Why Did OpenText Buy EMC's Enterprise Content Division?

After buying HP’s customer management software unit earlier this year, in a predictable move, Canadian enterprise information management vendor OpenText has agreed to acquire Dell Technologies' Enterprise Content Division (ECD), including Documentum for $1.62 billion in a deal that, the companies say, will allow them to focus on their core missions.

“We are at the beginning of the Digital revolution where extreme connectivity, automation, and computing are converging,” said OpenText CEO and CTO Mark J. Barrenechea. “This acquisition further strengthens OpenText as a leader in Enterprise Information Management, enabling customers to capture their Digital future and transform into information-based businesses. We are very excited about the opportunities which ECD and Documentum bring, and I look forward to welcoming our new customers, employees, and partners to OpenText.” Barclays acted as a financial advisor to OpenText and provided a $1.0 billion debt commitment in support of the transaction.

“We are at the beginning of the Digital revolution where extreme connectivity, automation, and computing are converging,” said OpenText CEO and CTO Mark J. Barrenechea. “This acquisition further strengthens OpenText as a leader in Enterprise Information Management, enabling customers to capture their Digital future and transform into information-based businesses. We are very excited about the opportunities which ECD and Documentum bring, and I look forward to welcoming our new customers, employees, and partners to OpenText.” Barclays acted as a financial advisor to OpenText and provided a $1.0 billion debt commitment in support of the transaction.

The Acquisition Overview

-

The Dell-EMC enterprise content division (ECD) offers content management services for enterprises and generated about $599 million in revenue in 2015. The purchase price of $1.62 billion is approximately 2.7 times the 2015 revenue.

-

The acquisition is not subject to a financing condition and is expected to be finalized within 90 to 120 days, subject to regulatory approvals and customary closing conditions.

-

The deal is expected to contribute to OpenText’s earnings within the first 12 months.

-

OpenText’s objective is to maintain a conservative capital structure, including preserving its current credit ratings.

-

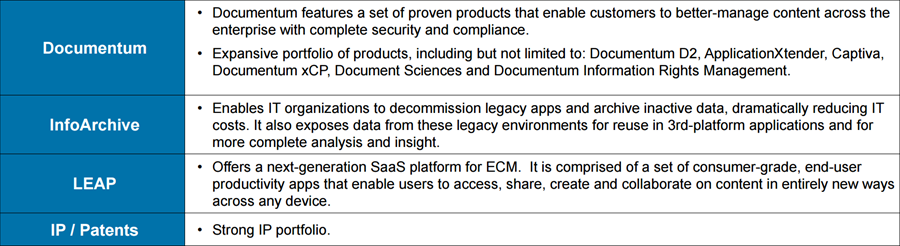

The products that OpenText purchased with this deal are Documentum, InfoArchive, and LEAP which can be deployed on-premises, in the Cloud, or as hybrid architectures.

What Does the Deal Bring to OpenText?

-

The deal will enable OpenText to have a better geographical coverage globally, but in particular, in the emerging markets like Asia and Africa.

-

Documentum, InfoArchive, and LEAP are the most popular product lines in the enterprise content management market and are stronger enterprise capture products than OpenText’s own product, so the deal expands OpenText’s EIM products and services portfolio.

-

It will bring satisfied, loyal, and medium- to large-size company customers. Given that approximately 75% of recurring revenues and 50% of total revenue are from maintenance for Documentum, the division has a strong recurring revenue portfolio.

-

According to OpenText, Documentum is used by Top 10 of 10 global pharmaceutical companies, Top 9 of 10 largest global banks, Top 9 of 10 largest global insurance companies, Top 7 of 10 largest global oil and gas companies, and Top 8 of 10 largest U.S. utilities. It means that Documentum will help OpenText extend its portfolio in the healthcare, life sciences, and public sector verticals while strengthening OpenText’s presence in financial services, energy, and engineering.

-

The acquisition gives OpenText a chance to optimize financial performance as their 2020 aspiration of 34% to 38% adjusted operating margin (AOM) remains unchanged.

-

With the deal, approximately 2,000 talented employees with deep market and industry experience will be acquired.

-

It also means a rich partner network and strong relationships with global systems integrators, resellers, and ecosystem partners.

Alan Pelz-Sharpe, Vice President & Managing Director VOCalis with Digital Clarity Group and previous guest on The CMS-Connected Show, is very optimistic about the deal, so much so that he wrote this on his blog post:

“For the first time in over a decade, they will be in a place that understands what they do and appreciates both their technology and the strength of the Documentum brand. Hopefully, Documentum will remain semi-autonomous within OpenText and be provided the support needed to return to strong growth.”

