Why Did Verizon Buy Yahoo's "Worthless" Core Assets

American telecoms giant Verizon Communications has entered into an agreement to acquire Yahoo’s core assets for $4.83 billion in cash, marking the beginning of another chapter for a company that once defined the internet. The transaction does not include Yahoo's cash, its shares in Alibaba Group Holdings, its shares in Yahoo Japan, or Yahoo's non-core patents, called the Excalibur portfolio.

“Yahoo is a company that has changed the world, and will continue to do so through this combination with Verizon and AOL. The sale of our operating business, which effectively separates our Asian asset equity stakes, is an important step in our plan to unlock shareholder value for Yahoo,” Marissa Mayer said in the release. “This transaction also sets up a great opportunity for Yahoo to build further distribution and accelerate our work in mobile, video, native advertising and social. Yahoo and AOL popularized the Internet, email, search, and real-time media. It’s poetic to be joining forces with AOL and Verizon as we enter our next chapter focused on achieving scale on mobile. We have a terrific, loyal, experienced and quality team, and I couldn’t be prouder of our achievements to date, including building our new lines of business to $1.6 billion in GAAP revenue in 2015. I’m excited to extend our momentum through this transaction.”

“Yahoo is a company that has changed the world, and will continue to do so through this combination with Verizon and AOL. The sale of our operating business, which effectively separates our Asian asset equity stakes, is an important step in our plan to unlock shareholder value for Yahoo,” Marissa Mayer said in the release. “This transaction also sets up a great opportunity for Yahoo to build further distribution and accelerate our work in mobile, video, native advertising and social. Yahoo and AOL popularized the Internet, email, search, and real-time media. It’s poetic to be joining forces with AOL and Verizon as we enter our next chapter focused on achieving scale on mobile. We have a terrific, loyal, experienced and quality team, and I couldn’t be prouder of our achievements to date, including building our new lines of business to $1.6 billion in GAAP revenue in 2015. I’m excited to extend our momentum through this transaction.”

Although most analysts predict the deal to spell the end of Mayer’s four-year reign, who failed to turn the company around, she told employees via a Tumblr post that she wants to stay without specifying for how long: “For me personally, I’m planning to stay. I love Yahoo, and I believe in all of you. It’s important to me to see Yahoo into its next chapter.”

The deal makes sense for Verizon. Just over a year ago the company also bought AOL, which is best known for the dial-up internet it popularized in the ‘90s and owns popular media sites like Huffington Post, and TechCrunch, in order to take advantage of its ad technology. Since Verizon already owns AOL, analysts believe Verizon is probably the best fit for Yahoo instead of the other suitors.

“It’s the eyeballs that generate the advertising, you have to get to that viewership to get the advertisers to advertise, and that’s the model that we have to follow,” said Verizon CFO Francis Shammo at an investment conference in May in response to a question about Yahoo’s appeal.

Yahoo will be integrated with AOL under Marni Walden, EVP and president of the Product Innovation and New Businesses organization at Verizon, and CEO Marissa Mayer could be working again with AOL CEO Tim Armstrong, who worked with Mayer at Google for years and unsuccessfully attempted to convince her to combine the two companies when they both remained independent.

After the sale is completed early next year, Yahoo will become a holding company for its two stakes in China's e-commerce leader, Alibaba Group, and Yahoo Japan. Those investments made more than a decade ago, are worth at least $40 billion US before taxes. In other words, they are by far the most valuable businesses of Yahoo as its 15 percent stake in Alibaba represents $31.2 billion, and its 34 percent of Yahoo Japan is worth $8.3 billion.

What Does This Deal Mean?

Verizon purchased AOL for $4.4 billion last year, now the company spent $4.82 billion on the acquisition of Yahoo. Meanwhile Salesforce.com CEO, Mark Benioff stated that it would have paid more than the $26.2 billion paid by Microsoft for LinkedIn. Why did Verizon pay such a high price for internet assets that are considered “worthless” by Wall Street? Why did Salesforce regret that it couldn’t acquire LinkedIn? The answer is the importance of user data and content in today’s digital ecosystems.

With the integration, Yahoo will bring in millions of more users, who still regularly visit the site to pick up their email, check the weather and catch up on current events, celebrity gossip, and the stock market, to boost Verizon’s popular properties like TechCrunch and Huffington Post.

Online advertising is currently dominated by Google and Facebook, and Verizon, eventually, wants to compete with those two giants. The takeover is expected to double the size of Verizon’s digital advertising, placing it as a distant third behind Google and Facebook in the $160-billion market for digital advertising, according to research firm eMarketer.

“Yahoo gives us scale that is what is most critical here," Marni Walden, who is Head of Product Innovation and New Business at Verizon told CNBC, adding that the company’s audience will go from the millions to the billions. “We want to compete and that is the place we need to be.”

Verizon’s advertising technology through AOL can be enhanced with Yahoo’s capability in native advertising, especially in the mobile space. Yahoo also could help Verizon improve in the search space, where it falls behind. On the other hand, even with the AOL and Yahoo assets, it will not be easy to catch up with the online advertising front runners as Verizon with AOL currently holds just 1.8% of the $69 billion digital ad market in the US. Yahoo has about 3.4%, while Google and Facebook together occupy almost half of it. On the bride side, though, there’s plenty of market share to gain.

According to eMarketer, if Verizon fully owned Yahoo right now, it would generate about $3.6-billion in U.S. ad revenue this year to eclipse Microsoft for third place in the market. It would still lag in ad revenue, compared with Google’s projected $27-billion, and Facebook’s projected $10-billion.

