What Does Microsoft's New Partnership with Adobe Mean?

By Venus Tamturk

September 28, 2016

Adobe, Amazon, Amazon Web Services, Artificial Intelligence, Business Intelligence, Dynamics, Microsoft, Oracle, partnership, Salesforce

Microsoft announced at its Ignite conference that it’s entering into a partnership with Adobe Inc. that will see the two companies promote the use of each other’s cloud-computing tools. Under the deal, Adobe will now make Azure its “preferred cloud platform” for its three main services: the Adobe Marketing Cloud, Creative Cloud and Document Cloud. In return, Microsoft will designate Adobe Marketing Cloud as its "preferred marketing service" for its Dynamics 365 product, which is Microsoft’s line of sales, accounting, and inventory management software that competes with various Salesforce products.

In recent years, both companies have significantly made the cloud a central part of their strategies as Microsoft has been touting Azure and heavily investing in its Microsoft’s cloud offerings, including its Office 365 software-as-a-service application. Adobe has been extending its marketing cloud and harvesting its business migration from a software sales model to a cloud-based subscription service.

In recent years, both companies have significantly made the cloud a central part of their strategies as Microsoft has been touting Azure and heavily investing in its Microsoft’s cloud offerings, including its Office 365 software-as-a-service application. Adobe has been extending its marketing cloud and harvesting its business migration from a software sales model to a cloud-based subscription service.

“Business leaders in every industry are focused on how to better engage their digital customers, wherever they are,” said Satya Nadella, CEO of Microsoft. “Together, Adobe and Microsoft are bringing the most advanced marketing capabilities on the most powerful and intelligent cloud to help companies digitally transform and engage customers in new ways.”

Shantanu Narayen, President and CEO of Adobe, emphasized the importance of having a strong cloud infrastructure, noting that Adobe processes 23 trillion transactions each quarter, or over 90 trillion per year and added: “Customers today expect a well-designed, personalized and consistent experience every time they engage with a brand,” said Narayen. “Adobe and Microsoft will bring together the cloud horsepower and end-to-end capabilities brands need to design and deliver great digital experiences.”

Neither deal is exclusive, but rather described as “preferred,” and Adobe already has similar deals with Amazon and SAP. In fact, it had previously hosted many parts of its cloud products on the competing Amazon Web Services cloud. It also, has its own cloud. Now, it’s adding Azure as well, meaning that the deal doesn’t mean a wholesale shift of Adobe’s cloud business to Microsoft. Therefore, the extent and breadth of benefits for each company are a little bit up in the air. For the time being, Adobe continues to work with Amazon.com Inc.’s Amazon Web Services, but moving forward, it is not clear that Adobe is planning to put Azure at the center of its cloud-computing developments or keep it only as a part of its computing plan in order to provide a multi-cloud environment.

Adobe will use SQL Server and Azure’s machine learning services available in the Microsoft Cortana Intelligence Suite. Microsoft will officially recommend that those companies use Adobe Marketing Cloud if they want to utilize their Dynamics 365 data to run a marketing campaign, alongside forthcoming new data integrations. Here’s the Adobe announcement from Microsoft Ignite:

What’s in it for the Customer?

For the companies’ mutual customers, the partnership essentially means that customer data will be much easier to both collect and analyze. They will be able to exploit their data in order to engage customer touchpoints across their business, and to make predictions. From there, they will boost their relationship with customers, and ultimately, drive growth. The integration is also expected to minimize the customized work both companies’ customers’ software developers have to do to make their products work together. For the future, Nadella confirmed that MS and Adobe will coordinate to bring their products to market together.

From Adobe users’ perspective, they will have an access to more intelligence as Adobe will get to utilize Microsoft’s AI/machine learning service, Cortana Intelligence Suite, which makes it easier for customers to apply Microsoft’s analytics technologies to information created and stored on Adobe’s services. Also, for small businesses which use the Adobe Cloud products, the transition to Azure means a strong cloud infrastructure to rely on.

For both existing customers and prospects, the deal completes what is missing in each product as Adobe lacks the hosting capacity to handle the immense amount of customer data in play, while Microsoft Azure Cloud doesn’t have anything like Adobe’s technology in place. For small businesses which use the Adobe Cloud products, the transition to Azure means a strong cloud infrastructure to rely on.

