eCommerce Trends and Statistics

E-Commerce has come a long way, from an unreliable craze to a mainstream tide that lifted all boats. Even though cyber-shops was available, it took a long time for consumers to adopt as they had avoided giving their personal and credit card information to the third party, instead, they preferred to put up with long lines, parking, weather problems, and wobbly shopping carts to play safe. However, it is no longer the case.

The online retail sector is one of the largest segments of e-commerce and is dominated by the sale of consumer electronics, apparel, and accessories. According to Forrester Research, online retail sales are projected to surpass traditional sales for at least several years, and the research firm predicted that online retail sales are expected to reach $370 billion by 2017, powered by smartphones and tablets penetration and also by increased investment in online sales by traditional retailers.

The online retail sector is one of the largest segments of e-commerce and is dominated by the sale of consumer electronics, apparel, and accessories. According to Forrester Research, online retail sales are projected to surpass traditional sales for at least several years, and the research firm predicted that online retail sales are expected to reach $370 billion by 2017, powered by smartphones and tablets penetration and also by increased investment in online sales by traditional retailers.

The Industry Growth

According to the U.S. Commerce Department, U.S. online retail sales during 2011 totaled roughly $194 billion. By 2013 this figure had increased to $262 billion, an increase of 13.4 percent over the prior year. Fifty retailers account for 80 percent of this market, and pure-play online retailers generally hold the advantage of speed and dynamics over brick-and-mortar brands that have expanded online. Consumers have become more sophisticated and online retail has become more competitive.

E-commerce sales remained strong in 2015 as online sales totaled $341.7 billion for the year, a 14.6% increase over 2014's $298.3 billion, according to non-adjusted estimates released this morning by the U.S. Department of Commerce. Moreover, a new report from Forrester, titled “U.S. Cross-Channel Retail Forecast, 2015 To 2020,” predicts online sales will grow at an average annual rate of 9.32% over the next five years in the United States.

“Screen sizes for mobile phones have gradually increased in size and wireless networks are better than before, which has made web browsing easier than ever,” report Author and Forrester Principal Analyst Sucharita Mulpuru wrote. “Additionally, consumers are more accustomed to using their phones everywhere and shopping is a byproduct of that ubiquity. We expect the speed and availability of mobile networks to continue to grow rapidly, which should significantly catalyze how much people use their phones to shop and how quickly they can retrieve information,” Mulpuru stated.

“Screen sizes for mobile phones have gradually increased in size and wireless networks are better than before, which has made web browsing easier than ever,” report Author and Forrester Principal Analyst Sucharita Mulpuru wrote. “Additionally, consumers are more accustomed to using their phones everywhere and shopping is a byproduct of that ubiquity. We expect the speed and availability of mobile networks to continue to grow rapidly, which should significantly catalyze how much people use their phones to shop and how quickly they can retrieve information,” Mulpuru stated.

The trend has not been much different in the world either. According to eMarketer’s figures, retail e-commerce sales will make up 7.4% of the total retail market worldwide, or $1.671 trillion. By 2019, that share will jump to $3.578 trillion, yet retail e-commerce will account for just 12.8% of retail purchases.

Here is the brief video of Global Retail & Consumer Leader John Maxwell explaining how consumers around the world are pushing the boundaries of what shopping means:

Business-to-Business

Business-to-business (B2B) online retailing has been significantly growing due to the accelerated migration of manufacturers and wholesalers from legacy systems to open, online platforms. B2B businesses have started to abandon legacy systems as they utilize electronic data interchange which is pricey and cumbersome to manage. Instead, companies take advantage of online platforms as they enable retailers to transact goods and services with ease from anywhere in the world. In fact, the B2B online retail market is expected to reach double the size of the business-to-consumer (B2C) online market, generating revenues of 6.7 trillion USD by 2020.

Research and advisory firm Frost & Sullivan projects that B2B e-commerce will hit $12 trillion in sales worldwide by 2020, up from $5.5 trillion in 2012, for a compound annual growth rate of 8.11%. Geographically, China and the United States will lead the B2B online retailing market. Forrester estimates that U.S. B2B e-commerce will grow from $855 billion in 2016 to $1.13 trillion by 2020.

“As such, private industrial networks, where specific companies come together to exchange products, and public marketplaces that are employed for on-the-spot purchasing, have gained prominence over the last decade,” explained Frost & Sullivan Visionary Innovation Group Team Lead Archana Vidyasekar. “With businesses buying more than selling online, these seller-driven B2C-type open public networks will help provide more visibility and storefront capabilities to sellers.”

On the flip side, retailers will encounter some significant challenges while executing B2B e-commerce tactics as in the B2B e-commerce setup, prices are volatile and volumes are high, unlike the B2C setting. As a result, this type of setup requires a flexible shipping and logistics solution as well as numerous tax and regulatory concerns. Besides these confrontations, there are other noticeable challenges regarding the implementation of marketing and educational initiatives in the B2B context as the products are much more complicated and sophisticated to figure out the way they work and integrate with other systems that are already in place or are being considered for purchase.

One of the fastest growing B2B segments is the software-as-a-service market, a market pioneered by Salesforce.com, which is benefiting from corporate America’s desire to reduce tech spending along with the proliferation of cloud computing services. As CMS-Connected reported in early June, Salesforce acquired an enterprise cloud e-commerce software provider Demandware for $2.8 billion in cash. “Demandware is an amazing company—the global cloud leader in the multi-billion dollar digital commerce market,” said Marc Benioff, Chairman and CEO, Salesforce. “With Demandware, Salesforce will be well positioned to deliver the future of commerce as part of our Customer Success Platform and create yet another billion dollar cloud.”

