The 2019 State of IT

The Annual Report on IT Budgets and Tech Trends

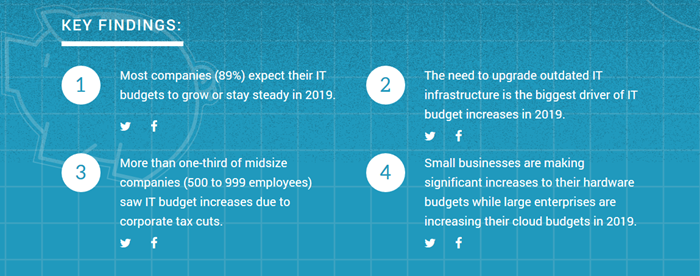

Technology purchase blueprint for the coming year In part one of the 2019 State of IT, Spiceworks inspected how organizations are spending their tech budgets next year. After surveying more than 700 business technology buyers across North America and Europe, we discovered business revenue is on the rise and IT budgets are expected to grow or remain level.

Foundational Support...

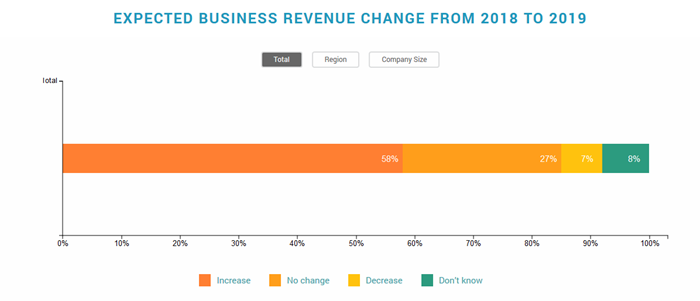

The majority of organizations (58%) across North America and Europe expect business revenue to increase in 2019. Enterprises with 1,000+ employees are even more likely to see a revenue boost. This upward trend is consistent with 2018 numbers, which shows most businesses don’t expect the economy to slow down in the near future.

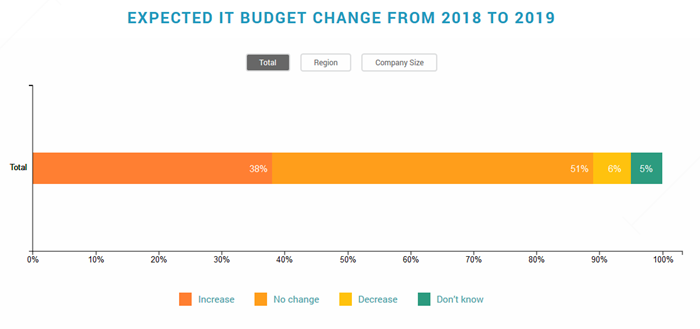

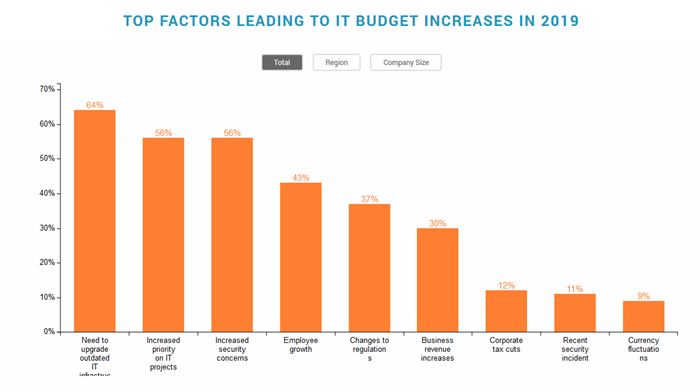

Unsurprisingly, compared to their counterparts in North America, European businesses were more likely to increase IT budgets due to changes in regulations, such as GDPR, and due to currency fluctuations.