The Cloud Battle

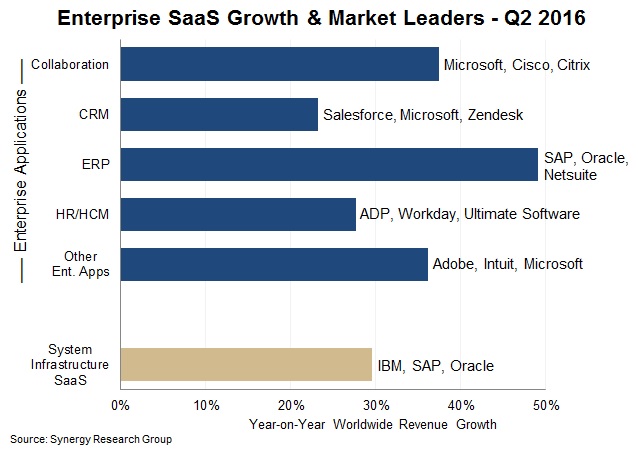

The deal will improve Microsoft’s CRM/ERP cloud product to gain more customers. Although Microsoft is already a leader in Enterprise Collaboration Software-as-a-Service, it is still not sitting with the leaders in ERP SaaS applications while it is second to Salesforce in the Enterprise CRM space:

The partnership announcement came on the heels of the news that Amazon and Google were battling to attain more software companies to utilize their respective clouds. A long-time Microsoft strategic partner and arch enemy Salesforce, for example, recently announced a multi-year, $400 million plan to use Amazon Web Services to backstop new Salesforce CRM applications.

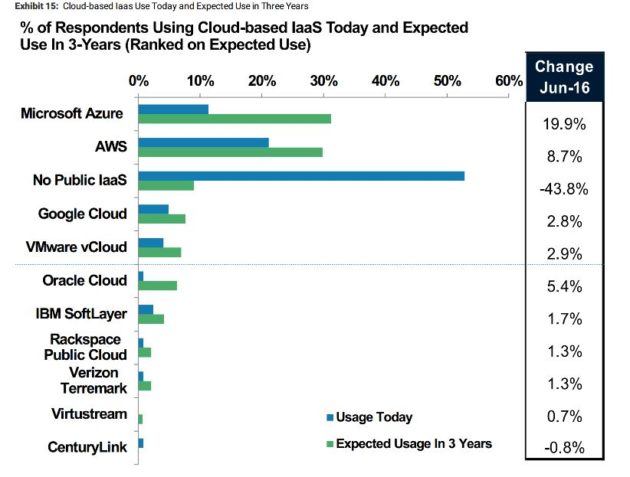

According to Morgan Stanley’s 2016 CIO Survey, Microsoft’s Azure will edge out Amazon Web Services by 2019 for both Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) use among 100 executives surveyed. Roughly 31 percent of the CIOs will be using Azure for IaaS, versus roughly 30 percent using AWS. Today, about 21 percent are using AWS and 12 percent are using Azure. While nearly 55 percent of the surveyed CIOs said they’re using no public cloud IaaS today, that number will drop to less than 10 percent by the end of 2019.

In addition to that, Satya Nadella has been reorienting Microsoft’s business around cloud and productivity services to fuel growth, as traditional software sales shrink. It has started to pay off as Redmond, Washington-based Microsoft reported revenue from Azure doubled in the quarter ending June 30. Annualized revenue from commercial cloud products was more than $12.1 billion, a number that Microsoft has pledged will reach $20 billion by fiscal 2018.

Since Microsoft doesn't have a marketing software competitor, and Adobe doesn't have a sales software play, with the deal, Microsoft and Adobe are planning to present a unified front in the cloud battle, in opposition to Oracle's growing cloud presence and the rise of Salesforce. Salesforce competes with Microsoft Dynamics 365 with its flagship Salesforce Sales Cloud product, and with Adobe, with the Salesforce Marketing Cloud. The deal also gives Adobe a way to compete with Salesforce Einstein, their just-announced artificial intelligence platform.

Speaking of artificial intelligence, after Oracle announced its plan to dominate this space last week at OpenWorld, and Salesforce unveiled its Einstein offering at its annual event Dreamforce, it was clearly Microsoft’s turn to take the stage to introduce its own AI game plan, and Nadella stated that his firm’s objective was “democratizing AI”, explaining: “We are not pursuing AI to beat humans at games. We are pursuing AI so that we can empower every person and every institution that people build with tools of AI so that they can go on to solve the most pressing problems of our society and our economy. That’s the pursuit.”

In my opinion, although the benefits of the deal seem like they are slightly more in favor of Adobe than MS, it gives Microsoft cloud apps that favor Azure over Amazon’s market-leading Amazon Web Services, and an opportunity to acquire new customers as Adobe Creative Cloud alone has more than 7 million subscribers. Besides, Adobe’s Marketing Cloud is used by many corporations that consistently monitor and analyze online behavior and measure the success of their personalized advertising based on that data, while Microsoft is offering complementary platforms like Dynamics CRM and ERP tools, as well as LinkedIn. I don’t see any reason for Microsoft not to become the best as a targeted advertising software, given the combination of the tools, some developed in-house, some acquired, and some added through partnerships.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.