Forrester Evaluates Lead-To-Revenue Management Vendors

By Venus Tamturk

November 24, 2016

B2B Content Marketing, Digital Marketing, Hubspot, IBM, inbound marketing, marketing automation, Marketo, Oracle, Salesforce, vendors

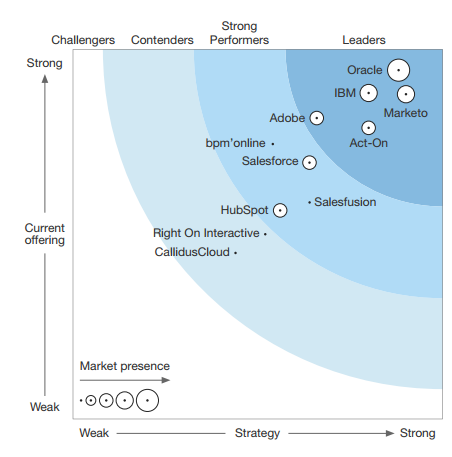

Forrester published The Forrester Wave: Lead-To-Revenue Management Platform Vendors, Q4 2016. Of the 11 vendors Forrester evaluated for the lead-to-revenue management (L2RM) report, Act-On, Adobe, IBM, Marketo, and Oracle lead the pack; bpm'online, HubSpot, Salesforce, and Salesfusion are considered “strong performers”; and CallidusCloud and Right On Interactive are Contenders. According to Forrester, “this report shows how each provider measures up and helps business-to-business (B2B) marketing professionals make the right choice.”

Before discussing the vendors individually, I would like to briefly touch upon the criteria Forrester considers, to choose the most significant offerings in the L2RM space. This year, the independent research firm evaluated the products across 36 different criteria which are grouped into three important categories:

Current offering is the vertical axis of the Forrester Wave graphic and illustrates the strength of each vendor’s current L2RM offering. To position the vendors on this particular axis, Forrester gathers the knowledge through vendor evaluation responses, documentation, demonstration, pricing scenarios, client feedback, and customer references. Once they have gathered all the information, the vendors are eliminated based on the twenty-nine criteria.

Strategy is the horizontal axis and illustrates how well each vendor is meeting with current customer needs as well as shaping its product investments and partnership strategies based on its predictions for future customer needs. The material that Forrester uses for this category are vendor strategy briefings.

Market presence, are the dots in the graph that illustrate how strong of an impact each vendor has on market reach and presence.

Vendor Inclusion Criteria

-

The lead-to-revenue management functionality of the solution provides a range of capabilities that Forrester listed in an eligibility survey.

-

At least 300 customers use the product (for B2B marketing use cases) or the product generates revenue of at least $25 million per year.

-

The vendor has a sustained presence in the B2B marketing automation market and has focused on B2B marketing automation for at least three years.

-

The vendor has sufficient mindshare within Forrester’s client base.

Who Leads the Pack?

Oracle

The product evaluated was Oracle Eloqua Marketing Cloud Services. In terms of product features and functions, Forrester has found that the platform provides the majority of the evaluated functionality. Additionally, the report cited that a number of different products in the Oracle Marketing Cloud offering, specifically Deliverability Plus, Oracle Eloqua Digital Advertising, and Oracle Content Marketing fosters Oracle Eloqua’s functional depth.

Although Oracle Eloqua’s program canvas, was originally designed to make the user interface easy to orchestrate the complex, multistage interactions required throughout B2B buying cycles, Forrester points out that the vendor is evolving the use of that canvas as an integration design tool to CRMs and to third-party capabilities, to offer deep functionality for marketing tasks and tactics. Additionally, the vendor provides vertical solutions such as prepackaged marketing capabilities tuned for the requirements that vary based on the industry.

The report also touches upon the perception about the difficulties in the implementation and use of Oracle Eloqua. The research firm believes that “its reputation may not be the result of product weaknesses but a reflection of marketing complexity” as Oracle Eloqua is implemented in far more complex contexts than many other L2RM platform products. However, the report cited that Oracle’s strategy, vision, and roadmap for the B2B marketer is becoming its weakness as the customers have started to need more clarity and communication on those elements in the past three years.

Marketo

According to Forrester, approximately 4,200 companies have deployed Marketo’s L2RM solution, and Marketo is on every B2B marketer’s shortlist when considering a marketing automation system. The reason is that from the large organizations’ perspective, the functionality of the product maximizes lead generation and management, whereas, from the midsize organizations’ perspective, its user interface is the motivation. The Customer Engagement engine is designed to help B2B marketers execute a contextual nurturing strategy, while Marketo’s web personalization enables marketers to deliver tailored experiences to web visitors. Moving forward, in an effort to delivering more contextually relevant messages across mediums, the vendor plans to provide deeper advertising integrations, expanded analytics, and new uses for predictive technologies.

