Does Microsoft's Acquisition of LinkedIn Make Sense?

Microsoft Corp. announced that it has agreed to acquire LinkedIn, the social network for professionals with some 433 million users, in an all-cash transaction for a jaw-dropping price of $26.2 billion.

This is a very bold move by Microsoft as the deal is its largest acquisition in the history of the company and the price is 7% of Microsoft's current market cap. According to what Microsoft said after the acquisition, LinkedIn CEO Jeff Weiner will report to Microsoft CEO Satya Nadella, but LinkedIn will continue to operate independently and will retain its brand after the acquisition.

This is a very bold move by Microsoft as the deal is its largest acquisition in the history of the company and the price is 7% of Microsoft's current market cap. According to what Microsoft said after the acquisition, LinkedIn CEO Jeff Weiner will report to Microsoft CEO Satya Nadella, but LinkedIn will continue to operate independently and will retain its brand after the acquisition.

Satya Nadella and Jeff Weiner discussed Microsoft's $26.2 billion purchase of LinkedIn, how both companies benefit from the agreement, and what the deal means to customers on day one of Microsoft's biggest-ever acquisition:

Roger Martin, Professor at and the Former Dean of the Rotman School of Management at the University of Toronto, has recently posted an article on Harvard Business Reviews, claiming that “in which typically 70%–90% of acquisitions are abysmal failures.” Is this going to be a case for Microsoft too? To find out, let’s start with the desired purpose of the acquisition.

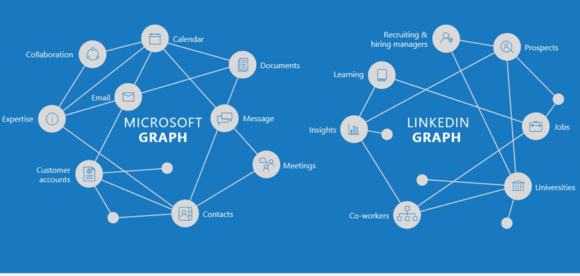

The two companies have both been developing their own graphs for a long time. Microsoft Graph is designed to expose APIs, data and intelligence such as contacts, messages, calendar entries, and documents across Office 365 and Azure AD. LinkedIn Economic Graph data consists of every employee and their resume, a record of every job openining, as well as every current job position and even every skill necessary to win those jobs.

The acquisition assembles these two graphs in a hope of boosting Microsoft’s machine learning and business intelligence processes by providing more data. “If you connect these two graphs, this is where the magic happens, where digital work is concerned,” Satya Nadella said during a conference call. At the end of the day, the ultimate outcome for users is to make professionals more productive.

Cory Johnson and Alex Sherman of Bloomberg, assessed the deal valued at $26.2 billion, paying $196 per share or a 49.5 percent premium to LinkedIn's closing price on Friday.

Where Did LinkedIn Go Wrong?

-

LinkedIn’s stocks have been struggling since July 2015, as it lost a value more than 43% and there hasn’t been a significant indication that tells us it would go up anytime soon.

-

LinkedIn’s core business is recruitment ads which generated $2 billion of the company’s $3 billion in revenues in 2015. However, according to LinkedIn’s Q4 earnings reported earlier in February, its ad business grew just 20% for the quarter year after year, compared to growth of 56% in the same quarter the year before. In addition, research firm eMarketer predicted LinkedIn’s U.S. digital ad revenue would grow less than 10% this year.

-

The amount of LinkedIn profiles increased, the number of unique visitors didn’t accelerate from Q1 to Q2 and from Q3 to Q4. Also, the site has seen a significant drop in its page-views.

-

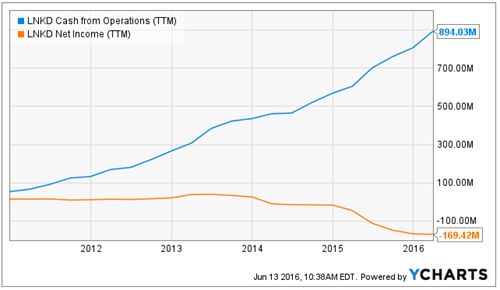

LinkedIn didn't make money last year, posting a loss of $166 million in 2015. The loss grew in Q1 to $45.8 million/quarter. Here is the chart below demonstrates the gap between what the company earns in GAAP net income and how much cash it collects:

Microsoft's Recent Acquisitions History

Under Satya Nadella’s management, Microsoft has been purchasing technologies that weren’t invented in-house, but the challenge is that it is becoming the company’s ritual to make some acquisitions which seem puzzling at the time, then make them even worse.

