Microsoft & Adobe Join Forces to Outflank Salesforce & Oracle

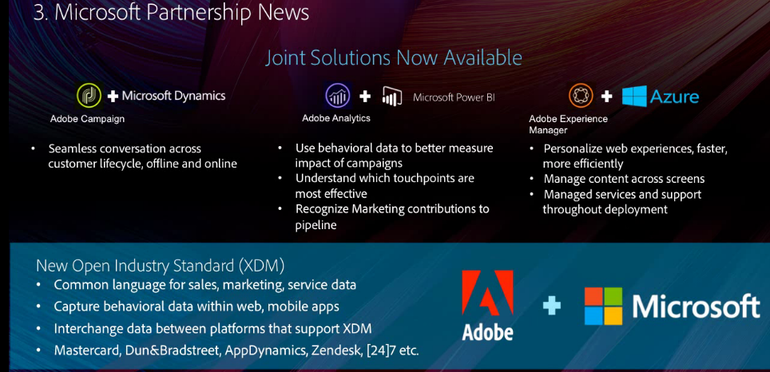

Adobe and Microsoft announced the availability of their first set of joint enterprise solutions focused on transforming customer experiences. The tightened partnership concerns Adobe Experience Cloud, Microsoft Azure, Dynamics 365 and Power BI along with the semantic data model that provides a new co-developed language for describing consumer attributes and behavior to enable easy interchange of customer profile data between applications, and has the support of MasterCard, AppDynamics, Qualtrics, Dun & Bradstreet and Zendesk.

Adobe and Microsoft first entered into a partnership last fall when Adobe agreed to use Microsoft’s Azure cloud computing services, with business to business marketing software, particularly software that companies use to run digital marketing and advertising campaigns, accounting for some $1.2bn of Adobe’s $4.6bn revenues last year. However, when I reported on that partnership, I said that because neither deal is exclusive, but rather described as “preferred,” and Adobe already has similar deals with Amazon and SAP, the deal doesn’t mean a wholesale shift of Adobe’s cloud business to Microsoft thus the extent and breadth of benefits for each company is a little bit up in the air. That being said, the newly announced further tie-up made more incremental progress on the initial partnership deal where the benefits for both sides is more obvious and compelling.

What Does this Mean for Adobe?

In recent years, both companies have significantly made the cloud a central part of their strategies as Microsoft has been touting Azure and heavily investing in its Microsoft’s cloud offerings, including its Office 365 software-as-a-service application. Adobe has been extending its marketing cloud and harvesting its business migration from a software sales model to a cloud-based subscription service.

Adobe Experience Manager Sites Managed Service, now available on Microsoft Azure, enables brands to manage their web content across any screen within Adobe Experience Manager with lower management and resource costs. This new addition addresses Forrester’s criticism about Adobe’s cloud strategy in its Wave report, citing: “AEM Sites’ current cloud strategy is a weakness, as the only option is a managed hosted flavor of platform-as-a-service (PaaS).” With this new integration, one of the most important roadblocks has been removed as the vendor, now, offers a unified marketing and sales cloud solution. Launching its Experience Manager Sites Managed Service on Microsoft Azure will allow its users to deliver personalized Web experiences faster and more efficiently in an organic process, without having to integrate with additional vendor applications.

Gartner’s Vice President and distinguished analyst Gene Phifer said that Adobe is doing what needs to be done. "I've been concerned all along that Adobe has great vision but was still focused on marketing alone, this move addresses that,” he said.

First Cross-channel Ad Platform: Adobe Advertising Cloud

In conjunction with the expanded strategic partnership, Adobe also announced a new umbrella service called Adobe Experience Cloud, which is comprised of the Adobe Marketing Cloud, Adobe Analytics Cloud, and Adobe Advertising Cloud that is developed with the help of the newly-acquired TubeMogul team. The new Adobe Advertising Cloud is designed to enable businesses to manage to advertise across traditional TV and digital formats and offers search management tools as well as automated display, social, video, and programmatic TV ad buying. Here are some advantages of the platform, according to Adobe:

-

Manages over $3.5 Billion in ad spend, annually with over 1000 clients

-

Unparalleled audience activation (90% match rate)

-

Performance without compromise on media quality and brand safety

-

Data-driven linear TV buying

-

100% independent and aligned with advertiser interests

Tim Waddell, Head of Product Marketing for Adobe's ad business, said: “The Advertising Cloud will synchronize cookies across its cloud to better track inventory and brand safety to make sure ads run in the right places. Other analytics tools to track viewability and performance will be included. Waddell added that Adobe aims to be the Switzerland of advertising tools.”

