IT Spending is Flat According to Gartner Report

According to Gartner’s latest report, Worldwide IT spending is forecast to be flat in 2016, totaling $3.41 trillion, and the change has been attributed to the rapid rise of the U.S dollar as compared to other currencies around the world.

The overall IT spending totals to $3.41 trillion which differs depending on the location. For instance, the largest region for total IT spending in 2016 still remains North America, with $1.18 trillion, while the fastest-growing region is Asia/Pacific, followed by Africa. The reason behind the fast growth could be emerging fintech startups, especially, in Singapore, India, and Thailand.

The overall IT spending totals to $3.41 trillion which differs depending on the location. For instance, the largest region for total IT spending in 2016 still remains North America, with $1.18 trillion, while the fastest-growing region is Asia/Pacific, followed by Africa. The reason behind the fast growth could be emerging fintech startups, especially, in Singapore, India, and Thailand.

As a result of the predicted drop, “both consumers and businesses will postpone buying electronic devices such as new smartphones, PCs, and tablets as they become more cautious and find their overall spending squeezed by sharply rising prices on imports,” the tech research group stated.

In addition to this cut in “discretionary” tech spending, John-David Lovelock, Vice-President of Research also predicted that organizations would abandon some of the mergers and acquisitions and strategic expansion plans as they, generally, cause extra spending on IT.

The previous forecast report assumed that UK wouldn’t exit the European Union. However, with the UK’s exit, the research company reiterates its stance on the effect of Brexit on global technology industry:

“Only a day before the Brexit vote, Gartner issued a forecast for 1.7 per cent growth in UK tech spending this year, from last year’s £123.9bn. The UK’s vote to leave the EU will slice 2-5 percent from that,” Mr. Lovelock said and added: “With the UK’s exit, there will likely be an erosion in business confidence and price increases which will impact the UK, Western Europe, and worldwide IT spending.”

The IT professional network Spiceworks has also published its 2016 State of IT report, including survey results from over 800 IT professionals. Spiceworks' survey finds that IT budgets remain flat, with planned spending rising by just 0.7 percent overall. During the study, the organization interviewed some IT professionals to ask them how they make their purchase decisions and where they plan to spend in 2016:

Although Many CIOs still utilize Excel spreadsheets to manage their IT budgets, there is actually specialized Technology Business Management (TBM) software available. Sunny Gupta, Co-founder and CEO at Apptio, a TBM software provider, told ZDNet:

"A lot of CIOs over the last three to five years have been under pressure to cut costs and have used approaches like insourcing and outsourcing to drive some level of optimization," says Gupta. "But now their budgets are flat or going down and they're being asked to do more. Also, the cloud is not helping because people can see what a unit of computing from Amazon or Microsoft will cost -- but what is the internal cost structure for running data centers and computing, and how can better decisions be based on real data and facts?"

Currency Fluctuations

According to Gartner, currency fluctuations is the main factor behind its reasoning. Brexit has brought  The British economy to the point where France briefly surpassed the UK as the fifth largest economy in the word due to currency swings with the decline of the pound. “While the UK has embarked on a process to change, that change is yet to be defined,” said Gartner’s John-David Lovelock in a statement about the latest IT spending forecast. “The ‘leave’ vote will quickly affect IT spending in the UK and in Europe while other changes will take longer.”

The British economy to the point where France briefly surpassed the UK as the fifth largest economy in the word due to currency swings with the decline of the pound. “While the UK has embarked on a process to change, that change is yet to be defined,” said Gartner’s John-David Lovelock in a statement about the latest IT spending forecast. “The ‘leave’ vote will quickly affect IT spending in the UK and in Europe while other changes will take longer.”

Meanwhile, not only will businesses "put their hands back in their pockets," as Lovelock put it, but the drop in sterling is reasoning double-digit price increases in British shops. For instance, US-based PC maker Dell announced their intentions to raise UK prices in response to sterling's falling value in the fallout of Brexit, while consumers have less purchasing power. The company denied to confirm the scale of the rises but indicated the reason is sterling’s fall against the dollar.

There are other repercussions from sterling’s decline which will have an impact on other technology costs as well. There is an annual maintenance fee which is equal to 20% of the original purchase price of the new software. With currency fluctuations, British companies, which have not already paid their 2016 maintenance fees yet, will face another price increase. In addition to another cost, it will also affect internationally mobile part of the sector’s workforce the most as according to Gartner, the largest immediate issue could be staffing. The research firm points out that non-UK workers will find the country a “less attractive” prospect.

On the other hand, the future of IT industry is still solid, Gartner says, noting that the pace of change in 2016 “will never be as slow as it is now”. According to the findings, the shift to digital platforms, Internet of Things, and new technologies such as machine learning will materialize. Enterprises have been prioritizing “cost optimization efforts” like replacing software licenses with Software-as-a-Service (SaaS) subscriptions, voice over LTE [VoLTE] instead of cellular, or digital personal assistants instead of people.

