The 2017 Global Ecommerce Report

This study is one of the biggest research reports of its kind, outlining both retailer and consumer perspectives. It maps the global ecommerce landscape, asks the simple question “How do you grow?” and provides the complicated, sometimes contradictory, answers.

Our research surveyed 1,200 retailers from 8 countries and 12,000 consumers from 11 global markets.

Retailer

Trend 1:

Take a cue (or two) from marketplaces.

Optimizing the domestic market

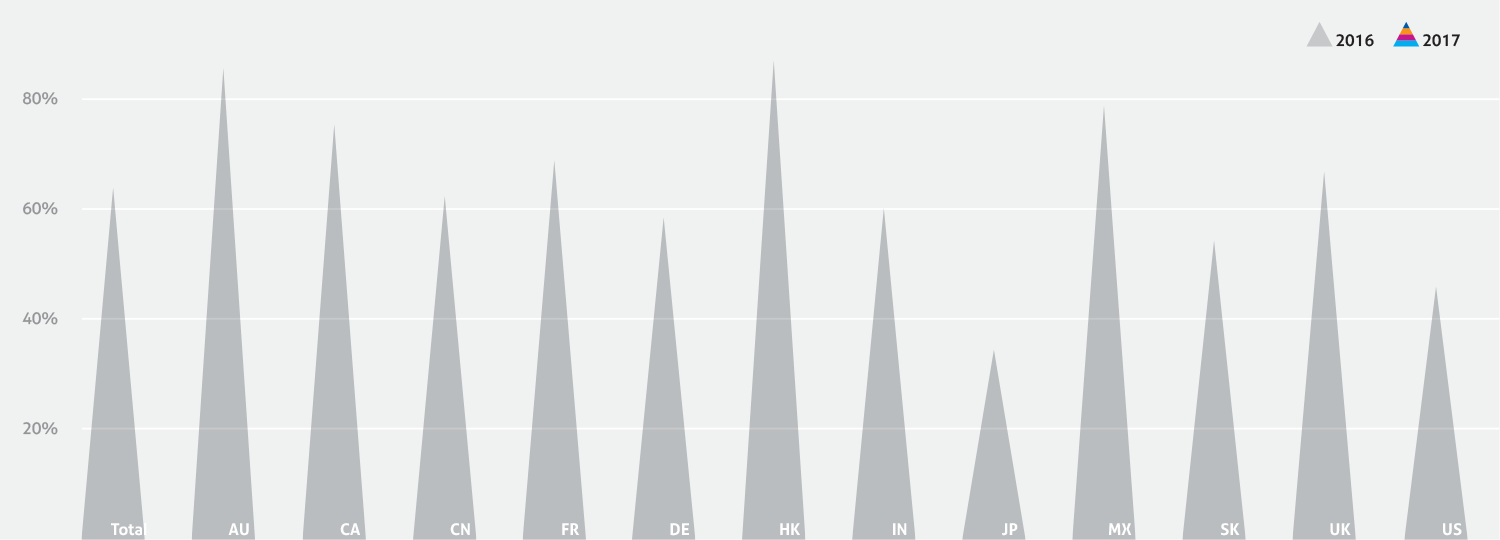

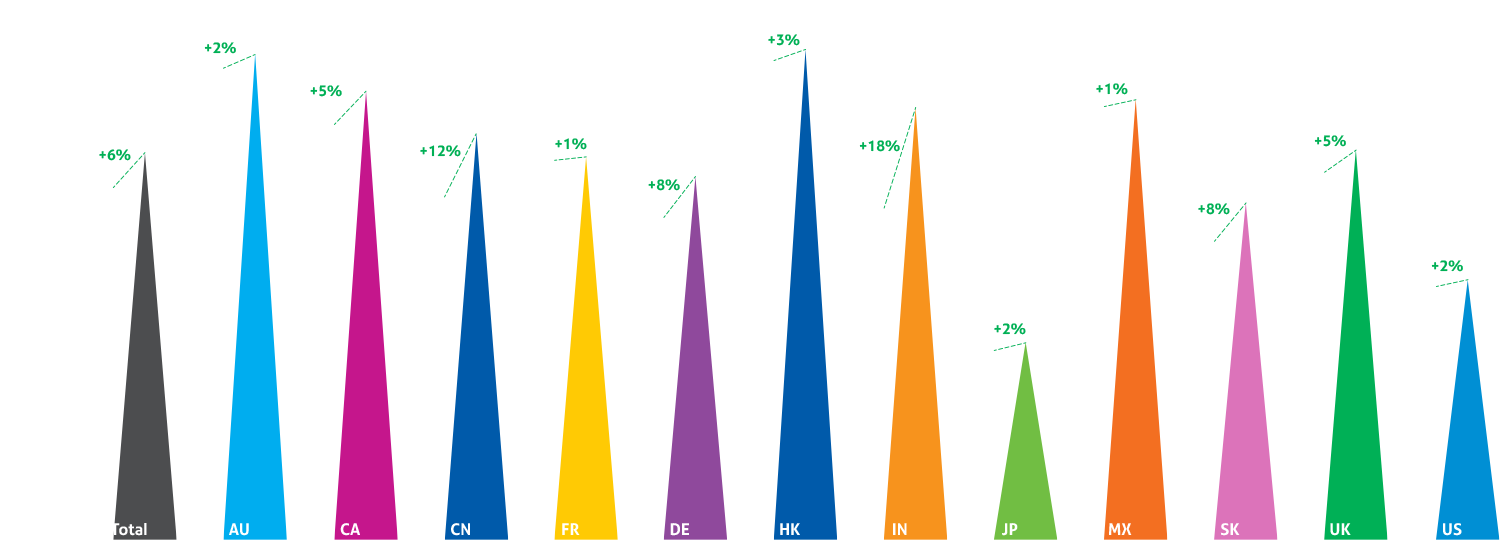

Domestic ecommerce is nearing maturity. Frequency of online purchases has increased by only 2% year over year, while online marketplaces are now attracting the majority of consumer mindshare in nearly every country surveyed.

In the US, UK, France, Hong Kong, and Japan, online purchase frequency has peaked, indicating an advanced level of market maturation. China is home to a staggering number of frequent online shoppers, having now reached saturation with negligible growth.

Nearly all (96%) of digitally-empowered Chinese consumers shop online daily, weekly, or monthly. Australia, Canada and Mexico are seeing the highest growth in consumers shopping online more often.

Consumers making online purchases daily or weekly, 2017 vs 2016

Retailers expect their domestic retail ecommerce through marketplaces to double in the next two years – despite many marketing channels being substantially less utilized by consumers in most markets.

45% of retailers surveyed have either already implemented or are piloting end-to-end shipping management capabilities.

Trend 2:

Don’t rely on brand alone.

Capturing near-border markets

The majority of retailers are expanding cross-border, with a third of respondents rating international selling as a top growth lever for the business — equal to the value ascribed to domestic ecommerce growth. Most retailers, however, have prioritized selling in countries that are either geographically or culturally adjacent, creating a “near-border” market with its own growth dynamics.

93% of domestic & global retailers either are or will be engaged in cross-border ecommerce by end of year

Average cross-border values are 17% higher than domestic AOVs

Trend 3:

Look like a foreigner, talk like a local.

Expanding into global markets

Our analysis has shown that the prioritization of near-border markets has come at the cost of underserving consumers in countries with higher adoption of cross-border ecommerce. Entering these markets requires amplifying the aspects of your brand that have the highest value for consumers, while tailoring the experience with nuanced localization.

