions by channel for Prime Day, our survey findings indicate a significant spike in overall voice commerce year-over-year due to retailers like Walmart, including voice search within their mobile apps. The trick is having retailers track the customer journey to tie that voice search with conversions because voice commerce is primarily being used in the consideration stage at this point.”

I have no doubt in my mind that Amazon Prime Day will continue to grow year after year just as Cyber Monday has before it. These eCommerce inventions have solidified their place in today's world. Undoubtedly, more brands and shoppers alike will begin to highly anticipate this mid-summer sale season just as they do with Cyber Week.

Erika Jones

Erika Jones is a Tech Reporter and Content Marketer with CMSC Media. Erika enjoys combining her creativity with her technical skills through graphic design. She has a background in communications and marketing and has a flair for social media and content creation. Erika is an avid traveller and enjoys seeing firsthand how technology connects us all in business and pleasure.