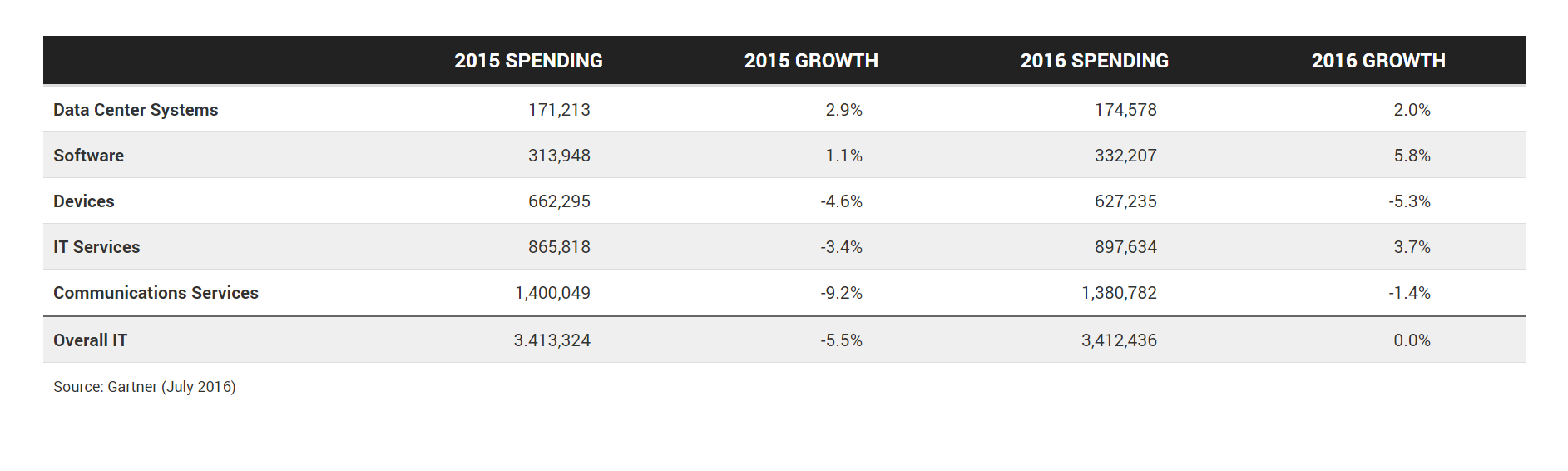

IT Spending Forecast by Category

Data Center Systems:

Data Center Systems:

It is expected to see a modest 2% rise in spending and may reach $175 billion this year. The increase is driven by strong growth in the server markets in Greater China and Western Europe, and accelerated interest in the North American enterprise network equipment market. The user demand for this segment is projected to stay robust due to the shift towards software-defined storage and cloud delivery which have a huge impact on future iterations in the forecast. In the long run, data center systems’ spending might witness a decrease.

Enterprise Software:

It’s no surprise that software segment is one of the few bright spots in this year’s IT forecast, with 5.8 percent growth being predicted. North America is the dominant regional driving force behind the growth as it represents $11.6 billion of the $24 billion dollar increase in 2016. Another important finding is that the fastest-growing market remains to be customer relationship management (CRM) software such as Salesforce.

As regards software, in 2014, John-David Lovelock predicted during the Gartner Symposium/ITxpo 2014: “SaaS will reach 50% of all CRM deployments by 2016. ERP will get there, but by 2025. Licensed software should plunge from 93% of deals in 2000 to 16% in 2020, and from 95% of spend to 21% for the same period. Licensing doesn't go away, it stays in on premise infrastructure.”

Devices:

Due to the lackluster economic issues in Russia, Japan, and Brazil, demand and worldwide PC recovery will slow-down in 2016. This market is projected to be held back and see a reduction in end-user spending to $708 billion this year which illustrates a 3.6 per cent drop from 2015. Gartner also pointed out that Windows 10 upgrades have led to further PC buying delays, as consumers are willing to “use older PCs longer, once they are upgraded to Windows 10”. In a previous report, the firm has also predicted that global smartphone sales are estimated to reach 1.5 billion units in 2016. The total mobile phone market is forecast to reach 1.9 billion units in 2016.

IT Services:

Spending in the IT services market is expected to increase 3.7%, totaling $898 billion as compared to 3.8% growth expected last quarter. Japan is seen as the fastest-growing region for IT services spending, with over 8.9% growth. It demonstrates that Japanese companies value consulting support when they transform their businesses and upgrade their new technologies.

Communication Services:

Communications services spending is expected to total $1.38 trillion in 2016, down 1.4 percent from 2015. Japan is, once again, leading the growth in this segment with 8.3% increase, while Greater China adds the most dollars to spend with just more than $8.3 billion. Eastern Europe, Western Europe and North America all are forecast to decrease as price wars and declining usage affect virtually all communications services markets.

The Brexit comes at a critical time for the IT market where companies have recently been investing in cloud and mobile technologies to reduce costs and leverage productivity. Some of those investments could be put on hold or minimalized. And there will be numerous negotiations around new rules for a variety of issues, including how the UK deals with EU data protection laws and where new data centers are located.

Follow us on LinkedIn and be the first to know when CMS-Connected publishes new content.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.