Dell-EMC Deal Closes & Here's What That Means

On October 12th, Dell announced it was buying EMC for a record price (for a tech acquisition) of $67 billion. The acquisition was given the go-ahead by the European Commission last March and has actually been all over since July 19th, when 98 percent of voting EMC shareholders approved the deal. However, the companies were waiting for the approval from China’s Ministry of Commerce (MOFCOM), which finally approved the proposed combination three weeks ago. This final regulatory condition to closing the transaction took a while as Chinese authorities were reportedly concerned about the possibility that Dell/EMC combined would create more competition for Chinese companies such as Huawei Technologies Co. Ltd. and Lenovo Group Ltd.

Last May, Dell Chair and CEO, Michael Dell announced at the EMC World Conference in Las Vegas that the biggest merger in tech history will be named Dell Technologies. The new company expects to be a one-stop shop for information technology sold to businesses, with its 140,000 employees globally. It will maintain operations in Hopkinton, Mass., where EMC was located. It’s worth mentioning, with $74 billion in revenue, Dell Technologies will be the world’s largest privately controlled tech company. On a side note, VMware on Wednesday said that Mr. Dell had been elected to the Board of Directors as Chairman. In addition, Egon Durban was also elected to be on the Board of Directors. Joseph Tucci, VMware’s Chairman since 2007, and John R. Egan resigned from the Board.

Last May, Dell Chair and CEO, Michael Dell announced at the EMC World Conference in Las Vegas that the biggest merger in tech history will be named Dell Technologies. The new company expects to be a one-stop shop for information technology sold to businesses, with its 140,000 employees globally. It will maintain operations in Hopkinton, Mass., where EMC was located. It’s worth mentioning, with $74 billion in revenue, Dell Technologies will be the world’s largest privately controlled tech company. On a side note, VMware on Wednesday said that Mr. Dell had been elected to the Board of Directors as Chairman. In addition, Egon Durban was also elected to be on the Board of Directors. Joseph Tucci, VMware’s Chairman since 2007, and John R. Egan resigned from the Board.

“We are at the dawn of the next industrial revolution,” said Michael Dell. “Our world is becoming more intelligent and more connected by the minute, and ultimately will become intertwined with a vast internet of things, paving the way for our customers to do incredible things. This is why we created Dell Technologies. We have the products, services, talent and global scale to be a catalyst for change and guide customers, large and small, on their digital journey.”

The closure of the merger comes a day after Dell reported its financial results for the quarter ended July 29th. According to the announcement, its revenue for the three-month period increased to $13.05 billion from $12.98 billion a year earlier. Overall, Dell decreased its losses from continuing operations to $264 million, compared to a year-earlier with a loss from continuing operations of $292 million.

Meanwhile, the merger involves a substantial amount of debt, approximately $47 billion. Dell CFO Tom Sweet commented on concerns about the company’s ability to pay off that financial burden: “We’re completing this transaction on historically good terms,” he said. “Our payments are much less than what our competitors pay in share buybacks and dividends. Any FUD (fear/uncertainty/doubt) out there to the contrary is just factually incorrect.”

Sweet also emphasized that Dell’s debt rating has been upgraded twice since the leveraged buyout was announced. He said the company expects cash flow to be three times the amount needed to service the debt. Sweet brought the attention to the combined company’s strength: $74 billion in revenue, serving 98% of Fortune 500 companies, with 140,000 employees, 30,000 full-time customer service professionals and a presence in 180 countries.

What the Combination of Dell & EMC Means?

PC shipments fell 9.8% in 2013, 10.4% in 2015 and are expected to drop another 7.3% this year with $161 billion in sales, according to International Data Corp. The $64 billion market for servers, storage, and network hardware has been falling since 2014 and is expected to slide 1.3% annually for the next four years. Since technology has been shifting to mobile devices as well as lower-margin hardware such as servers and storage used in cloud computing, the merger stands a good chance to boost both companies’ businesses. How so?

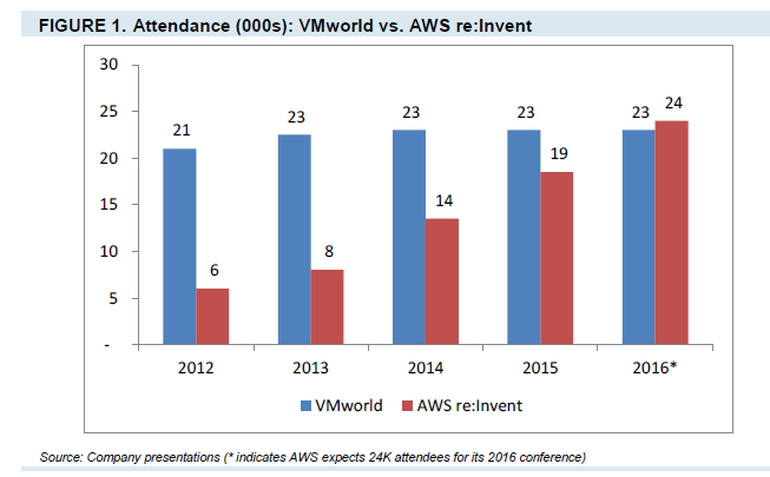

First off, the combination of Dell and EMC are expected to dominate the data center, meaning many enterprises will be interested in purchasing their product. If their IT buyers are not in favor of product diversification, then they can even consider adding VMware into their data centers. For those who want to diversify, the options are either longtime rivals Lenovo and HPE or the public cloud players. Speaking of cloud, delivering the hybrid cloud will be the main focus for the combined company, although VMware, Virtustream, and other outposts of Dell Technologies offer a few public cloud options. The graph below presented by JMP Securities Analyst Patrick Walravens indicates that interest has been shifting from traditional IT to the public cloud.