Scott Liewehr, co-host of the CMS-Connected Show and CEO & Co-founder of Digital Clarity Group also commented on the acquisition and unveiled his bold theory:

Not only Salesforce but also its big rivals have been moving into the e-commerce space; SAP bought Ariba in 2012 and Oracle bought Micros in 2014.

Business-to-Customer

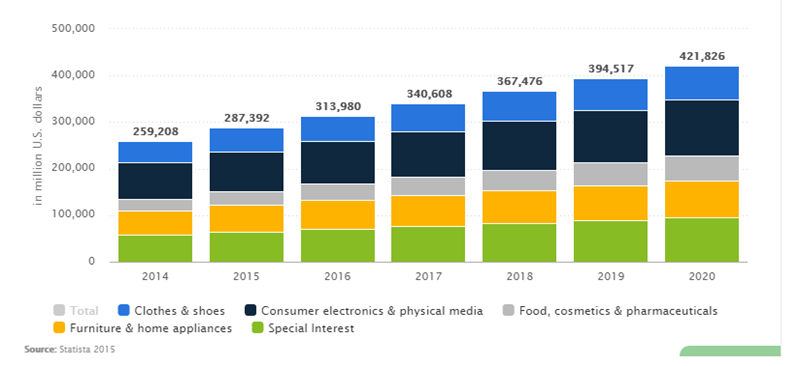

According to Statista, revenue in the eCommerce market for “Clothes & shoes”, “Consumer electronics & physical media”, “Food, cosmetics & pharmaceuticals”, “Furniture & home appliances” and “Special Interest” has increased to $313,980.5 million in 2016.

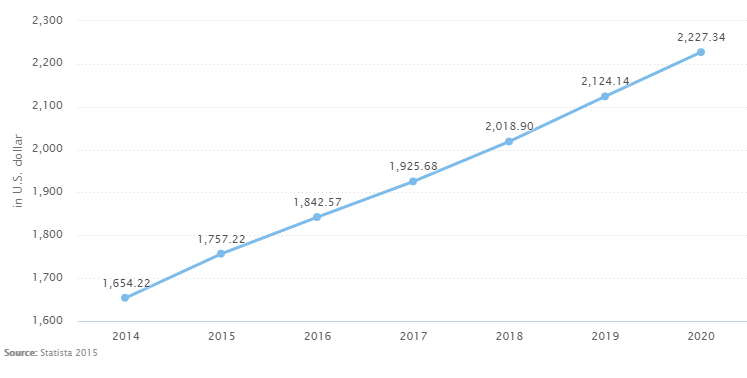

The bar graph above illustrates the forecasted revenue development of the selected market in million US dollars for each year. In addition, as the line chart below demonstrates, the average revenue per user (ARPU) in the selected eCommerce market came down to $1,842.57 in 2016.

Moreover, according to Research and Markets’ recent report, with the growth of online retail in emerging markets, which are Asia-Pacific, the Middle East, and Africa, adding to the substantial market size of the established markets, global sales are projected to pass one trillion US dollars this year, according to various sources cited in this publication.

One of the report key findings is the rapid growth of Internet connectivity as the number of Internet users in Africa has grown at a 3 digit percentage rate. Although Internet penetration and online shopping adoption rates in Africa, Latin America and some emerging regions of Asia are far below those of the leading markets such as Germany, UK, and South Korea, these areas are retaining high potential for further adoption of B2C E-Commerce.

E-commerce Platforms & Product Safety

Many retailers have achieved to sell their goods through the giant marketplaces like Amazon and eBay, but highly-customizable and easy-to-manage e-commerce platforms have also emerged. With the combination of these platforms and content marketing, many entrepreneurs with hopes of opening their own online stores have succeeded in expanding their market reach.

Launching online store is not an easy task, especially, for small businesses, but e-commerce vendors help them design and maintain a relatively simple and affordable online store.

As mentioned above, safety had been the biggest roadblock to online sales growth, but lately, many countries jointly enforce product safety in online commerce. U.S., European and Chinese regulators have held five such meetings since 2008. They pledged to watch online sales more closely and encourage manufacturers to do more to design safety standards into products.

The statement by American, European Union and Chinese officials stress the rapid growth of international e-commerce, which the officials said "has created new challenges" in protecting consumers from dangerous products. American envoy, Elliot F. Kaye, Chairman of the Consumer Product Safety Commission, said the U.S.-Chinese relationship in product safety is close and cooperative, in contrast to disputes in other areas.

On July 28th, we will be recording at Faneuil Hall (also known as Quincy Market) which was rated #4 on the  top most visited tourist attractions in the US by Forbes Traveler. Industry Analyst, Scott Liewehr and CMS-Connected Host, Tyler Pyburn welcome featured guest, Arthur Lawida, President at commercetools, to explore how ecommerce platforms are now offering content management and whether or not these platforms can offer enough to deliver a unique experience that builds loyalty, attracts repeat customers and cultivates customer advocacy. Or are they best served to leave it alone and let traditional content management systems fill these web ecosystem holes.

top most visited tourist attractions in the US by Forbes Traveler. Industry Analyst, Scott Liewehr and CMS-Connected Host, Tyler Pyburn welcome featured guest, Arthur Lawida, President at commercetools, to explore how ecommerce platforms are now offering content management and whether or not these platforms can offer enough to deliver a unique experience that builds loyalty, attracts repeat customers and cultivates customer advocacy. Or are they best served to leave it alone and let traditional content management systems fill these web ecosystem holes.

Also in this episode we will be commenting on the top news stories for the month, Amy Martyn from Falcon-Software will review SDL Web.

Join Us

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.