Is Opera’s Built-in Ad-blocker a Broadside in the Web Content Wars?

Opera released the latest developer version of its browser with the built-in ad blocking feature Thursday morning, becoming the first browser vendor to integrate an ad-blocking feature. Ad-blockers for other browsers are created by third parties and released as plugins. Opera says native ad-blocking technology is more effective than plugins, although they perform the same function.

The company claims that the ad-blocking feature can speed website load times by as much as 90 percent, and its solution provides a 45 percent faster browsing experience than Chrome and 21 percent faster than Firefox with third-party ad-blockers.

Krystian Kolondra, the Senior Vice President in charge of engineering for Opera states, “Our goal is to provide the fastest and the smoothest online experience for our users,” told PC World. “While working on that we have discovered that a lot more time is spent on handling ads and trackers than we thought earlier.”

Attributes of Opera’s Ad-blocking Feature

-

As soon as the browser runs, a pop-up appears asking you “would you like to block ads and the web faster”. If users click on “Block ads”, ads are blocked immediately.

-

Alternatively, users can simply click a small, grayed-out “shield” icon to the far right of the URL address bar. When ad-blocking is enabled, that shield is blue.

-

Opera also added a benchmark tool to show users how many ads it’s blocked on a given page.

-

The browser doesn’t stop there, it also enables users to perform a speed test to demonstrate how fast a page loads with or without ads. Opera teaches users which ads are slowing down their browsing experience.

-

Tracking pixels and third-party scripts will be blocked if they are placed for advertising purposes.

-

The same with third-party blockers, Opera allows users to set up their own whitelists for sites, which will allow specified ads to appear.

Does It Matter for Content Creators?

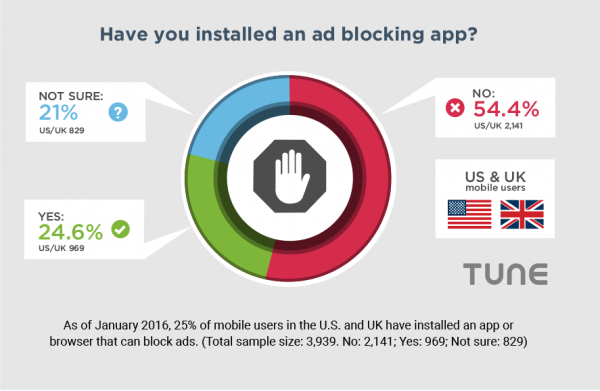

A study by PageFair and Adobe estimated online ad revenue lost to blockers in 2015 would amount to $21.8 billion and those losses could almost double to $41.4 billion in 2016. Ad-blocking grew 48 percent in the U.S. and 82 percent in the U.K in 2015. Meanwhile, ad-placement firm Carat forecasts global digital and mobile advertising will near $150 billion this year.

In the light of these stats and predictions above, the more effective ad-blocker idea naturally worries both advertisers and publishers, since their income depend on the essence of advertising as a marketing method on the one hand, and as a revenue stream on the other. Therefore, the CEO of the International Advertising Bureau has recently called Adblock Plus, a leading ad-blocking solution, “mendacious,” “unethical,” and even “immoral.” He believes that there is an unwritten contract between advertisers, publishers, and readers in which publishers create content, advertisers fund content, and readers consume content. As a result, ad blocking harms this inherent contract.

Earlier this month in a speech at the Oxford Media Convention, John Whittingdale, the Secretary of State for Culture, Media and Sport in the UK government, called ad-blocking a “modern-day protection racket” and said: “Quite simply – if people don’t pay in some way for content, then that content will eventually no longer exist.”

On this note, Krystian Kolondra said: "Advertising fuels the Internet, allowing many services to be free for users. But, as our new research shows, most Web pages today are significantly slowed down by bloated ads and heavy tracking. We don't accept it—we want the Web to be a better place for us all, as users."

On the other hand, we have started to see a counterattack from some web owners. A small but growing number of sites simply resist to show their content to users who block their ads. Here is an example:

On the bright side, most recent data indicates that only a small, single-digit percentage of mobile traffic is coming from ad-blocking browsers. It means that marketers and content creators still have some time to tweak their strategies around this threat.

At the end of the day, Google’s business model depends on selling online advertising and has a large market share, while, conversely, a business model that doesn’t depend on online advertising holds less than 2 percent market share. Now, many people has left with these two thoughts concerning the rise and recent progresses in ad-blocking:

- What will the Web look like when users block ads?

- Will free content providers take vengeance by limiting access in return?

We’d love to hear your predictions on these thoughts in the comments section below.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.