From the Dell Technologies’ Perspective

Give that Dell Technologies’ primary focus is the data center infrastructure market, Dell offloading the division makes so much sense. It is a good call not only for focusing on the company’s core product lines but also paying off the multibillion-dollar debt faster so the less interest will be incurred, meaning that it frees up capital for business activities.

"In determining the best long-term future for ECD, we wanted to create a business with a leading position in enterprise information management," Dell EMC President David Goulden said in a statement. "OpenText shares our vision for the transformation to digital business, our passion for the role of information in the digital world, and the breadth of capabilities to help our customers realize that vision."

In addition to that, Rohit Ghai, President of the Enterprise Content Division at Dell EMC, also commented on the OpenText buy in a blog post in an effort to suppress the worry:

"As we work toward the close of the transaction, I assure you that we will continue to provide the world-class care our customers have come to expect. To underscore our joint commitment, OpenText and Dell EMC have also announced their intent to enter into a strategic commercial partnership to expand customer offerings and better serve customer needs. Customers and partners can continue to realize value from their ECD investments and gain additional value from a richer portfolio of ECM and EIM solutions, he said, adding that today's news is great for all stakeholders. "We hope you are as energized as we are about the opportunity ahead." .

OpenText Acquisitions

OpenText has been on an acquisition spree in recent months. To be exact, OpenText has announced 5 acquisitions in the past 6 months, including ECD Documentum for $1.62 billion, HP Inc’s customer communications management assets: HP Extream and HP LiquidOffice for $315 million, Recommind for $170 million, ANXeBusiness for $105 million, and HP Inc’s customer experience management assets: HP TeamSite and HP MediaBin.

Actually, the strategy has been creating value as it made Open Text the third most valuable publicly-traded tech firm in Canada, with a market capitalization of between CAD $10-billion and CAD $11-billion.

According to Erik Gordon, a Professor at the Ross School of Business at the University of Michigan, the company should end its acquisition spree before its debts pile up too high: “It is time for them to focus on making their acquisitions work,” Gordon said. “If you take on too much debt to finance a string of acquisitions you may not have enough free cash flow to improve your operations.”

Melissa Webster, Vice President of Content and Digital Media Technologies at IDC: "OpenText made a decision years ago that it was either get big or get bought. This company has grown through acquisitions for 10 years. They're very practiced acquirers," said Webster. "If OpenText makes this work - and I believe it will -- it will become a major player in the document/content management space with numerous opportunities to expand that business."

Enterprise Content Management Market

According to MarketsandMarkets, the ECM market size is expected to grow from USD 28.10 billion in 2016 to  USD 66.27 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 18.7% during the forecast period.

USD 66.27 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 18.7% during the forecast period.

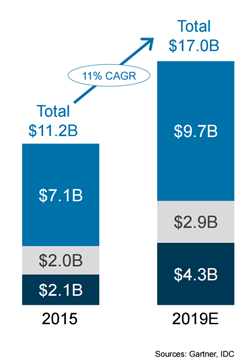

Based on the other market research, the Enterprise Content Market is expected to grow at a cumulative growth rate (CAGR) of 10.9% to $17 billion by 2019. Here’s the breakdown:

-

Traditional ECM: $9.7B (8% CAGR).

-

Information Archiving: $2.9B (10% CAGR).

-

Cloud Content & Collaboration: $4.3B (19% CAGR).

In the ECM space, although there are a plenty of very well established vendors, with the new acquisition there will be cut-throat competition between OpenText and Microsoft. Meanwhile, Microsoft Office 365 and SharePoint online stepped up their game with their integrated cloud offering. With Office 365, Microsoft has a created a SaaS platform and a more open ecosystem so they can integrate new features faster than traditional ECM systems. On the other hand, there are these purely cloud-based disruptors such as Box and Dropbox which have been earning a space for themselves through consecutive innovations in the ECM market where large vendors are struggling due to a very slow pace of innovation, and swollen features that cause longer deployment as well as complicated user interface.

To go back to the acquisition, Documentum has been giving up its industry leading position under the shadow of EMC in recent years, while OpenText has been generating the revenue growth through its acquisition strategy. Although we’ll be discussing more on where this deal leaves the state of the Enterprise Content Management industry in the coming days, I believe that with this new acquisition, it’s only a matter of time for OpenText to take a leader position in the ECM space.

Venus Tamturk

Venus is the Media Reporter for CMS-Connected, with one of her tasks to write thorough articles by creating the most up-to-date and engaging content using B2B digital marketing. She enjoys increasing brand equity and conversion through the strategic use of social media channels and integrated media marketing plans.