Digital Transformation to Push IT Spending Up to $2.7T by 2020

By Venus Tamturk

August 30, 2016

Analytics, big data, cloud, data, Digital Transformation, gartner, IDC, innovations, smart data, technology

Worldwide revenues for information technology products and services will grow from nearly $2.4 trillion in 2016 to more than $2.7 trillion in 2020, according to a newly published update by International Data Corporation (IDC).

"While the consumer and public sectors have dragged on overall IT spending so far in 2016, we see stronger momentum in other key industries including financial services and manufacturing," said Stephen Minton, Vice President, Customer Insights and Analysis at IDC. "Enterprise investment in new project-based initiatives, including data analytics and collaborative applications, remains strong and mid-sized companies have been especially nimble when it comes to rapidly adopting 3rd Platform technologies and solutions. Assuming the economy remains stable in 2017, smaller businesses will also begin to climb aboard the 3rd Platform in greater numbers."

"While the consumer and public sectors have dragged on overall IT spending so far in 2016, we see stronger momentum in other key industries including financial services and manufacturing," said Stephen Minton, Vice President, Customer Insights and Analysis at IDC. "Enterprise investment in new project-based initiatives, including data analytics and collaborative applications, remains strong and mid-sized companies have been especially nimble when it comes to rapidly adopting 3rd Platform technologies and solutions. Assuming the economy remains stable in 2017, smaller businesses will also begin to climb aboard the 3rd Platform in greater numbers."

Given that the report includes the study on IT spending across more than 100 technology categories and 53 countries, covering 20 industries, it is projected that healthcare would remain the fastest growing industry in terms of IT expenditures with a five-year compound annual growth rate (CAGR) of 5.7%. Besides banking, media, and professional services will show solid growth as well, while the telecommunications industry will remain relatively sluggish.

More importantly, a big part of that growth will come from companies investing in cloud, mobility, and big data technologies as part of their digital transformation efforts. Medium and large businesses will see the fastest growth in IT spending, while more than 45% of all IT spending worldwide will come from large enterprises with more than 1,000 employees throughout the forecast period.

"The small business market has been challenged by the economic slowdown in some regions but there is now some pent-up demand for IT assets in this segment, which will materialize as the economy begins to improve," Minton added. "Meanwhile, the strongest growth is still among mid-sized companies, which are more nimble than very large enterprises and less exposed to economic volatility than the smallest businesses."

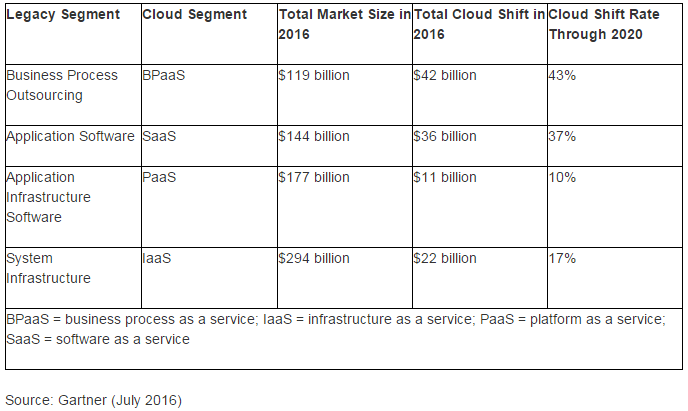

Not only ICD but also Gartner has shed a light on the impact of cloud shift on IT spending, projecting that the “cloud shift” will affect more than $1 trillion in IT spending by 2020. The aggregate amount of cloud shift in 2016 is estimated to reach $111 billion, increasing to $216 billion in 2020. Here’s the table demonstrating the cloud shift summary by market segment:

Purchases on the consumer side accounted for nearly a quarter of all IT revenues in 2015, and the biggest drive behind that is the smartphone explosion, according to IDC. However, the new report claims that general consumer spending on PCs, tablets, and smartphones has been declining, so looking ahead the drop will, supposedly, have an impact on the IT market overall. Interestingly, even the moderate growth forecast for the tablet market will be driven by commercial segments instead of consumer tablet sales. On the flip side, software will account for the lion’s share of spending, while hardware will remain to be an important part of the market.

In addition to worldwide IT spending, despite the fact that gradual improvement is expected in the public sector, government purchases of technology will continue to lag behind much of the private sector, according to the report. However, IDC also published a separate document, stating an interesting fact that the U.S Federal government spends nearly four times more on IT spending per employee comparing the industry average. To put this into perspective, currently, the federal government spends an average of about $39.2 thousand per employee on a wide range of IT solutions, while the average for IT spending per employee, across all other industries (excluding government and education), is just under $9.9 thousand.

Although roughly one-quarter of all IT spending comes from the SMB category, there is a potential growth as smaller companies will spend more on enterprise-level technology initiatives such as machine learning, IoT and such, as long as the economy is stable in 2017.

Let’s wrap this up with the brief summary of the report:

-

Worldwide IT spending is expected to hit more than $2.7 trillion by 2020.

-

The increase represents a jump of 3.3% from nearly $2.4 trillion in 2016.

-

Consumer purchases generated 25% of IT revenues in 2015.

-

The healthcare sector will outgrow other industries, with its IT spending set to rise 5.7% by 2020.

-

The telecommunications industry and consumer areas are forecast to remain slow.

-

The positive momentum is driven by companies’ digital transformation efforts.

On a side note, last month as CMS-Connected reported, Gartner issued that worldwide IT spending is forecasted to be flat in 2016, totaling $3.41 trillion, warning that the numbers will likely change for the worse due to Brexit. Industry Analyst Scott Liewehr also explained the fuel behind IT spending in the headline news segment of CMS-Connected Show aired on July 28th:

I believe we’ll continue to see very significant changes in predictions as the industry faces a number of fundamental shifts that will shape its future. Nevertheless, mid-sized companies will have the highest impact on IT spending as they can rapidly adopt new technologies and solutions without getting too affected by economic volatility.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.