Is Salesforce Done Shopping After Disappointing Q3 Guidance?

Last Wednesday, Salesforce announced in a statement that in the period ending in October, sales will be $2.11 billion to $2.12 billion, while the analysts on average had estimated revenue of $2.13 billion. On the other hand, revenue of $2.04 billion, an increase of 25 percent year-over-year, surpassed analysts’ estimation for revenues of $2.02 billion.

Although it’s the first time that the San Francisco-based company generated $2 billion in revenue in a single quarter, it’s still not enough to keep up with Salesforce's acquisition spree. "Foreign exchange was just brutal in the quarter," Salesforce CEO Marc Benioff told CNBC's Jim Cramer on "Mad Money" on Wednesday evening: "Not only did we have Brexit, but we have this precipitous fall of the great British pound, which is how we roll up our European currencies," Benioff said. "That dramatically affected our revenue in the quarter. In fact, we've lost $150 million in revenue for the year through this foreign exchange change. Even through that, though, we are raising our revenue guidance for the year. We did see a bit of softness in the United States at the very end of the second quarter," Benioff added. He stressed that it was not the result of any industry or macroeconomic forces. "It has to do with our own execution in the United States in the quarter in the end. But I have a lot of confidence in the second half," he said. Salesforce shares dropped by as much as 8% after reporting its quarterly earnings on Wednesday.

Although it’s the first time that the San Francisco-based company generated $2 billion in revenue in a single quarter, it’s still not enough to keep up with Salesforce's acquisition spree. "Foreign exchange was just brutal in the quarter," Salesforce CEO Marc Benioff told CNBC's Jim Cramer on "Mad Money" on Wednesday evening: "Not only did we have Brexit, but we have this precipitous fall of the great British pound, which is how we roll up our European currencies," Benioff said. "That dramatically affected our revenue in the quarter. In fact, we've lost $150 million in revenue for the year through this foreign exchange change. Even through that, though, we are raising our revenue guidance for the year. We did see a bit of softness in the United States at the very end of the second quarter," Benioff added. He stressed that it was not the result of any industry or macroeconomic forces. "It has to do with our own execution in the United States in the quarter in the end. But I have a lot of confidence in the second half," he said. Salesforce shares dropped by as much as 8% after reporting its quarterly earnings on Wednesday.

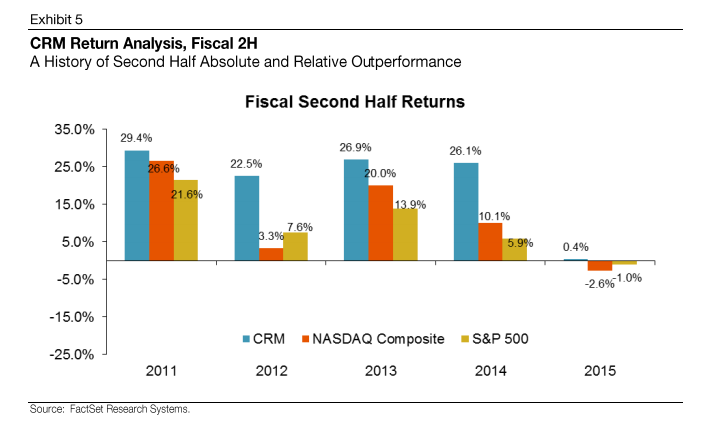

Nevertheless, Salesforce exhibited a high level of confidence in its ability to turn things around over the next 6 months, raising its full-year guidance for the third time this year. In fact, this claim is also supported by many analysts in the market. Market research firm PiperJaffray for instance, states that Salesforce has historically shown stronger returns in the second half of the year, far outpacing the performance of the NASDAQ and S&P 500 over the past 5 years, as seen in the chart below:

According to PiperJaffray, Salesforce's upcoming Dreamforce annual conference and the typical enterprise sales cycle, which tends to close more towards the end of the year, will serve as catalysts for this trend. And, given Salesforce's weak earnings last quarter, PiperJaffray anticipates this trend to be even greater this year: "We believe investors should use periods of weakness to buy secular growth stories which we believe Salesforce continues to be. We believe Salesforce sits at the nexus of a sea of change in Enterprise Software where fundamentally the customer relationship becomes the product for end customers."

$4 Billion to Buy Eight Startups

Last week the enterprise cloud and CRM services company also unveiled that they spent roughly $4 billion on acquisitions this year alone. According to the company’s 10-Q filed with the SEC, eight startups in areas like workplace productivity, machine learning, and e-commerce solutions were acquired. Although the whopping amount of that $4 billion was famously spent on the acquisition of the enterprise cloud e-commerce software provider, Demandware, for $2.8 billion in cash and the acquisition of the cloud-based word processing app Quip, the filing also disclosed the prices of some other deals such as $110 million for the enterprise analytics business BeyondCore and $58.4 million in cash for three other companies; data center analytics startup Coolan, data-entry automation company Implisit Insights, and open source-based machine learning server developer PredictionIO. It's worth noting that these individual acquisition prices were not revealed at the time their deals were announced.