“Our mission at AOL is to build brands people love, and we will continue to invest in and grow them. Yahoo has been a long-time investor in premium content and created some of the most beloved consumer brands in key categories like sports, news, and finance,” AOL CEO Tim Armstrong said in the release. “We have enormous respect for what Yahoo has accomplished: this transaction is about unleashing Yahoo’s full potential, building upon our collective synergies, and strengthening and accelerating that growth. Combining Verizon, AOL, and Yahoo will create a new powerful competitive rival in mobile media, and an open, scaled alternative offering for advertisers and publishers.”

In the official announcement, Verizon pointed out a couple of reasons to justify the acquisition. Yahoo has a global audience of more than 1 billion users, including 600 million on mobile. The company also owns premium brands in finance, news, and sports. Yahoo Mail has 225 million monthly active users. In terms of advertising technology and analytics, Verizon mentioned Brightroll, Flurry, and Gemini, without naming Tumblr.

“The deal speaks to a clear strategy shift at Verizon,” Craig Moffett, an analyst with Moffett Nathanson, stated. “They are trying to monetize wireless in an entirely new way. Instead of charging customers for traffic, they are turning to charging advertisers for eyeballs. Verizon is hoping that combining Yahoo’s content with AOL’s ad technology platform and Verizon’s own insights into user data can make the advertising inventory much more valuable.”

How Yahoo Lost Its Way

In the 1990s, Yahoo was king in the world of the internet with the emergence of graphical web browsers. Co-founders Jerry Yang and David Filo built a web directory as Stanford University computer graduate students in 1994. Afterward, as Yahoo rapidly became the online hub for tens of millions of people, while other dot-com startups were burning through millions of dollars.

However, since the company mainly focused on building a multimedia business, it didn’t stress internet search enough and let Google become a mainstream. Yahoo also missed out the power of social networking and mobile devices. Instead, Yahoo unsuccessfully attempted to acquire Google and Facebook in those companies’ developmental years.

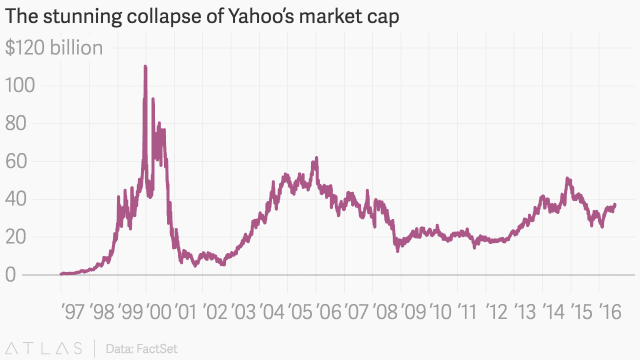

The price tag for today’s deal, $4.83 billion, is well below what Yahoo used to be worth, and to what many private tech startups are valued at today. It was worth at $125 billion during the dot.com boom and also had a chance to be sold to Microsoft for $44.6 billion in early 2008 which would have been the largest pure technology deal ever as the offer constituted a 62% premium over Yahoo’s most recent share price. However, Yahoo turned down the deal.

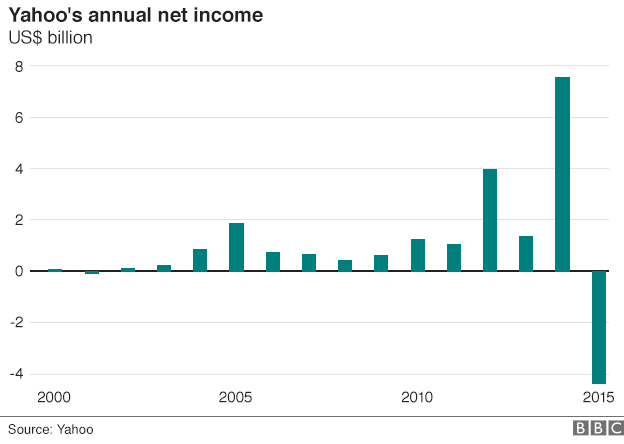

Marissa Mayer was enthusiastically welcomed at Yahoo in July 2012 due to her ability to act as a flag-bearer for women running big companies in Silicon Valley and she was expected to engineer a comeback. She doubled down on mobile, made some acquisitions like Tumblr for $1.1 billion and Brightroll for $640 million as well as upgraded some key products, such as Yahoo Mail, Flickr, Yahoo Weather, and Yahoo Messenger. However, all of these efforts didn't generate enough revenue to prevent disappointment on many levels. She presumably envisioned that she could have turned it around if the site became a news organization, but the strategy didn’t result in that way. As a result, shareholders fed up with a steep downturn in the company’s revenue during the past eight years and this situation led the company to today’s acquisition.

Last week the firm reported that its revenue fell 19 percent from a year earlier, while its operating loss widened to $440 million from last year's $22 million, but Mayer told CNBC she is proud of her accomplishments at Yahoo, even though the company's annual revenue, after ad commissions, fell from $4.4 billion US before her arrival to a projected $3.5 billion US this year: "We set out to create a stronger, more modern, version of Yahoo and that's very much happened."

Last September, the company also announced plans to cut 15 percent of its workforce, leaving it with a headcount 42 percent lower than in 2012. Mayer has already jettisoned 1,900 Yahoo workers since then.

Verizon’s purchase of AOL a year ago for its programmatic advertising technology leveraged its platform and now, the organization expects the acquisition of Yahoo to help them gain a larger share of the booming digital advertising pie. On the other hand, it might be an opportunity for Yahoo to focus on what it does best. Regardless, it will be interesting to watch their business strategies.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.