Take the Global Ecommerce Assessment where you will be able to compare yourself to your peers. Take the assessment

Consumer

Trend 1:

Take a cue (or two) from marketplaces.

Optimizing the domestic market

Domestic ecommerce is nearing maturity. Frequency of online purchases has increased by only 2% year over year, while online marketplaces are now attracting the majority of consumer mindshare in nearly every country surveyed.

As of 2017, marketplaces are now #1 destination for product searches in nearly every country surveyed—Australia being the lone exception (where search engines now rank highest).

Consumers flock to marketplaces, while retailers hedge their bets

Top 5 reasons consumers shop at...

Marketplaces:

-

Product assortment

-

Better deals

-

One-click checkout

-

Quicker delivery time

-

Free shipping and delivery

Retailers' sites:

-

Brand loyalty and trust

-

Take advantage of loyalty points

-

Personalized customer experience

-

Better quality of products

-

Quicker delivery time

Trend 2:

Don’t rely on brand alone.

Capturing near-border markets

The majority of retailers are expanding cross-border, with a third of respondents rating international selling as a top growth lever for the business — equal to the value ascribed to domestic ecommerce growth. Most retailers, however, have prioritized selling in countries that are either geographically or culturally adjacent, creating a “near-border” market with its own growth dynamics.

70% of consumers globally make at least one crossborder purchase annually, a 6% increase over our 2016 Global Shopping Study

Trend 3:

Look like a foreigner, talk like a local.

Expanding into global markets

Our analysis has shown that the prioritization of near-border markets has come at the cost of underserving consumers in countries with higher adoption of cross-border ecommerce. Entering these markets requires amplifying the aspects of your brand that have the highest value for consumers, while tailoring the experience with nuanced localization.

In every country surveyed, more consumers had made cross-border purchases via marketplaces than via retailers’ own websites—13% more globally, a 5% increase over last year.

Download the full report

View more details and insights in the Global Ecommerce Report. Get the Full Report

View original content: Here