During the earning calls, Benioff commented on Salesforce's acquisition binge: "We came into this year and we didn't really have M&A on our forecast. But then there were some pretty big changes that happened in the market ... It's been an incredible time for us to acquire some phenomenal assets, and I've never been more excited about Salesforce and our pipeline," he said and added: "I'm very committed to top-line growth, but I'm also committed to bottom-line growth. We'll continue to do that while being able to participate in this M&A environment, because, as you can see, we not only bought companies, but we also beat our numbers."

Salesforce has been scooping up a number of startups in the machine learning and artificial intelligence space lately. Here are some of those companies:

BeyondCore

BeyondCore is an enterprise analytics tool that bolsters business intelligence with computational and statistical analysis. The company as a startup had disclosed only $9 million in funding. The acquisition of BeyondCore marked the company’s seventh acquisition in 2016. When the deal was announced, Benioff stated that BeyondCare’s expertise in AI would be put to use by integrating it into Salesforce’s Analytics Cloud. Here's the tweet by Benioff welcoming BeyondCore:

MetaMind

Last May, Salesforce acquired the natural language processing and image recognition startup, MetaMind, for $32.8 million. The purpose of the buy-out is to extend Salesforce’s data science capabilities by embedding deep learning within the Salesforce platform as well as to use its technology to “further automate and personalize customer support, marketing automation, and many other business processes."

Implisit Insight

Salesforce acquired a data automation startup called Implisit Insights this past May. Implisit Insights’ platform could predict the best possible deals and identify those most at risk of losing while providing recommended actions to improve the sales process. Implisit was Salesforce’s third acquisition of 2016, following the purchase of two other data intelligence startups; PredictionIO and MetaMind.

Acquiring Technologies or Talents?

The acquisitions are extremely important for both acquirees and acquirers in different ways. From the smaller companies perspective; the majority of startups which have emerged over the last several years are scooped up by bigger fish as either the startups see more opportunity in combining with bigger entities or simply funding is getting harder to find. Meanwhile, from the bigger fish’s perspective, in many cases, it’s more efficient to attain technologies, products, talent, and customer base than developing from the ground up.

Let’s go back to Salesforce and see what’s next for the company, and how all these acquisitions are shaping its future plans. Salesforce will launch its new artificial intelligence platform, Einstein, next month at its massive annual Dreamforce tech conference. Benioff, like other leaders, including Alphabet Executive Chairman Eric Schmidt and Microsoft CEO Satya Nadella, believes so strongly that machine learning is the next big thing in the tech world, but as with many other tech companies, he needs talent in order to develop this major new machine-learning product. The challenge for the industry is that there are simply not enough people with the big-data/machine-learning background to meet this need. So he quietly assembled a team of 175 data scientists, mostly through acquisitions: "Salesforce Einstein is AI for everyone. It's going to democratize artificial intelligence. It's going to make every company and every employee smarter, faster and more productive. We are going to deliver the world's smartest CRM. And as you know, over the last few years we have acquired a number of AI companies — incredible companies like RelateIQ, MetaMind, Implisit, PredictionIO, Tempo AI, and more with amazing, amazing people and technology. We have been able to stitch all this together into this incredible AI platform, and this focus on AI and on the critical aspects of AI as the next wave of our industry has resulted in a machine-learning team of more than 175 data scientists who have built this amazing Einstein platform," Benioff said during the quarterly conference call.

Actually, this quiet picking up of data scientists has been on since 2014 when the company hired a group of LinkedIn data scientists in a few months: Vitaly Gordon, Leah McGuire, Sal Uryasev, Ahmet Bugdayci, Ruslan Belkin, Richard Park, and DJ Patil.

The Game is On

Just because Salesforce is a leader in internet-based software for the time being, doesn’t mean the big players, Oracle, SAP SE, and Microsoft, are willing to lose the fast-growing cloud market to their younger rival.

Microsoft has become a major competitor to Salesforce for its flagship customer relationship management software since Salesforce lost out on the acquisition of LinkedIn Corp. to Microsoft Corp., in the biggest tech takeover unveiled so far this year, with an agreed price of $26.2 billion. As soon as Microsoft closed the deal with LinkedIn, the software giant started to leverage its CRM platform Dynamics 365. Besides, since CEO Satya Nadella took over, Microsoft has been executing its strategy around the cloud-first approach as the company has launched the capability of running its popular business applications, including Office, from the internet, and its Azure platform that enables customers to rent computing and storage capabilities. Microsoft’s commercial cloud revenue run rate topped $12.1 billion in the quarter ending June 30, compared to more than $10 billion in the previous quarter.

Not only Microsoft, but also a longtime rival Oracle has been investing in its cloud-based services. As a result, those services brought in about 8% of the company’s total sales in its last quarter. It’s important to note that Oracle, which competes with Salesforce’s main customer-relationship-management products, is about three times the size of Salesforce based on market value, while Microsoft is more than eight times as large. "Salesforce has growing competition to their core business from both Oracle and Microsoft as well as pressure from Wall Street to grow their 2017 revenues," said Steve Herrod, a Managing Director at General Catalyst Partners. "Aggressive M&A activity can give them the opportunity to address both." Also, many experts agree that Salesforce could go after the same acquisition targets as Oracle.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.