What Does this Mean for Microsoft?

Microsoft, on the other hand, has been muscling up its CRM platform, Microsoft Dynamics, and the vendor believes that the integration of Adobe Campaign and Microsoft Dynamics 365 will enable enterprises to compile customer insights across various channels, creating a single view of the customer that can be used to personalize experiences across marketing touchpoints. "We believe the combined power of our technologies will allow enterprise businesses to harness their data in new ways, unlocking critical business insights and actionable intelligence," said Scott Guthrie, Executive Vice President, Microsoft, in the statement.

the vendor believes that the integration of Adobe Campaign and Microsoft Dynamics 365 will enable enterprises to compile customer insights across various channels, creating a single view of the customer that can be used to personalize experiences across marketing touchpoints. "We believe the combined power of our technologies will allow enterprise businesses to harness their data in new ways, unlocking critical business insights and actionable intelligence," said Scott Guthrie, Executive Vice President, Microsoft, in the statement.

Adobe confirmed its plan to collaborate with Microsoft to create a shared data format between Adobe Experience Cloud, and Microsoft Dynamics 365 which will allow their joint SaaS clients to seamlessly integrate their marketing and sales processes. Adobe benefits from this integration the most as the vendor doesn’t offer its own CRM whereas its rivals, Salesforce and Oracle, provide both marketing and CRM cloud-based services. By plugging into Microsoft's ecosystem, Adobe can pull deep insights from Microsoft Dynamics 365.

While the integration is plugging Adobe’s CRM hole, it also completes the missing piece of Microsoft’s puzzle: a suite of tools on the digital marketing side. Abhay Parasnis, Executive Vice President and CTO, Adobe: “Today’s customers have high standards when it comes to brand interactions. Enterprise companies must deliver exceptional experiences at scale or risk losing customers to competitors,” saying further, “Bringing together Adobe’s and Microsoft’s sales, marketing and customer intelligence solutions enables brands to better understand and engage with their customers across all touch points.”

Adding Adobe Sensei to Microsoft Tools

Although there is no timeline for when this integration will be available, Sensei will venture into the Microsoft suite soon in an effort to provide more automated, intelligence-based business insight as Adobe products can now use data from Microsoft Dynamics 365, Microsoft Power BI and Microsoft Azure into Sensei for intelligent machine learning. The data is expected to enhance Sensei’s algorithm-based recommendations, once the integration has been completed.

the Microsoft suite soon in an effort to provide more automated, intelligence-based business insight as Adobe products can now use data from Microsoft Dynamics 365, Microsoft Power BI and Microsoft Azure into Sensei for intelligent machine learning. The data is expected to enhance Sensei’s algorithm-based recommendations, once the integration has been completed.

"The goal is to one day combine Adobe's Sensei to build it into Microsoft's tools in order to provide machine learning [ML] automation to improve selling, service, and marketing," Amit Ahuja, Vice President of Emerging Businesses at Adobe said. "A lot of the work around Sensei is being done with Microsoft but there is no timeline for when it will be turned on [on Microsoft's end]."

The two tech giants were working on standard data models and sharing of core libraries between Adobe's Sensei and Microsoft's Cortana, Microsoft’s search tool which can verbally provide answers to search queries and both are based on artificial intelligence. The combinations of these two integrate the advertising, marketing, and analytics products offered on Cloud with a backup of creatives and documentation. The deal also gives Adobe a way to compete with Salesforce’s artificial intelligence platform, Einstein.

Additionally, as mentioned in my opening statement, the partnership also includes a collaboration on the semantic data model that it is expected to be helpful for sales, customer service, and marketing but detailed information on that is not yet available. Microsoft will be talking further about the details of the project and how to use it at its upcoming Build developer event in May.