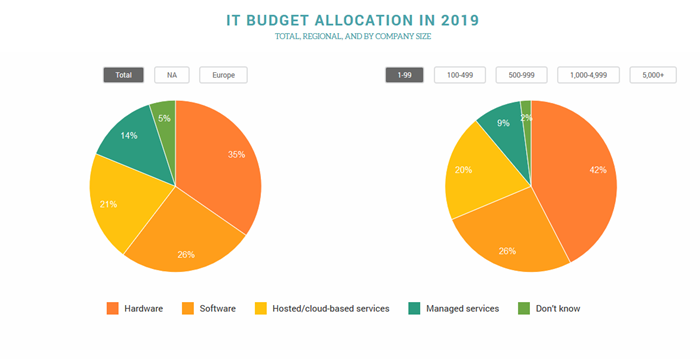

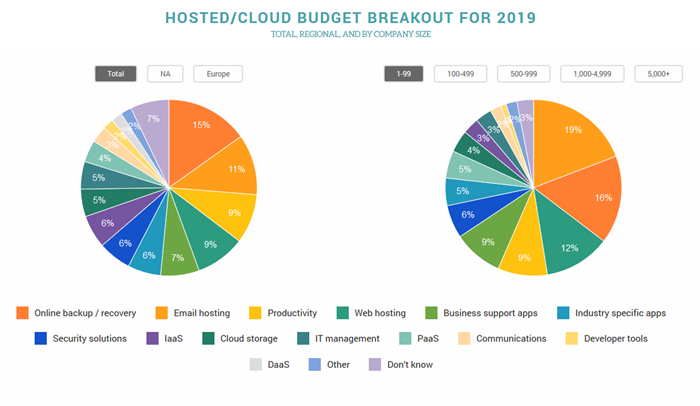

In terms of how IT budgets will be allocated in 2019, software and cloud budgets remain steady year over year at 26% and 21% respectively. However, as a percentage of total spend, hardware budget allocations get smaller as company sizes increase and managed service budget allocations get larger.

Compared to last year, smaller orgs with less than 100 employees have significantly leveled up their investments in hardware (31% of their IT budget allocation in 2018 to 42% in 2019). At the same time, large enterprises slightly increased their cloud budget allocations. Companies with 1,000 to 4,999 employees lifted cloud spend by 2 percentage points, while enterprises with 5,000+ employees took their cloud budgets up by 3 percentage points.

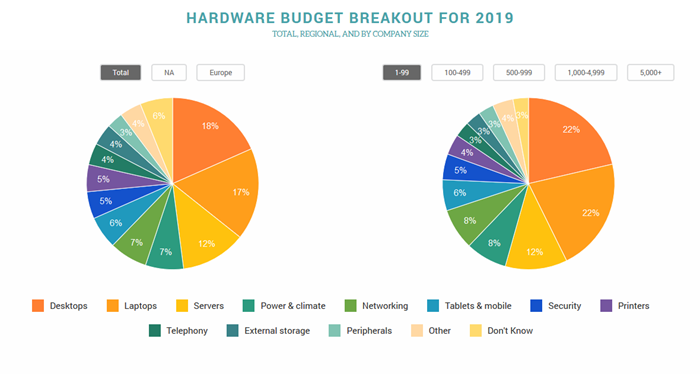

When we deconstruct hardware budgets, desktops, laptops, servers, and power and climate hardware top the list. It’s evident desktop investments are still a cornerstone in many organizations, particularly in smaller companies. In fact, according to our recent study on the lifetime of tech in the workplace, desktops are the primary computing device in 68 percent of organizations, compared to only 29 percent of organizations using laptops and 1 percent using tablets as the primary device for employees.

Across company sizes, smaller orgs are investing a larger percentage of their hardware budget in desktops and laptops, midsize orgs with 500 to 999 employees are investing a bigger portion of their budget in tablets and mobile devices, and larger enterprises expect to spend a larger chunk of their hardware budget on security gear.

