CMSC Media Examines: The Forrester Wave DXP Q3 2019—Part 1

By Ellie Somfelean

August 7, 2019

Acquia, Adobe, BloomReach, Digital Experience, Digital Experience Platform, DXP, Episerver, Forrester, Liferay, OpenText, Oracle, Salesforce, SAP, sitecore

Please click here to read our CMSC Media Examines: The Forrester Wave: DXP 2019 Q3—Part 2.

CMSC Media is proud to share our exclusive interviews with six of the leading digital experience platform (DXP) providers presented in the most recent Forrester Wave Report (Q3 2019). We undertake a two-part exploration of Forrester’s review and speak to DXP vendors ranked in the Leader, Strong Performer, and Contender groupings. Each article will feature discussions with three vendors from each of the aforementioned categories.

Click our link to receive a free copy of The Forrester Wave™: Digital Experience Platforms, Q3 2019

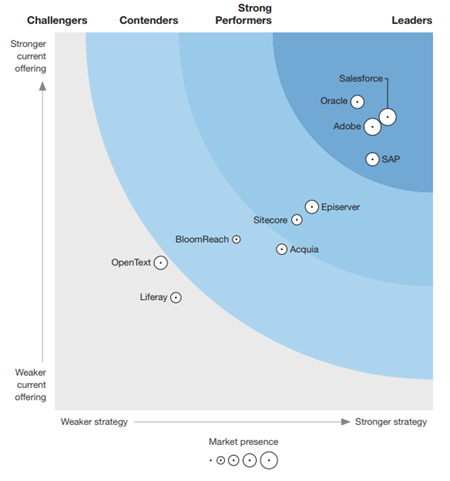

The new Forrester Wave Report Q3 2019 is here, this time evaluating the top ten digital experience platform providers. The Forrester Wave analyzes and assesses how each of the participating vendors “measures up and helps digital experience leaders make the right choice” when companies are in the market to purchase technology. Its infographic is divided into four main ranking positions: Leaders, Strong Performers, Contenders, and Challengers. Entries are then further positioned on the graphic based on their Current Offerings and Strategies.

The ten DXP vendors featured in Forrester’s latest review are (listed alphabetically):

-

Acquia

-

Adobe

-

BloomReach

-

Episerver

-

Liferay

-

OpenText

-

Oracle

-

SAP

-

Salesforce

-

Sitecore

According to Forrester, the three key features that make a digital experience platform stand out are:

-

Experience management and delivery applications

-

Platform services that assist performance needs

-

Infrastructure services that support scaling, security, and operations

Forrester evaluated and categorized the top vendors on the market, highlighting their strengths and weaknesses. Below is a summary of the main categories and a quick overview of what and how each vendor is doing:

Leaders

Vendors in this category excel in their array of offerings, with many expanding and acquiring companies to help fill in missing gaps. Most of the leaders are robustly reliable in their B2B and B2C offerings, API management, and experience management and platform services. Some shine more than others in various aspects, but there are some commonalities in areas of weakness revolving around support, developer tools, marketing, and rich media content.

Salesforce secured its position at the top thanks to recent, strategic acquisitions that allowed them to expand their offerings. The vendor excels with its commerce capabilities in B2C and B2B thanks to having Demandware and CloudCraze on board. It also augmented its already-strong developer tool and API management department by acquiring MuleSoft. While Salesforce still needs to work on its web experience management, marketing, and rich media content, it gets points for its capabilities in dealer portals and commerce, campaigns and messaging, customer profiles, as well as an overall strong product offering.

Oracle also benefited from strategic acquisitions; increasing its product offering and strength in a wide range of categories with everything from commerce, marketing, AI/ML automation, and API management. While the vendor seems to continue to fall somewhat short in the support department—as well as their developer and practitioner talent pools—there’s hope that the new leadership will help to bring Oracle on par with their peers.

Adobe continues to stand out in experience management and platform services and gets praise from its clients for its AI and integration capabilities. The vendor has focused on improving its B2B marketing and commerce through the acquisition of Magento and Marketo and continues to have the most digital experience agency partners out of all the vendors Forrester is tracking. Adobe seems to be an ideal solution for large companies and can manage those companies’ demands, especially when it comes to Adobe’s experience management and platform services. The vendor loses points in the infrastructure services category, which includes API-management and code development, and its complex price structure can be prohibitive for some clients.

SAP ‘s new C/4HANA platform is seen as a solution to help unify and centralize the firm’s commerce, customer data, marketing, sales, and service clouds. The vendor’s strengths lie in their B2B and B2C commerce capabilities as well as their access and API management, making it the right solution for businesses with complex needs. It is noted that SAP needs to work on improving product integration, customer process automation, developer tools, and rich media content.

