Reasons Behind U.S Retail Store Closures & Bankruptcies

In the first three months of this year, 2,880 store closures were announced, and there have been nine retail bankruptcies. To put this into perspective, the number of closed stores was 1,153 during the same time period in 2016. Moreover, it’s estimated that there could be 8,640 store closings in 2017, higher than the 2008 peak of about 6,200. One would think that this is happening because of an economic recession. Well, not quite, as GDP has been surging in the recent eight years, unemployment is under 5 percent, and the middle and lower class income has been on the rise for the last 18 months in the US. Then, what on earth is causing this rapid descent of brick-and-mortar stores? Let’s dig it out!

Consumer Spend is Changing

First off, retailers’ combined same-store sales are expected to rise just 0.3% in the first fiscal quarter which represents the industry’s worst performance in four years, according to Retail Metrics, which follows Wall Street predictions. Retail Metrics President Ken Perkins said: “Retailers can’t blame the economy for their ongoing woes,” and he backed up his opinion with the better-than-expected private sector ADP payroll numbers. According to him, the reason is “the tectonic shifts taking place on the consumer spending front.” Obviously, Perkins is not the only one who thinks that consumer spending has a lot to do with decreasing profits of stores. Mark Ghermezian, who runs the venture capital arm of real estate giant Triple Five Group, which owns the continent’s largest malls, also said: “Buying clothes has become a secondary priority for consumers who now come to the mall for experience and entertainment,” and added: “Though luxury and outlet centers are thriving, the middle-market mall-heavy with clothing chains will soon be extinct.”

Young people are increasingly spending less on clothing and furnishing as they want to spend their money on experiences that they can post about on social media like traveling and dining out. Considering Millennials are set to overtake Baby Boomers’ place as the largest consuming class, this changing trend is alarming for many industries such as appeal and housewares. To prove my point, the number of passengers that domestic airlines have carried has been increasing each year since 2010. Furthermore, in 2016, U.S. airlines set a record, with 823 million passengers which represented a 3.1% growth, from 798 million in 2015, according to the Bureau of Transportation Statistics. 2015, also marked the first time ever when Americans spent more money in restaurants and bars than at grocery stores.

Therefore, retailers should step back from traditional marketing campaigns and find a way to bridge the gap between younger buyers and stores by leveraging social media and advanced technology. “Millennials are not walking into the mall and making a decision of what to buy just from what was in reach,” said Tim Weingarten, Founder and CEO of the Hunt, that develops software that enables consumers to locate clothing they like in pictures posted on social media.

The Bubble Has Now Burst

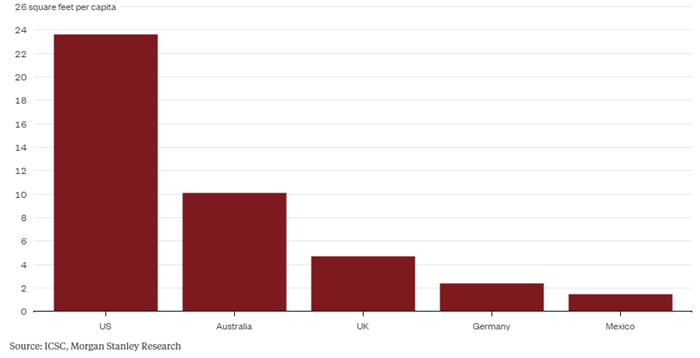

The United States has almost five times more retail space per person than France, Japan, and the U.K. Another way to put it is that the U.S. has more retail square footage than Australia, the U.K., Germany, and Mexico combined. The number of malls in the U.S. grew more than twice as fast as the population between 1970 and 2015, according to Cowen Research.

Like many other industry insiders, Richard Hayne, Urban Outfitters Chief Executive Officer, has a bearish opinion on the ugly retail truth as he believes that the US market is oversaturated with retail space, especially with apparel stores. “This created a bubble, and like housing, that bubble has now burst,” he said. “We are seeing the results: Doors shuttering and rents retreating. This trend will continue for the foreseeable future and may even accelerate,” he said.

A real-estate research firm, Green Street Advisors, saw this situation a decade ago, claiming that chains would need to collectively close 800 stores to achieve the kind of profitability per square foot they needed. Green Street Advisors issued a report specifically saying that a substantial number of department-store closures will be "problematic" for “lower productivity malls that have already had their fair share of struggles competing against online retail."

As a result, the bubble has finally burst and retailers have realized that they should keep up with the digital era. To do so, it makes sense to shed the parts of their business that weigh on their profit and re-evaluate their operating models to take steps to make e-commerce and m-commerce a larger share of their business. Here is a rundown of major chains that have announced major store closures so far this year:

And, Of Course, There is the “Amazon Effect”

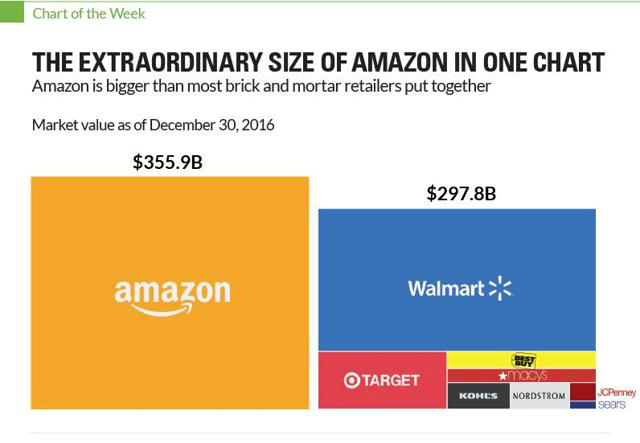

According to Slice Intelligence, Amazon accounted for 53% of all retail e-commerce sales growth in 2016. As CNN reported, half of all U.S. households are now Amazon Prime subscribers. Due to lower prices, a wide range of options, easy return policy, and increased convenience for shoppers, Amazon has been dominating the market. Therefore, market analysts often point out to the Amazon effect as one of the biggest culprits of these store closures.