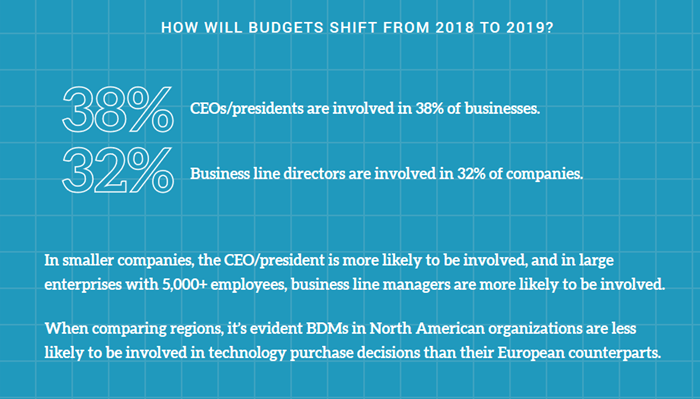

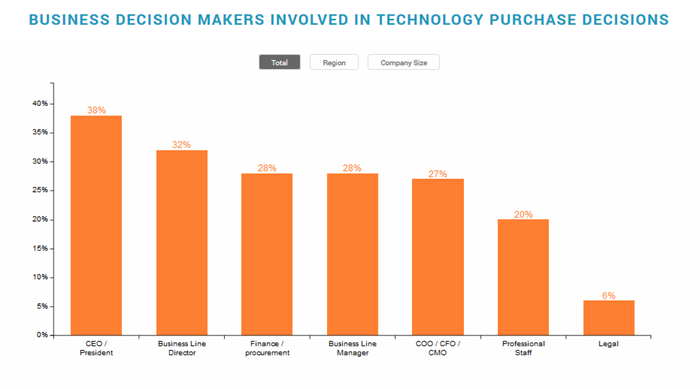

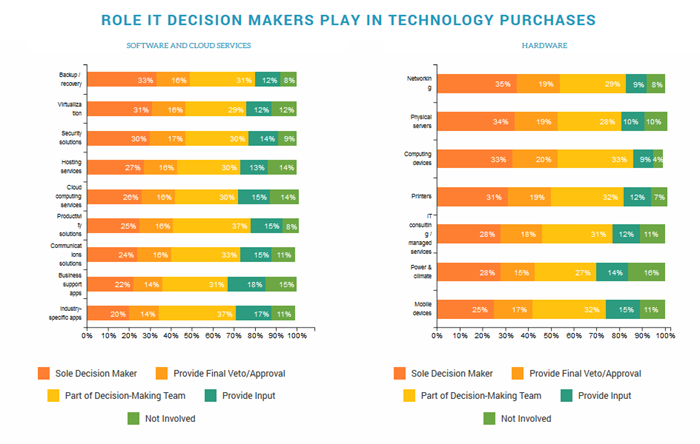

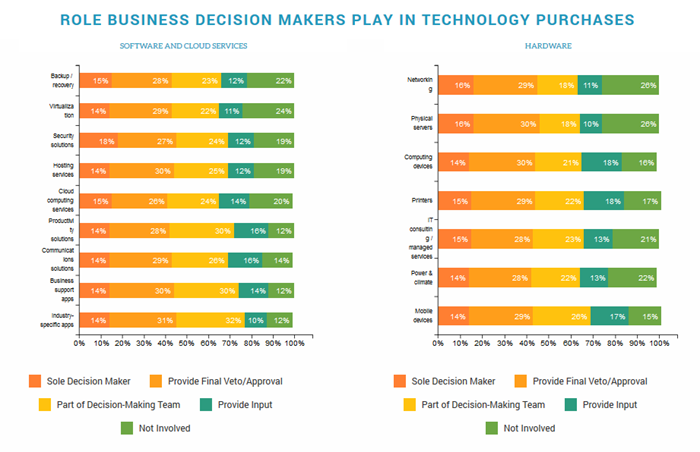

What role do business decision makers (BDMs) play vs. IT decision makers (ITDMs)? Across all company sizes, it’s evident that compared to BDMs, ITDMs are nearly twice as likely to be the sole decision maker for most technology categories. In small businesses, ITDMs are nearly four times as likely to be the sole decision maker, perhaps because in large enterprises there’s typically more people and processes in place when IT decision makers are making big tech purchases. But across the board, IT decision makers are most likely to hold the keys to the purchasing vault when it comes to networking devices, servers, computing devices, and backup/recovery solutions.

When involved, BDMs are more likely to either sign off on final approval or veto the deal after ITDMs have made their vendor selection. They’re least likely to be involved in technology purchases when it comes to networking devices, servers, virtualization, backup/recovery, and power and climate technology. But compared to other tech categories, BDMs are more likely to be involved in the purchase decisions for business support apps and industry-specific apps.

