SAP Sees High License Growth & No Impact from Brexit

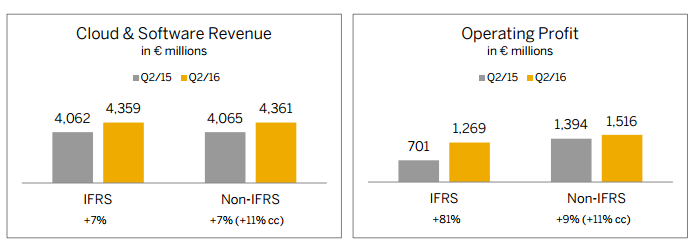

German IT services and enterprise resource planning (ERP) provider SAP SE reported results that topped analysts’ estimates as its operating profit (IFRS) jumped a whopping 81 percent to €1.27 billion ($1.4 billion), and its Non-IFRS cloud subscriptions and support revenue rose 30 percent to €721 million ($794 million).

“Our groundbreaking new architecture is accelerating momentum across all businesses – cloud, core, and business networks. As a result, SAP delivered a unique trifecta of double-digit growth in software, cloud, and operating income. Our S/4HANA pipeline has never been stronger and we confidently reiterate our full year guidance,” CEO Bill McDermott said in a statement.

“Our groundbreaking new architecture is accelerating momentum across all businesses – cloud, core, and business networks. As a result, SAP delivered a unique trifecta of double-digit growth in software, cloud, and operating income. Our S/4HANA pipeline has never been stronger and we confidently reiterate our full year guidance,” CEO Bill McDermott said in a statement.

The achievement is driven by strong performance of the Cloud and Software segments as rivals struggle to shift from one-time license purchases to cloud subscription models. Software license and support revenue (IFRS) has seen a 7 percent jump over the year-ago quarter’s figure to €4,359 million ($4,800 million), while cloud revenues were up 33 percent. Cloud subscriptions comprise less than 20 percent of the company’s overall revenues, so it means that there is still plenty of room for growth.

Also, new cloud bookings, which is considered a key indicator of sales success in the cloud business, continued to gain momentum, seeing an increase of 28% and reaching €255 million ($280 million) in the quarter under review.

It is not the first time that SAP has beaten earnings expectations as each of its last four quarters results exceeded expectations along with growing revenue and profit. "SAP performed better than its peers in terms of growth and profitability," said Harald Schnitzer at DZ Bank and noted: “The restructuring and job elimination in 2015 helped profit margins,” referencing restructuring costs took €290 million off SAP’s Q1 operating profit.

If we look into the growth geographically, the EMEA region reported double-digit software license revenues growth in the majority of the end markets including France, Netherlands, Switzerland and Germany. Despite a weak start to the first quarter of 2016, North America got back on track, contributing to growth in the American region. Additionally, the growth of software licenses revenue in Brazil and Mexico added to the overall sales in the region. For the Asia-Pacific (APJ) region, triple digit software license growth in Japan coupled with double-digit growth in India and China represented as key growth spark.

Although SAP is holding its core ERP business steady, it reported more than 1,250 customers for its Human Capital Management offerings at the end of the quarter. Cloud subscriptions and support revenue in the SAP Business Network segment, which encompasses a community of trading partners who use SAP software for sourcing and procurement, flexible labor management, and travel/expense management, was up 21 percent at constant currency rates.

SAP has also released a host of products including SAP HANA smart data integration, SAP Cloud Identity Access Governance, SAP Data Services and SAP HANA smart data quality. It’s also launched SAP Exchange Media, and SAP Vehicle Insights.

S/4HANA

SAP has also announced that its in-memory, column-oriented relational database management system S/4HANA won 500 new customers in the second quarter, including big names like Hershey Company, Targin Group of Russia, Cathay Pacific of Hong Kong, and Roy Hill Holdings of Australia. Although SAP didn’t break out HANA revenues, it stated that about 40 percent of S/4HANA sales are net new customers. According to the company, HANA is an on-ramp to the cloud for its customers via the SAP HANA Enterprise Cloud platform.

McDermott said during the earnings call that the S/4 HANA update marks the fastest migration the company has seen from one version of its software to another. He said S/4 HANA is experiencing four times the adoption rate of R3 (the client-server version released in the 1990s), with more than 10% of SAP's ERP customer base signed on for S/4 HANA already. Considering enterprise customers are generally slow when it comes to moving to new versions of software, the platform has enjoyed a strong reception so far.

No Brexit Impact

"Yes we were aware of the Brexit but no, there was no impact from it. This follows history - when there was the Greek debt crisis or the China growth crisis, the global footprint of SAP and our solutions to help customers seemed to be in the mix of growth because they need our software to navigate through these choppy waters. So it makes SAP a very resilient asset in the software industry," Bill McDermott told CNBC.

During another interview with Bloomberg television, McDermott said that SAP would be "opportunistic" about smaller acquisitions: "The good news about SAP is organically we’re growing very fast," and admitted that SAP had looked at recently-acquired business software companies Qlik Technologies Inc. and Marketo Inc. but passed on them as they were “just not at the threshold of excellence to justify an acquisition by SAP at any price."

Private equity firm Thoma Bravo is planning to acquire business intelligence software provider Qlik for $3 billion, while Marketo, a provider of marketing automation technology, were acquired by Vista Equity Partners in a deal valued at about $1.79 billion, as CMS-Connected reported.

Although some analysts had expected a negative effect following the June 23 Brexit vote, he confirmed that SAP hadn’t been affected by the U.K. vote to leave the European Union, noting that the firm scored double-digit growth in the British market in the second quarter.

Positive Results by SAP’s Rivals

Oracle, IBM, and Microsoft also recently reported better-than-expected results in the past week, largely attributable to their cloud strategies, despite political turmoil in Europe.

Microsoft’s quarterly sales and profit beat analysts’ estimates and it doubled revenue which was driven by its Azure cloud-computing platform, while Data-center software maker VMware’s profit and sales topped estimates. Meanwhile, IBM, another tech giant in transition, reported accelerating revenue in a key data analysis software, noting that Brexit hadn't hurt its results. IBM's report demonstrated its cloud and analytics investments had started to yield favorable results.

In addition, last month Oracle also reported higher than expected results for its fourth quarter. Chairman and CTO Larry Ellison highlighted customer demand for the company's emergent infrastructure-as-a-service cloud business, after demonstrating profits in both its platform-as-a-service and software-as-a-service businesses.

Michael Briest, Managing Director of Global Technology Research Group and Head of the European Technology Research at UBS Investment Bank, stated: “SAP has been less vulnerable than other software firms to platforms offered by Microsoft, Google and Amazon, which offer databases and application-connecting middleware in the cloud. Most SAP customers run its Hana database on their own computers and its middleware exposure is low.”

A recent report from Nucleus Research stated that some SAP customers were unsatisfied with the company's products and would pick something else if they had to choose again. McDermott indirectly addressed this report during the earnings call: “May smart, top-level analysts have commented on the strength and momentum of SAP's most recent product release.”

On a side note, SAP has closed some deals with Apple and Microsoft. The legacy software provider will develop apps for Apple’s iPhone and iPad and simplify it for its customers to write native iOS software. The company is also creating more additions available on Microsoft’s Azure cloud platform.

After the quarterly results published, CEO Bill McDermott “confidently” reiterated full-year guidance in a statement. The company expects its revenue from the cloud to be in the range of €2.95 - €3.05 billion and its operating profit for the fiscal year to be in the range of €6.4 - €6.7 billion.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.