What Does this Mean for the Cloud Battle?

Microsoft and Adobe are planning to present a unified front in the cloud battle, in opposition to Oracle's growing cloud presence and the rise of Salesforce. Salesforce competes with Microsoft Dynamics 365 with its flagship Salesforce Sales Cloud product, and with Adobe, with the Salesforce Marketing Cloud.

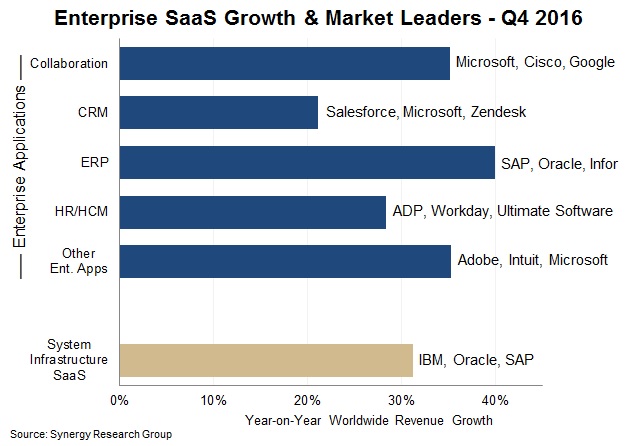

According to Synergy Research Group, the enterprise SaaS market grew 32% year on year to reach almost $13 billion in quarterly revenues, with ERP and collaboration being the highest growth segments. For the third successive quarter, Microsoft is the clear leader in overall enterprise SaaS, having overtaken long-time market leader Salesforce. Other leading SaaS providers include SAP, Oracle, Adobe, ADP, IBM, Workday, Intuit, Cisco, and Google. Among the major SaaS vendors, those with the highest growth rates were Oracle and Google, the latter thanks to a big push for its G Suite collaborative apps.

Even though Oracle’s CTO Larry Ellison believes that there is a big infrastructure-as-a-service swing coming, the research firm found that the enterprise SaaS market is somewhat mature compared to other cloud markets like Infrastructure-as-as-Service (IaaS) and Platform-as-as-Service (PaaS) and consequently has a lower growth rate. Synergy Research Group further added that SaaS market will grow at 2X in size and revenue by 2020, registering growth across all product segments and geographical areas.

“There are a variety of factors driving the SaaS market which will guarantee substantial growth for many years to come,” said John Dinsdale, a Chief Analyst and Research Director at Synergy Research Group. “Traditional enterprise software vendors like SAP, Oracle and IBM are all pushing to convert their huge base of on-premise software customers to a SaaS subscription relationship. Meanwhile, relatively new cloud-based vendors like Workday and Zendesk are aggressively targeting the enterprise market and industry giants Microsoft and Google are on a charge to grow their subscriber bases, especially in the collaboration market.”

Speaking of IaaS, according to Morgan Stanley’s 2016 CIO Survey, Microsoft’s Azure will edge out Amazon Web Services by 2019 for both IaaS and PaaS use among 100 executives surveyed. Roughly 31 percent of the CIOs will be using Azure for IaaS, versus roughly 30 percent using AWS. Today, about 21 percent are using AWS and 12 percent are using Azure. While nearly 55 percent of the surveyed CIOs said they’re using no public cloud IaaS today, that number will drop to less than 10 percent by the end of 2019.

My POV

For Adobe, this strengthened strategic partnership poses a huge opportunity as the vendor will improve its two most prominent weakness: the cloud strategy and the lack of CRM. On top of these, Adobe now got a chance to beef up its artificial intelligence platform Sensei which is also critical for both Adobe and Microsoft, given 85 percent of customer interactions will be managed without a human within the next three years, according to Gartner.

For Microsoft, the partnership will definitely give the vendor an upper hand in the competition against Salesforce and Oracle and gives Microsoft cloud apps that favor Azure over Amazon’s market-leading Amazon Web Services. Besides these, the tight product integration between MS and Adobe also helps Microsoft retain new customers considering Adobe Creative Cloud alone has more than 7 million subscribers.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.