In its report, Forrester also sheds light on Marketo’s innovations and its partner ecosystem. According to the research firm, the vendor’s steady pace of innovation is not only well received in the market but also timely. In terms of the partnership though, the report cites that Marketo relies on a robust partner ecosystem, with more than 500 ancillary technology solutions in its LaunchPoint solution portal.

As you may recall, Marketo has announced an agreement to be acquired by the technology-focused private equity firm Vista Equity Partners in a cash deal valued at $1.79 billion. At that time, since Vista often tends to reduce expenditures on sales and marketing after its acquisitions, many analysts expressed their concerns about the lack of innovation that could occur, especially given Vista's reputation. In this report, Forrester also stated that “customers are concerned about the impact of Vista Partners’ acquisition of Marketo on its product roadmap, vertical focus, and global expansion.”

IBM

The company provides its lead-to-revenue functionality through a combination of IBM Marketing Cloud, which was built on the foundation of Silverpop Engage (acquired in 2014), and IBM Marketing Software that was built on Unica (acquired in 2010). The problem with this that customers are often confused about which parts of which products can be configured to meet their lead-to-revenue requirements, according to Forrester. The majority of IBM’s L2RM functionality comes from Marketing Cloud, though.

Forrester noted that the platform is often not on the shortlist when Forrester talked to B2B clients who were evaluating marketing automation solutions, unlike Marketo. However, the research firm encourages those who invest in the IBM portfolio for sales and marketing (e.g., IBM Interact, IBM Tealeaf, IBM Customer Analytics [née Core Metrics], and IBM WebSphere Commerce) to evaluate IBM Marketing Cloud as an L2RM platform solution. Thanks to a new Journey Designer capability, which helps with complex engagement planning through visual campaign design and storyboard tools, the product maintains its strong multichannel campaign capabilities. Moving forward, IBM plans to deliver more reliable results via sophisticated predictive and cognitive analytics tools.

Act-On

Forrester suggests the smaller marketing teams found in midsize companies and autonomous divisions of larger enterprises to consider Act-On’s marketing automation solutions due to its product and delivery models. Since many tasks are guided by wizards and templates, the user interface is easy to use. When it comes to the platform’s capabilities, Forrester assures that Act-On offers more than to just meet the needs of simple product portfolios, simple marketing campaigns, and straightforward channels to market. On top of these, the research firm notes that its ease of deployment, ongoing resource requirements, and customer support are well received in the market. However, Forrester believes that Act-On might miss in depth, considering the emerging complaints from more advanced customers are about its limits in functionality.

The company offers prebuilt integrations to the major CRM providers, including Microsoft Dynamics CRM, NetSuite, Salesforce, SugarCRM, and Zoho; common web content management tools, such as Drupal, Joomla, and WordPress; and meetings and virtual events, such as Cisco’s WebEx, Citrix’s GoToMeeting, and ON24. Additionally, Act-On Anywhere provides data or access to marketing assets from any web-based environment, such as Gmail or LinkedIn.

Adobe

Although the vendor submitted Adobe Campaign, which is available as a standalone L2RM platform solution, for this evaluation. Forrester considered the capabilities from Adobe Marketing Cloud, specifically Adobe Target, Adobe Audience Manager, and Adobe Experience Manager, as well. Forrester stated in the report: “Adobe Campaign is a robust multichannel campaign management solution that can meet the needs of B2B, B2C, and business-to-business-to-consumer marketers.” The report also revealed that only about a quarter of Adobe’s customers are B2B marketers. According to Adobe, the distinction between B2B and B2C strategies are shrinking and its heritage in B2C brings great potential to B2B marketers.

The strengths of the vendor cited in the report are multichannel marketing capabilities, its customer engagement management capabilities, the ability to build sophisticated campaigns with very specific segmentation and targeting, and distributed marketing capabilities. Another important differentiator indicated is that Adobe Campaign is one of the few L2RM platform solutions that can be deployed on-premises or hosted at the vendor’s data center. Although the firm highly recommends the product to global companies operating in a B2B2C model and those who are heavily invested in Adobe for marketing solutions, it warns that Adobe Campaign may not be suitable for small organizations.

L2RM practitioners vs Other B2B marketers

Forrester’s L2RM report also revealed the differences between L2RM practitioners and other B2B marketers. Here are the key findings:

-

Companies that utilize L2RM technology contribute 52% of the sales pipeline, compared with the 35% contribution from firms that plan to implement L2RM automation for the first time.