The Labor Department figures released last week show retailers cut around 30,000 positions in March, which was the same total as in February and marked the worst two-month showing since 2009. In the meanwhile, Amazon announced 30,000 new part-time jobs, a sharp contrast to the meltdown of the retailers. This situation adds even more to the irony because now that other retailers are understaffed, they will naturally compromise store experiences. As a result, shoppers will be even more encouraged to get their shopping done online, and by now, as we all know, more than the half of online shoppers go to Amazon when they go online.

Recent research from One Click Retail (OCR) claimed that Amazon is enjoying an average year-over-year growth (YoY) rate of 38% compared to the total retail market’s combined growth average of 6% for U.S. housewares, health & personal care and beauty industries. "What we're currently witnessing is eCommerce finally beginning to disrupt everyday household products, with Amazon leading the pack," said Spencer Millerberg, OCR's CEO. "Consumers benefit from buying these items in bulk and having them delivered right to their doorsteps. Our numbers continue to demonstrate just how significant these everyday items are in helping to drive Amazon's exponential YoY growth."

mCommerce is Today’s Game Changer in Retail

2015 was a turning point for mobile shopping and in 2017, it is expected to take off. According to a BI Intelligence report, between 2016 and 2020, U.S. mobile commerce (mCommerce) sales are projected to grow nearly 260%, from $79 billion to $284 billion.

Gartner estimates that in 2017 U.S consumers’ mobile engagement behavior will push mobile commerce revenue up to 50 percent of U.S. digital commerce revenue. Therefore, mobile payment has become a competitive arena. Market leaders like Google Wallet, Apple Pay, PayPal, Venmo, V.me (by Visa), Masterpass (by MasterCard) and more are trying to consolidate their position in the face of growing competition fueled by new entrants.

At Starbucks, for instance, mobile payments currently account for more than 25% of transactions at its U.S. operated stores. Starbucks Mobile Order & Pay makes up more than 7% of total U.S. transactions. As the leading coffee brand believes in the importance of redeveloping its tools along the lines of the new consumer reality, Starbucks keeps innovating new ways of engaging with customers through fun and personalized experiences. The company has recently introduced a conversational ordering system called "My Starbucks Barista" which is a digital assistant powered by Apple's Siri. It will allow customers to place orders via voice command or messaging. On top of that, the platform will deliver real-time personalization and product suggestions. To do so, Starbucks will track your buying habits and use that information to recommend your favorite food and drinks so you will be served based on your tastes and preferences.

How about Tomorrow?

A recent Synchrony Financial report entitled "The Future of Retail" predicted that instant gratification coupled with a higher degree of tech-driven personalization would drive consumer behavior and the retail industry through to 2030. The study suggests that it is not the end of brick-and-mortar stores but a huge transformation is pivotal. The report cited: “People are social by nature and will be drawn to gathering places to share ideas and be entertained. It’s not just about making money. It’s about building trust. Retailers who tap into this trend will be rewarded.”

In August 2016, Macy’s announced its plans to shut down 100 more stores, which represent about 15% of the company’s total number of stores as the organization wants to strengthen its hand to combat with dominating online behemoth Amazon and adjust to changes in consumer spending behavior. Therefore, Macy’s will spend the cost savings of $250 million to invest in its digital business and other store-related growth strategies.

As digital transformation continues to engulf everything in its path, opportunities and challenges will equally get off the ground. So maybe instead of pointing the finger at Amazon, it is time for retailers to adopt a mobile-first approach, or maybe even go beyond that by adopting a proactive approach and innovate new ways of delivering exceptional shopping experiences. I believe that the secret sauce comes in the form of offline and online merging like Amazon has been doing to thrive. I mean, people still like running their fingers over soft fabrics but they also like convenience.

Don’t forget that the majority of tomorrow’s shoppers want to have a shopping experience that also makes the most popular Instagram post. You may laugh, but this is happening. Jokes aside, from the social element to the emerging demand for personalization, retailers need to create a melting pot of such different aspects to deliver a holistic, seamless shopping experience. As I listed in one of my e-commerce articles entitled 7 Emerging eCommerce Technology Innovations, implementing high-end technologies such as “memory” mirror technologies led by RFID tags into the store can bring convenience, ease of use, personalization, process simplification, and a high level of comfort to shoppers. A retailer that aims at disrupting the space may even pioneer in tapping into autonomous vehicle technology and combine a smart dressing room with its autonomous showroom vehicle to bring a fully-tailored experience to the doorstep of its shoppers. Not a bad idea, huh?

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.