For instance, after the acquisition of Nokia's smartphone business for more than $7 billion, Nadella didn’t make any progress in smartphones, but only laid off Nokia's former employees and executives to reduce the cost. In 2007, the company bought online advertising firm aQuantive for more than $5 billion in order to keep up with Google, but Microsoft has never become a competitor in that field as couldn’t even understand how to manage an online advertising business. Another great example is that the web-video calling company Skype which Microsoft acquired for $8.5 billion five years ago, couldn’t catch up to FaceTime, WhatsApp, and so on.

What’s in it for Microsoft?

-

Microsoft has never been a really successful company in social networking. So far, it invested in Facebook before it went public, and at one point it made a bid to acquire Slack for $8 billion. Actually, Microsoft’s enterprise social networking service kicked off with its Yammer acquisition for $1.2 billion in 2012. Therefore, Microsoft expects that LinkedIn’s bigger reach will give it a noticeable foothold in terms of social networking services and professional content.

-

Microsoft has plans to utilize LinkedIn’s Sales Navigator as an integrated sales productivity tool alongside its existing CRM product, Dynamics, which is second to Salesforce in the market. As a result, users will be able to operate the sales cycle with actionable and profitable insights on resume and employment data. In other words, there is a great potential here for Microsoft to turn the largest global professional network into a major customer relationship management software system for salespeople, so Microsoft’s Dynamics can finally compete with Salesforce. On that note, Anurag Rana, Senior Analyst at Bloomberg Intelligence said: “LinkedIn could become a really big competitor for Salesforce going forward.”

-

Overall, it is a good opportunity to improve its knowledge-management capabilities for Office 365, Dynamics CRM, and ERP.

-

LinkedIn has spent $1.5 billion on a failed acquisition of Lynda.com, as it didn’t make any financial sense. However, with Microsoft’s LinkedIn acquisition, Lynda.com training capabilities could collaborate with Microsoft’s certification and education efforts for its product lines.

Nadella sent a memo on what Microsoft will gain from this deal to his Microsoft staff:

Nadella sent a memo on what Microsoft will gain from this deal to his Microsoft staff:

“The LinkedIn team has grown a fantastic business centered on connecting the world’s professionals,” Nadella said in a statement. “Together we can accelerate the growth of LinkedIn, as well as Microsoft Office 365 and Dynamics as we seek to empower every person and organization on the planet.”

What’s in it for LinkedIn?

-

.The deal puts worries to rest on how LinkedIn could ever come into closer competition against companies which they have been leveraging their social graphs by developing more software on top

-

Connecting with Microsoft would enable LinkedIn to accelerate the number of its members, as the integrated system could give people more reason to involve, visit, and share their content.

-

A positive outcome has already appeared for LinkedIn, as its shares surged 47 percent after the announcement to near $193, while Microsoft's stock was down 3.2 percent.

-

LinkedIn has long been valued for having the potential viral growth of a social network with the recurring revenues of a software-as-a-service business. However, lately, growth has started alarmingly slow, so this is the right timing for the company to be sold.

-

Many experts also believe the marriage with Microsoft makes sense as the two companies don’t overlap in services, yet cater to the same audience which is business professionals.

Just like Nadella, Weiner shared a letter on the deal with LinkedIn staff too:

Just like Nadella, Weiner shared a letter on the deal with LinkedIn staff too:

“Just as we have changed the way the world connects to opportunity, this relationship with Microsoft, and the combination of their cloud and LinkedIn‘s network, now gives us a chance to also change the way the world works,” Weiner added in the memo. “For the last 13 years, we’ve been uniquely positioned to connect professionals to make them more productive and successful, and I’m looking forward to leading our team through the next chapter of our story.”

The deal has no effect on Google, but a slightly negative effect on Facebook as it has recently been trying to gain a traction from professionals. On the other hand, the acquisition is significantly alarming to the shareholders of SAP, Oracle, and Salesforce. The acquisition has also a positive impact on startups due to its high price, as it sets the pricing bar high to be used as benchmarks for future acquisitions. In addition, with nearly $40 billion in SaaS M&A so far this year, 2016 is becoming the best year for SaaS M&A ever. The LinkedIn acquisition is very likely the largest SaaS acquisition we’ll see for quite a while and its effects will be felt for a long time.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.