Conclusion

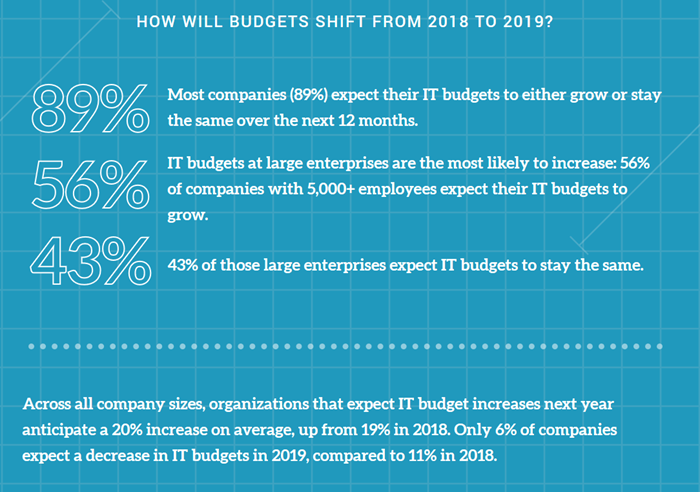

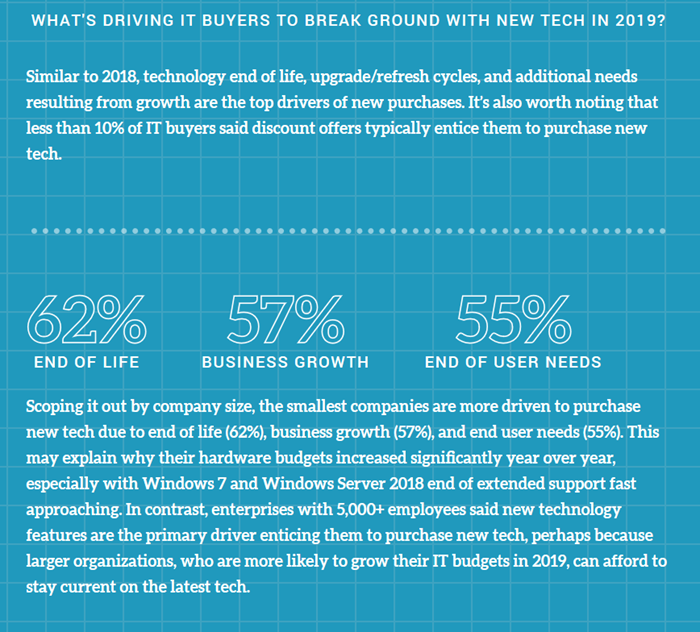

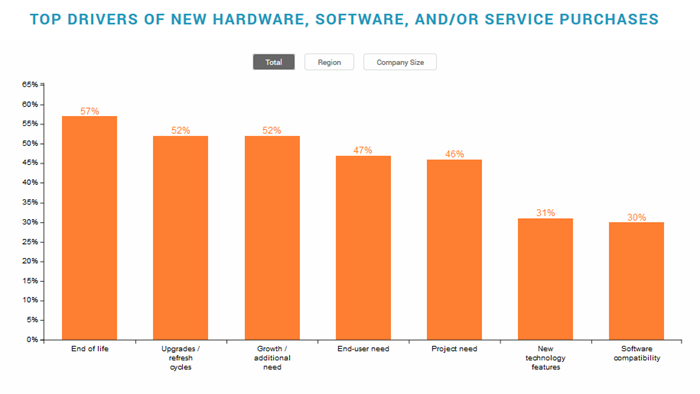

When it comes to the budgetary bank, 2019 will see business revenues rise. IT budgets will also increase or stay steady, with large enterprises seeing the biggest boost. As companies bulldoze outdated technology, they’re also safeguarding their infrastructure by investing more in a fundamental cornerstone: security.

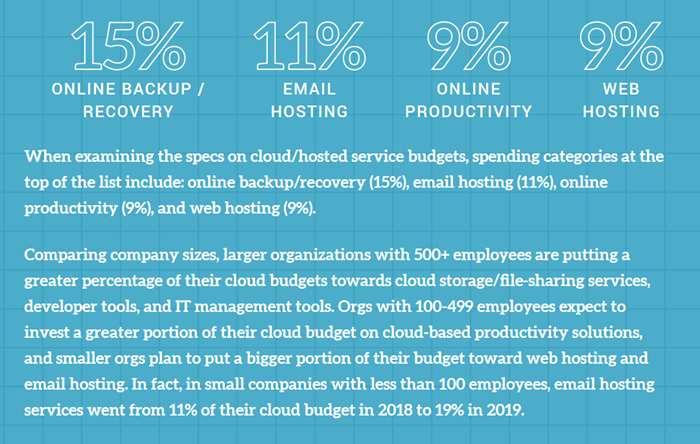

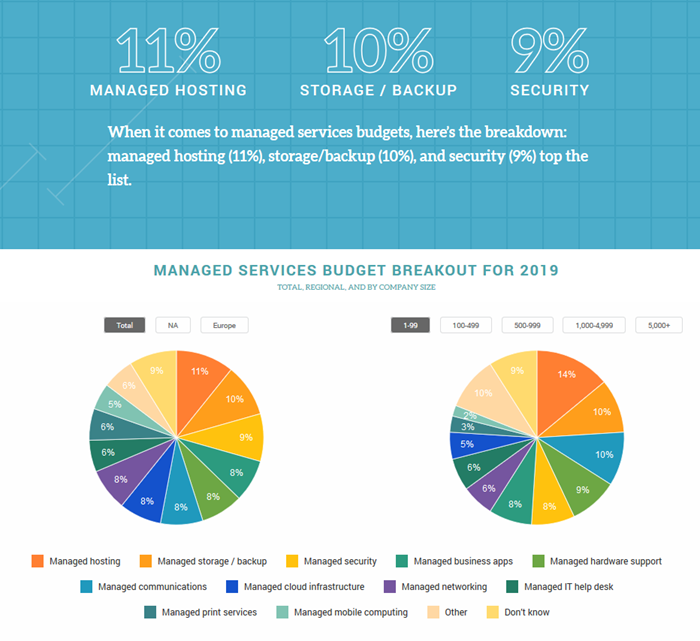

The bulk of IT budgets will go towards desktops, mobile devices, operating systems, online/backup recovery, and managed hosting. For some tech purchases, the entire crew has a hand from the IT manager to the CEO. But in many cases, the IT buyer will be the sole decision maker for the hardware, software, and services businesses need in 2019 to upgrade the outdated tech that’s holding them back.

View original content: Here