William Blair analyst Jason Ader wrote in a research note: “While we applaud management's efforts to evolve the VMware story from plain vanilla server virtualization to the larger software-defined data center, we struggle with modeling the business given the number of moving parts and the expected decline in the core vSphere license business. VMware's early success in emerging areas like networking (NSX) and hyper converged (vSAN) looks promising, but hybrid cloud management remains an unproven opportunity in very early days.”

VMware is a key independent piece of EMC as it is run as an entirely separate company and has its own publicly traded stock. From the VMware stockholders’ perspective, the deal is not the greatest thing which has happened to the company as the share price dropped from $82.09 all the way down to $43.84 between the day before the sale was announced and February 9th. Fortunately, it has rebounded to $73.39 a share since then. Based on VMware's most recent earnings and results, the company has been successful, which is to be expected as they have a very well established customer base, not to mention how critical its software is to the enterprise. Michael Dell said at VMworld that VMware will remain open and thrive with its cross-cloud architecture.

Dell Technologies plans to invest $4.5 billion a year in research and development going forward after cumulative investments of more than $12.7 billion over the past three years, according to the company.

One of the most positive outcomes which could arise from this merger is selling power. According to IDC, Dell ranks third in international PC sales, and is mostly enticing to smaller and midsize companies, while EMC is the leading provider of key storage products and appeals to large enterprises. So the combination could mean to sell far more of Dell’s products to EMC’s customers.

On the flip side of the merger, Mr. Dell hinted on the fact that there could be job cuts among 140,000 employees by expressing that the merger was more about revenue growth: "We have more, what I would call, revenue synergies than cost synergies because of the complementary nature of the businesses; we’re not putting together businesses that are the same -- and taking costs out," he said, declining to give any estimate for layoffs. "There are some overlapping functions and that sort of thing -- that’s not the primary feature of this, but there is some of that."

In addition to the overlapping issue, although Dell servers, EMC's storage arrays, and VMware virtualization assets are compatible, there are still some overlapping cloud, security, and storage products. Before the deal was closed, Dell shed its software business for $2 billion to equity firms Francisco Partners and Elliott Management in order to make room for EMC’s assets. It also sold its IT services businesses for $3 billion to NTT Data. This trend will continue after the merger as well, as the company will merge assets or discontinue products, but they will need time to do so to avoid losing their customers.

From the customers’ perspective, the merger will not change their use dramatically. For instance, VMware products will have higher levels of integration in Dell servers, but customers who prefer non-Dell servers will still be able to buy EMC products and support. In fact, Jeremy Burton, Chief Marketing Officer at Dell, said: “Customers shouldn’t expect much change in their sales teams for at least six months as existing compensation plans play out. Things are going to remain as they are until the end of Dell’s fiscal year in February, and we’ll make broader changes then,” he said. “One thing, customers should expect is more messaging around the Dell Technologies brand. A lot of people don’t really know what Dell Technologies stands for. With the addition of market-leading businesses in the areas of virtualization, security, platform-as-a-service, mobile management, and cloud infrastructure, today’s Dell is our bigger and more diverse than the brand most people know. The bottom line is that we’re the only guys that have got a competitive stack,” Burton said.

The only thing that EMC’s customers feel uncomfortable with is that as mentioned above, Michael Dell will sell some products either to get rid of that overlapping situation or to pay his debtors. Therefore, customers might be worried if the EMC assets will still be managed properly, once sold.

From the competitors’ perspective, EMC hasn’t been impressive when it comes to providing public cloud providers with assets, so the combined Dell Technologies will not compete toe-to-toe with giant public cloud provider Amazon Web Services, Google Cloud Platform, and Microsoft Azure but will improve the Virtustream business as an enterprise-class cloud for large mission-critical applications. Meanwhile, Hewlett-Packard split up into Hewlett-Packard Enterprise & HP Inc and IBM is getting prepared to shed commodity data center gear in order to focus on Watson.

On the other hand, Lenovo officials in a statement said that the Dell/EMC deal "creates significant business opportunities for Lenovo" because data center customers "will face tough choices, not only about how to transform their data centers to capture the benefits of cloud computing and next-generation IT, but also about how to transition their current infrastructure with the integration of two complex product portfolios. We believe these customers will be open to new options."

Charles King, Principal Analyst with Pund-IT, compared the deal to HP's $25 billion acquisition of Compaq in a research note: "Following the deal's closure scores of Compaq executives and managers were let go or forced out, and its product lines (outside of PCs) were decimated. By 2005, when CEO Carly Fiorina was finally ousted by HP's Board, Compaq had been largely subsumed and forgotten." He also said there is less product overlap between Dell and EMC than there was with HP and Compaq.

According to Forrester, there are several opportunities that are immediately visible that should play into the hands of partners.

“Dell and EMC merge to become a data center infrastructure giant. Dell’s cloud focus has stayed on the enablement side, and its acquisition of EMC is a strong adjacency play. This establishes Dell as the largest system technology vendor in the industry, adding roughly $24bn in storage-related revenues to its portfolio,” the firm stated in its Evolve or Crumble: prepare for the fate of the hardware incumbents research paper. The merged company will enable hybrid cloud architectures and support multiple on-premises private cloud stacks as well as multiple public cloud environments. Dell is a powerful channel player, supplying many lower tier cloud service providers and other partners. We anticipate that this ecosystem will bear even more fruit for Dell as it adds EMC and VMware,” they added.

How this enterprise giant navigates account management, innovation, and product overlaps for technology buyers remains to be seen. “We plan to be the trusted provider of infrastructure for the next Industrial Revolution,” said Dell Technologies CEO Michael Dell. We'll see how this one turns out.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.