Strong Performers

Both vendors in this category stand out with their B2C capabilities and web experience management. Where Sitecore leads in the partner ecosystem, Episerver lags. Customers want to see better API and marketing management as well as better market automation, eventing, role-based access, and platform operations and certifications.

Episerver is a great vendor for those running on Microsoft Azure and for those that would appreciate their great B2C commerce offerings, search, and web experience management. Areas that need improvement include digital asset management, infrastructure services, and partner ecosystem and market approach.

Sitecore stands out with its solid web experience management as well as rich media and marketing content capabilities. Following the acquisition of Stylelabs and their SaaS software for rich media and marketing content creation and management, Sitecore secured a stronger standing as a DX provider with creative capabilities. On the other hand, their weak spots seem to be customer data, analytics, marketing automation, eventing, role-based access, and platform operations.

Contenders

The contenders share similar strong points in their web experience management, development tooling, and platform operations. However, clients of this category would like to see better customer data, commerce, and marketing capabilities.

Acquia continues to stand apart thanks to its content hub, web experience management, development tools, and platform operations but falls short on customer data, commerce, and AI/ML automation capabilities.

BloomReach shines thanks to its web experience management, platform operations, AI/ML-based search, and a CMS backed by great developer tools, stable APIs, and developer tools. The vendor is rapidly evolving thanks to its leadership, and hopefully, this will translate in better marketing, customer data, and analytics capabilities.

Challengers

OpenText gets praised for its marketing and rich media content and content hub despite their shortcomings in B2B and B2C commerce offerings, developer tools, and general lack of support.

Liferay’s strength might not lie in marketing, customer data, analytics or AI/ML automation, but they get credit for being the strongest in platform support, developer tools, and platform operations.

Part One — CMSC Media Interviews with Salesforce, Episerver, and Acquia

CMSC Media consulted with six of the vendors to talk about the report, their services, and to see what they have in store for the upcoming future. We showcase our first three vendors in part one, with our remaining three vendors in part two.

Salesforce (Forrester Leader)

Sales Force Public Relations Team (Co-CEOs Keith Block and Marc Benioff pictured)

Forrester named you a leader in their newest Digital Experience Platform report. In your opinion, what makes Salesforce stand apart from the competition? What got you the number one spot?

“Any DXP Platform can be integrated with an external database, system, or CMS, but what really sets Salesforce apart—and where our customers see the most value—is in the full power of our single platform. Community Cloud is our digital experience platform; however, because it is powered by the entire Salesforce 360, we’re able to bring in the power of our entire platform including Commerce Cloud, Einstein, Marketing Cloud, MuleSoft, Pardot, and more. With Salesforce, our customers are armed with the insights and tools they need to deliver deeply personalized digital experiences.”

What role did MuleSoft’s integration capabilities play in enhancing Salesforce’s offerings and overall platform?

“With MuleSoft, Salesforce is accelerating our customers’ digital transformations, enabling them to unlock data across legacy systems, cloud apps and devices to make smarter, faster decisions and create highly differentiated connected customer experiences.”

What can you tell us about the Salesforce Community Cloud, and how is it helping your clients?

"Community Cloud is the center of Salesforce's Digital Experience Platform, enabling brands including Barclays, Lamborghini, and OpenTable to build beautiful, CRM-powered digital experiences—fast. Using Community Cloud, our customers are able to connect with more than 450 million members around the world, while experiencing a 23% increase in customer satisfaction and a 25% increase in faster case resolution time.”

What else is Salesforce doing to enhance its digital experience platform further? What can we expect to see in the near future?

“We’re always listening to, learning from, and working with our customers to evolve our products. We expect the use of AI to continue to increase, better-improving productivity, and relevance.”

Episerver (Forrester Strong Performer)

Nate Barad, Director of Product Marketing at Episerver

In your opinion, what makes a digital experience platform stand out?

“A DXP must deliver on the capabilities a business expected out of it when they signed on or those they further invested in. Customer and employee experiences are paramount, and projects with goals to support and improve them must be valuable and successful. Speed of integration, deployment capacities, and making it easier for teams to engage with their audience are at the top of the list of what makes a DXP shine.”

What are some of the biggest challenges a digital experience platform is facing?

“An inference that it’s a ‘big’ application, and perhaps isn’t on the list as a business imperative… yet. Organizations are wisely prioritizing projects for infrastructure alignment, security, privacy, operations, and, more often now, global operations. As these stabilize, all organizations can dedicate focus to their customer experience as everyone’s business operations merge with digital in every audience.”

What do you think are some of Episerver’s strengths when it comes to digital experience platforms?