-

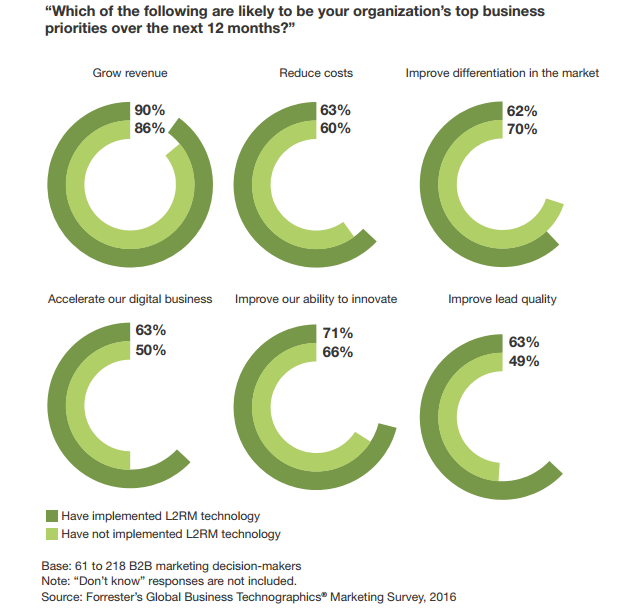

Those who have automated their L2RM processes, compared with those who haven’t, have slightly more focus on growing revenue, reducing costs, improving their ability to innovate, and improving lead quality.

-

78 percent of marketing decision-makers who have implemented L2RM in their B2B firms told Forrester that they use measurement and analytics to understand their marketing success, compared with just 52 percent of those who have not automated their lead-to-revenue process.

-

The firm also found the difference between L2RM practitioners and other B2B marketers, when it comes to priorities:

L2RM Platform Market Overview

Forrester defines L2RM as “business system for marketers whose offerings mandate a long, complex or highly considered buying process,” and stated in the report, “L2RM mostly applies to B2B marketers, but not exclusively. Consumer marketers who are taking highly considered products and services to market also benefit from the managed process of L2RM and the changing marketing remit that the practice enables. The L2RM business system comprises integrated goals, processes, and metrics that reshape marketing practices to drive effective customer engagement across the entire customer lifecycle — from awareness to advocacy.”

Forrester claims that B2B marketing leaders are now going beyond simple automation of their existing demand generation process and revenue performance management. To do so, here are the capabilities vendors must provide:

Website personalization: According to Forrester’s Global Business Technographics Marketing Survey, 2016, vendor websites are more influential than interacting with a vendor sales rep in person, which ranked third in the discover phase and second in the explore phase of the buyer journey. Therefore, for marketers, tackling personalized engagement across channels is more important than ever.

Account Based Marketing (ABM): As I discussed in one my most recent article titled “7 Content Marketing Trends to Allocate Your 2017 Budget For”, more and more companies are making ABM a key element in their 2017 marketing strategy. In fact, according to Frost&Sullivan, 80% of marketers measuring ROI say that ABM outperforms other marketing investments. The analysts at Forrester think alike based on the fact that three-quarters of the B2B marketers whom they interviewed indicate that they prioritize their relationship with sales peers and describe the partnership with the chief sales officer as “crucial". Therefore, the report suggests vendors provide new capabilities in their L2RM automation platform to identify accounts, link leads to accounts, and score and nurture at the account level.

If you would like to learn more on the marketing automation disconnect, I highly recommend watching the CMS-Connected debate as a panel of well-known experts, including Bruce Williams, Keith Durrant, Michael Kinkaid and Vince Mayfield, discuss how to best bridge the gap between the sales and marketing teams so that all campaigns can succeed.

Multichannel capabilities: The report, expectedly, underlines the importance of having a strong presence across social, digital, and physical channels. Therefore, vendors should enable seamless multichannel engagement on the web, in digital advertising, on mobile, in print, and, in email.

Predictive analytics: Forrester reveals an interesting finding of the vendors’ common failure when it comes to leveraging the data and behavioral insight generated through their L2RM platforms, as their capabilities don't meet the need for rich data and a centralized repository for explicit customer data and implicit customer insights.

Although the market is emerging, some small and medium-sized businesses (SMBs) may still feel L2RM is a complicated task that only the largest companies can pull off but, this is simply not true. In fact, there are many cases that SMBs may find even greater value, when they start small, say, first tracking the touch points throughout the buyer journey via marketing automation. To me, one of the biggest drives behind this market evolution is the increasing adoption of cloud-based deployments in both SMBs and enterprise.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.