“Episerver’s products deliver customers an ideal blend of creativity and data-driven decisions. Our teams build modern applications that are reliable and deliver value. The combination of creativity and information helps organizations improve relationships with their audiences, and our technology grows with them. Customers build applications that leverage a range of different services and interfaces and realize immediate and incremental value. Customers appreciate the ability to integrate with their operations and customer information quickly, and test different experiences as they build these applications.”

What is Episerver doing to enhance its digital experience platform further?

“Simply, a lot! We push updates weekly, keeping us fed with new capabilities and securities. Our product teams are continuing to expand applications and integrations in the Episerver App Marketplace, and further progress our deployment options. We are accelerating the operational capabilities for new regions and different cross-border businesses. Every region is unique, and we are constantly learning and building to partner with more brilliant organizations across the world.”

What can we expect to see in the near future from Episerver?

“Our Experience Design team has been hard at work. We released several new updates this spring and summer which are now available/visible to users. Combining business users’ creativity and expertise with their visitors’ information is central to these advances in our user experience. Leveraging our strengths in Artificial Intelligence, and the practical applications of it will continue to help users combine the art and science of experience to interactions on the web.

Customers can also look for more solutions and reference examples to get them started with their next steps quickly. Advances in both the reporting and recommendations have already surfaced and are the basis of many more improvements in helping analysis and automation.”

Acquia (Forrester Contender)

Tom Wentworth, SVP Product Marketing

In your opinion, what makes a digital experience platform stand out?

“At Acquia, we believe in DXPs — we even define ourselves as the open digital experience company. We bet that you’re going to hear — and use — the term “digital experience platform” (DXP) frequently in the next two to three years. But there are a lot of companies using the term, creating confusion in the market. Ask 100 people what a digital experience platform is, and you’ll likely get 100 different takes. Industry analysts like Forrester and Gartner define DXP slightly differently. But regardless of the exact definition, it’s clear to us that companies desperately need a better way to personally connect with their customers wherever they are.

To stand out, a DXP needs to embrace the rapid pace of change that consumers demand. Raise your hand if you predicted five years ago that you’d have multiple voice assistants sitting in your living room. Or that you’d be chatting with brands the same way you chat with your friends. What’s next? Who knows? That’s why we believe that DXPs have to be open to stand out. No single vendor can provide everything a company needs to stay ahead of their customers.”

What are some of the biggest challenges a digital experience platform is facing?

“When I went away to college a long time ago, my parents bought me one of those TVs with a built-in VCR. Remember those? One device to rule them all. Except it was a terrible VCR, and a few months later stopped working. So I was left with a decent TV with a useless VCR. That’s basically where we are with the current “closed” Digital Experience Platforms: they are the modern equivalent of the awful TV VCR combo.

As with any new technology, there’s no shortage of vendors wanting to sell you their version of the “perfect” DXP. But users need to be wary of vendors that try to peddle the one-stop-shop DXP solution. It looks great on a website or PowerPoint slides, but in the real world, it just doesn’t work.”

What do you think are some of Acquia's strengths when it comes to digital experience platforms?

“We believe that Digital Experience Platforms must be open and use this belief to help guide our vision for the company. Of course, every DXP vendor will claim they are open and will integrate with whatever you need them to. But being open is so fundamental to Acquia that it’s a part of our company DNA, and guides us today. Our co-founder Dries created Drupal, one of the largest open-source projects. We recently acquired Mautic, the only open marketing cloud. We offer hundreds of pre-built connectors so our customers can make their existing investments work better together. Developers can build whatever they need using modern APIs and development tools.

Open source dominates every single application in the modern enterprise IT stack from databases to virtualization to analytics, and there’s no doubt in my mind that the same will happen in DXP.”

What is Acquia doing to enhance its digital experience platform further? What can we expect to see in the near future?

“We want to help our customers tear down the organizational silos that stand in the way of delivering an excellent digital experience. The only way to do that in the real world where companies have already made significant investments in other products is to help companies get more value from the products they already own. We’ll do that by continuing to build products that are radically open, with pre-built integrations to all the DXP products being used in the enterprise and by providing simple APIs for developers to build exactly what they need. Our acquisition of Mautic is just one example of our commitment to building the only open DXP, and we’ll continue to look for ways to innovate on that mission.”

Please follow the link CMSC Media Examines: The Forrester Wave: DXP 2019 Q3—Part 2 to continue reading our commentary and where we speak to our remaining three top-ranked DXP vendors: SAP, Sitecore, and BloomReach.

Ellie Somfelean

Ellie is a Reporter and Content Marketer with CMSC Media. She is passionate about social media and digital marketing. She has a vast experience with content creation, influencer marketing and brand promotion.